December has entered the frame, and 2024 is already within view. Meanwhile, the Street’s analysts are busy pointing out the best opportunities ahead, with each investment bank favoring its own methodology. At Goldman Sachs, the company has a designated class for stocks that look particularly appealing; these go on what the banking giant calls its Conviction List, reserved for names that are not only deserving of Buy ratings but are the cream of the crop.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As the equity research team notes, only names that meet specific criteria are chosen to go on the list. “Our investment process is focused on identifying the most attractive fundamentally driven idiosyncratic opportunities from within our buy-rated coverage. To that end, we closely follow the returns of stocks after adjusting for their normal relationship with macro/style factors,” said the team in a recent research note.

Amongst the stocks that Goldman has earmarked as ones boasting high conviction credentials right now are two of the market giants – Nvidia (NASDAQ:NVDA) and Apple (NASDAQ:AAPL). Both have outperformed this year, but the Goldman experts think they will continue to do so.

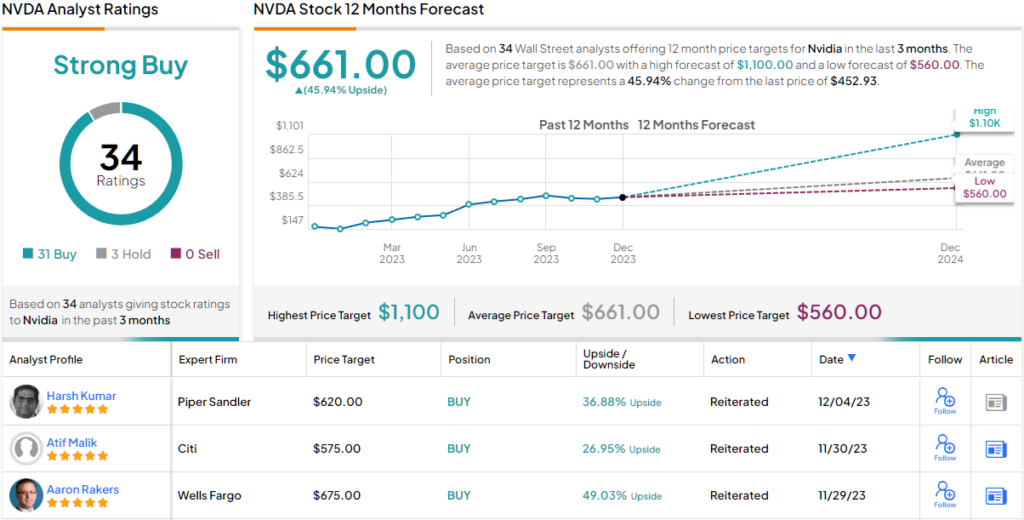

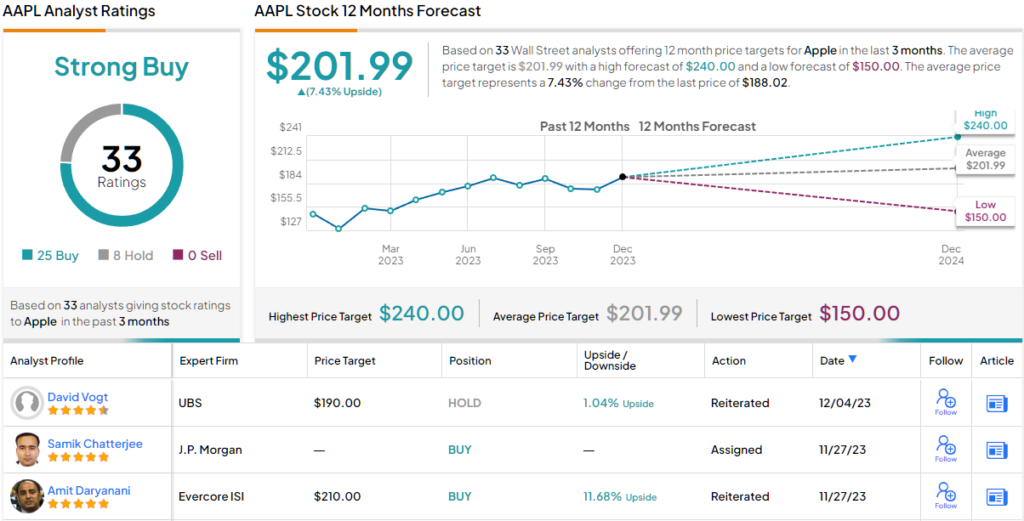

To be fair, it’s not only Goldman that fancies these names’ chances. According to the TipRanks database, both are also rated as Strong Buys by the analyst consensus. Let’s give them a closer look and see what makes them so.

Nvidia

2023 will undoubtedly go down as the year of AI, and among the names that have used the tech’s assault on the mainstream to fully take advantage, hardly any spring to mind more readily than Nvidia. That is because the semiconductor giant is in a class of its own in the chip-making process, providing companies with the AI chips used in Data Centers to facilitate the complex computational needs of the tech.

While Nvidia is focused on different verticals ranging from auto to crypto and first became famous for its gaming-focused GPUs, its Data Center endeavors have ultimately been responsible for incredible growth. This has been a feature of all its calendar 2023 earnings reports, with each one surpassing Street estimates and offering a myriad of highlights.

In the recently reported fiscal third-quarter report, Data Center was the star of the show again. The segment notched record revenues of $14.51 billion, representing a 279% year-over-year increase and a 41% improvement on the previous quarter. In total, revenue reached $18.12 billion, amounting to a 205.6% improvement over the same period a year ago. At the same time, the figure exceeded Street expectations by $2.01 billion.

At the bottom line, the company’s net income soared by nearly 600% from the prior year’s $1.46 billion to more than $10 billion, resulting in an adj. EPS of $4.02, $0.63 above the analysts’ forecast. Moving forward, for FQ4, Nvidia called for sales of $20 billion, plus or minus 2%, implying growth of 231%, while the Street was merely anticipating $17.82 billion.

For Goldman Sachs’ Toshiya Hari, Nvidia is the principal ‘shovel supplier’ in the AI ‘gold rush.’

“Look for NVDA to maintain its status as the accelerated computing industry standard for the foreseeable future given its competitive moat and the urgency with which customers are developing and deploying increasingly complex AI models,” the 5-star analyst said. “And, a strong and broadening demand profile in the Data Center, plus an improving supply backdrop should support sustained revenue growth through CY2024.”

These comments form the basis for Hari’s Buy rating while his $625 price target makes room for gains of 38% in the year ahead. (To watch Hari’s track record, click here)

Overall, there is broad-based agreement on Wall Street that NVDA stock is buying proposition. Of the 34 recent analyst reviews, 31 are to Buy against just 3 Holds. The $661 average price target indicates a potential for ~46% upside from the current trading price of $467.65. (See Nvidia stock forecast)

Apple

Nvidia’s success has ensured it now has a spot amongst the exclusive $1 trillion market cap club, but it still has a way to go to reach the almost $3 trillion valuation boasted by the biggest name out there. That would be Apple, of course, the world’s most valuable company.

Apple’s rise to the top has been built on a combination of innovation, elegance, and functionality. The company practically revolutionized our daily lives and cultural landscape with its groundbreaking products, spearheaded by its ubiquitous flagship, the iPhone. Additionally, its ever-evolving ecosystem continually explores novel avenues for growth, ranging from wearables and Apple TV to its highly successful Services business.

That said, recent times have shown that growth is not a given – even at Apple. In its fiscal fourth quarter report (September quarter), despite iPhone sales and Services revenue attaining record levels, total revenue fell by 1% year-over-year to $89.5 million, although that figure did meet Street expectations. At the other end of the scale, EPS of $1.46 outpaced the analysts’ forecast by $0.07.

However, for the December quarter, Apple suggested that for the fifth quarter in a row, sales growth will drop again. At the same time, there have also been worries that Apple’s iPhone sales in China could be impacted by rising competition – particularly from Huawei.

These concerns have not gone unnoticed by Goldman Sachs analyst Michael Ng. Nevertheless, when considering the prospects exhibited by other facets of Apple’s business, there’s plenty to suggest the Apple juggernaut will keep steaming ahead.

“Concerns about heightened iPhone competition provide the ‘wall of worry’ for investors to climb into a sustained favorable services expansion story,” writes Ng. “Look for AAPL to leverage its massive and consistently growing installed base, resulting in Services becoming 41% of gross profit by F2027, from 36% in F2023, helping to drive an average of 29%FCF margin and $130bn+ of annual average shareholder returns through F2027.”

Apple’s place on the Conviction List is assured then, with Ng recommending a Buy rating, backed by a $227 price target. There’s potential upside of 19% from current levels. (To watch Ng’s track record, click here)

Turning now to the rest of the Street, where Apple’s Strong Buy consensus rating is based on an additional 24 Buys vs. 8 Holds. That said, considering the big year-to-date gains (up by 53%), the upside appears somewhat capped; going by the $201.99 average target, a year from now, investors will be pocketing modest returns of ~7%. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.