Goldman Sachs (GS) is an American multinational financial services firm. The banking giant operates a range of services, including investment banking, wealth management, trading, and loan origination. I am bullish on the stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Less Reliance on Trading

Goldman has announced that it’s expanding on its private wealth team in London, hiring 9 new managers. This is part of an ongoing effort by the firm’s management to expand on its fee-based asset management services, which could see the bank drift away from its reliance on trading revenues.

According to its third-quarter earnings report, Goldman generated 47.8% of its revenue from trading. Asset trading revenue significantly increases a bank’s risk profile due to the unpredictability of its future earnings.

Investors may well benefit from this strategic decision, as it brings with it higher-earnings quality and less cyclical stock behavior.

Existing Risk

From an investor’s vantage point, the stock’s current risk-return profile doesn’t add up to anything extraordinary. The stock’s beta of 1.53 means that it’s 1.53x riskier investing in Goldman stock than in the S&P 500, yet over the past 5 years the stock has underperformed the index by a cumulative of 38.2%.

The move to de-risk the company ought to propel the stock’s performance as its cyclical attributes diminish. Additionally, investors could anticipate a more consistent dividend; Goldman’s dividend payout ratio of 9.48% is relatively low, which could change if its earnings become more predictable.

Valuation

We’re looking at a significantly undervalued stock here. Goldman’s PE ratio is trading at a 37.93%, and its PEG ratio of 0.03 indicates that the firm’s earnings growth is outpacing the stock’s price appreciation by 33.3x.

Another factor to mention is the market’s expectation of U.S. interest rate hikes in 2022. Interest rates correlate with bond yields, which usually lead to a rise in banking stocks.

Wall Street’s Take

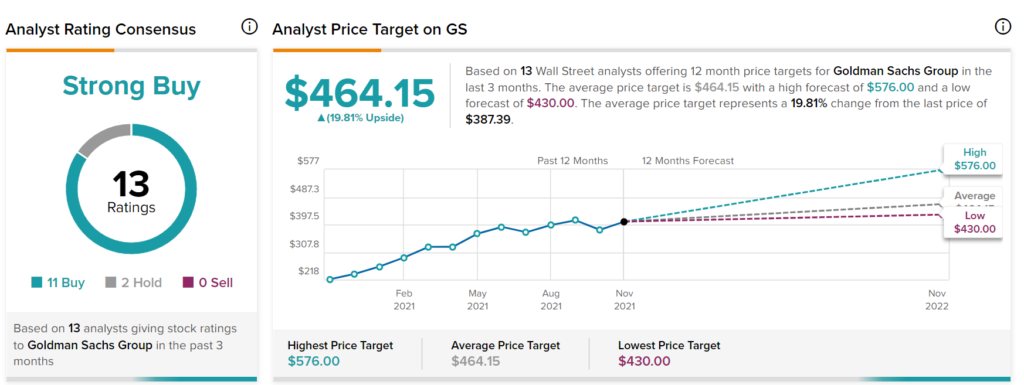

Wall Street loves Goldman Sachs stock. Out of 13 analyst ratings, there have been 11 Buys, 2 Holds, and no Sells assigned. The average Goldman Sachs price target among Wall Street analysts is $464.15, presenting a possible 19.81% upside to investors.

Concluding Thoughts

Goldman Sachs’ lower reliance on trading as a source of earnings will bring sustainability to its earnings and lead to a better risk-return profile of its stock. In addition, the stock is significantly undervalued when compared to its historical metrics.

Disclosure: At the time of publication, Steve Gray Booyens had a long position in GS.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.