Obesity drugs have taken the world by storm. Initially intended to treat diabetes, these medicines – called “GLP-1 drugs” or “semaglutide drugs” – have surged in popularity bordering on a craze. The appeal is understandable, given soaring global obesity rates which impact both the individuals suffering from obesity and overburdened healthcare systems struggling to provide sufficient care. As it is currently the most effective instrument to successfully fight obesity, GLP-1 has already become to the medical world what artificial intelligence is to technology, and it is only the beginning of the drug’s accent. Let us have a look into these drugs and try to establish the main winners and losers from the surging weight-loss megatrend.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Modern Pandemic

Obesity has become a modern pandemic; it is estimated that 42% of U.S. adults are obese and an additional 30% are considered overweight. Globally, 1 in 8 people are living with obesity. There are many factors to blame, including sedentary lifestyles, an abundance of high-calorie foods, emotional and social overeating, and more. Whatever the reason, millions of people are concerned with their weight, affecting their health and personal lives.

Meanwhile, the path back to healthier girths is not straightforward, as many people struggle to maintain sufficient physical activity, while dieting is even more difficult and often inefficient. Besides, about 95% of people who lost weight on a diet, gain it back, oftentimes with a surplus. Obesity is a serious condition that disrupts people’s daily lives and can cause grave long-term complications, such as arthritis, heart disease, cancer, and type 2 diabetes.

So, it should be no surprise that the arrival of weight-reducing drugs – which, contrary to all other weight-loss fads before them, actually work for almost everyone – was perceived as a godsend. Although these drugs are designed to be taken for a lifetime and have side effects, people suffering from obesity were so excited to eventually see positive results, that the sales took off immediately, with the demand strongly outpacing supply.

What are GLP-1 Drugs?

The weight-loss medications currently on the market or in the advanced stages of development, all work in the same way: they release a substance mimicking the action of a hormone called glucagon-like peptide-1 (GLP-1). The GLP-1 hormone prompts the body to produce more insulin and reduce blood sugar levels, regulating appetite. In other words, the active ingredients of these drugs enhance the effects of the naturally occurring GLP-1 hormone, reducing hunger and slowing digestion, while making users feel fuller for longer.

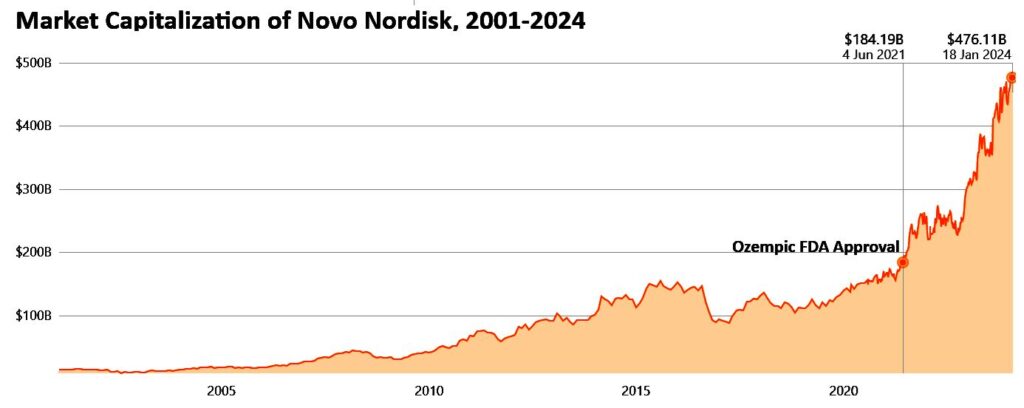

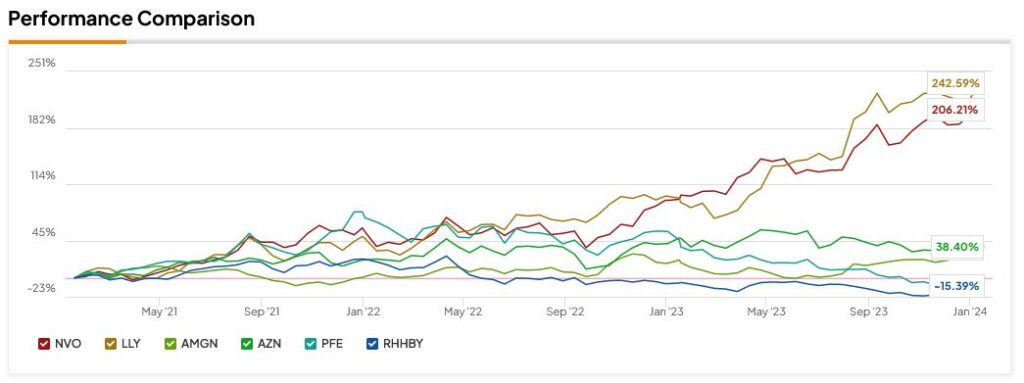

A pharma company from Denmark, Novo Nordisk (NVO), first developed its GLP-1 drug over a decade ago to treat type 2 diabetes. Later, studies in diabetic patients showed that the drug helped reduce weight. The subsequent global craze caught on like wildfire, propelling NVO to the status of Europe’s most valuable company, worth more than the whole Danish economy (!). As GLP-1 became a household name, another pharma giant, Eli Lilly & Co (LLY), followed suit, developing its own weight-loss drug based on the same concept.

The active ingredients in the GLP-1 drugs are liraglutide, used in an older-generation drug Saxenda; semaglutide, used in Ozempic and Wegovy; and tirzepatide, used in Mounjaro and the newest-generation Zepbound, produced by Eli Lilly. All these drugs are injectables, which is a dealbreaker for many patients. Currently, there is a slew of clinical trials at different stages for weight loss pills, such as Amgen’s (AMGN) next-generation drug, which is currently in Phase 2 of development. Besides, Eli Lilly has also presented data from trials showing that its daily tablet for weight loss has efficacy similar to that of the existing injectable GLP-1 drugs. If approved, the new treatments may spell the end of Novo Nordisk’s obesity-treatment market supremacy. However, the global weight-loss leader is not resting on its laurels: it has submitted its new oral semaglutide drug for regulatory approval in the U.S., Canada, and Europe.

The Sky is the Limit

The battle for the obesity drug market shares will be increasingly fierce, with a continued focus on therapies that offer more significant weight loss, longer-lasting effects, and fewer side effects.

Obesity a chronic disease linked to about half of all new diabetes diagnoses in the U.S., and is also highly correlated to heart disease, the number one cause of death in the country. Given the expected magnitude of obesity drugs’ impact on the affected population, the potential market for these drugs is almost unlimited, drawing an ever-growing number of competitors into this lucrative field.

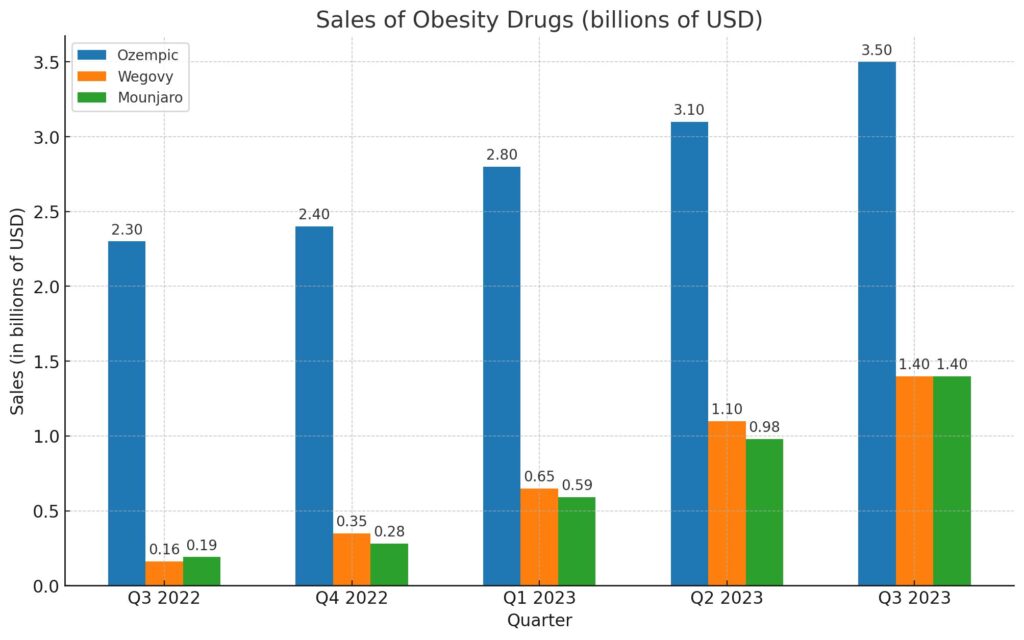

According to J.P. Morgan (JPM) analysis, the global obesity-treatment market will reach over $100 billion in revenue by 2030, versus $2.9 billion at the end of 2022. Analysts at Barclays (BCS) estimate that the global market could be worth as much as $200 billion in the next few years. According to analysts at Morgan Stanley (MS), Novo Nordisk will see revenues from obesity drugs reach $11 billion in 2030, while Eli Lilly is expected to rake in around $5.5 billion from the same market.

The demand is so strong that the only limitation to sales of these drugs will be posed by production capacity. The supply issues have been felt throughout the U.S. and Europe in 2023; however, Novo and Eli Lilly have invested heavily in capacity enhancement, and are expecting to significantly raise production this year.

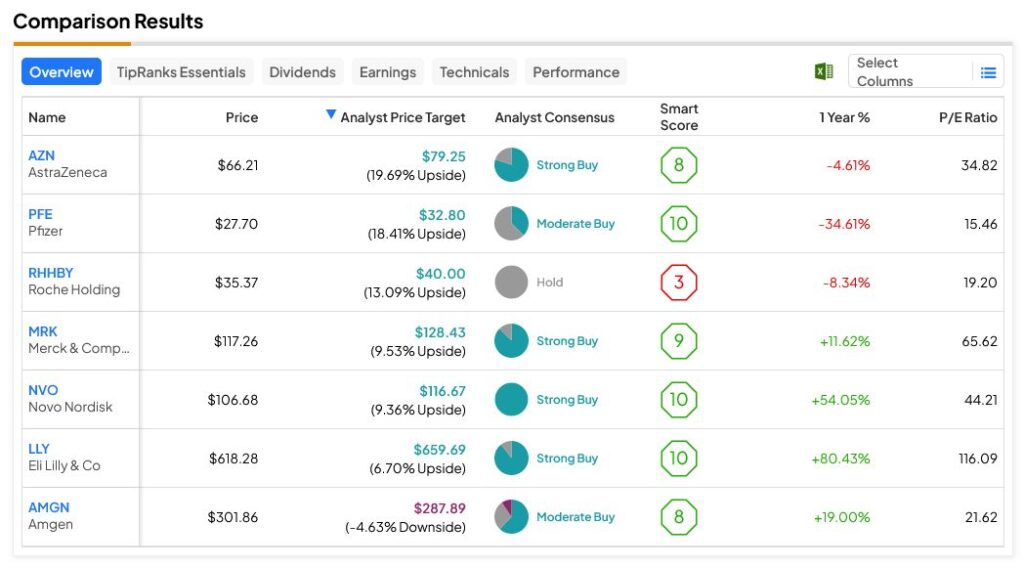

The global obesity drug market is currently a duopoly, with Novo Nordisk’s Ozempic and Wegovy and Eli Lilly’s Mounjaro making up all of the supply. JPM’s analysts project the obesity-fight leaders to hold on to over 90% of the market by 2030, with the late entrants such as Amgen, Roche (RHHBY), AstraZeneca (AZN), Pfizer (PFE), and Merck (MRK) grabbing only a modest percentage of sales. However, these companies are not prepared to give up as capturing even a small share of the obesity-treatment market could translate into billions of dollars of revenues.

Thus, the Swiss pharma behemoth Roche Holding AG acquired a U.S. biotech that is developing several early-stage weight-loss drugs. Pfizer said that in addition to conducting its own studies, it is looking for early-stage acquisitions in the space of oral obesity drugs, which are expected to reach a third of the total weight-loss market by the end of the decade. Merck, the latest newcomer to the obesity battle, also said it is seeking opportunities through its own research, as well as via acquisitions.

Injecting a Dose of Disruption

Since the GLP-1 craze caught on there has been a clear distinction in stock performance between two distinct groups of pharma companies: NVO and LLY that make obesity drugs, and all the rest. No wonder, then, that most of the large drugmakers are feverishly striving to enter the most lucrative market of the decade, if not the century.

The full potential of the GLP-1 drugs is not clear yet. There are signs that they can help treat Alzheimer’s, reduce the risk of kidney and liver diseases, and prevent heart diseases among obese patients. Analysts at Wells Fargo (WFC) say that GLP-1 treatments can shrink the market for treating cardiovascular disease, currently estimated at $250 billion a year in the U.S. Markets for drugs and treatments for Alzheimer’s, diabetes, Parkinson’s, kidney disease, fatty liver disease, and others, will all feel the impact. This future impact is already being felt by the shares of different MedTech companies, including dialysis providers. Johnson and Johnson (JNJ) reported a decline in sales of its devices used for bariatric surgery.

In addition, patients using GLP-1 injections have been increasingly reporting the drug’s positive effect on addictions like alcohol use disorder and smoking. Several studies are underway to test GLP-1 drugs’ positive effect on addictions. If a link can be demonstrated, this will open a whole new chapter, with the drugs potentially getting approved for treating alcoholism and substance abuse.

No Future for Coke and Lays?

The market disruption that began with NVO’s weight-loss epiphany does not end with pharma companies. Stocks of companies supplying weight-loss supplements, meal replacements, and other weight management and healthy living products, like Herbalife (HLF) and Medifast (MED), have tumbled by at least two-thirds since 2021. Some weight-loss centers and lifestyle program providers are already shutting down.

Others are attempting to ride the slimming wave: for example, Simply Good Foods (SMPL), the supplier of Atkins diet products, said it will be producing “products that complement the obesity drugs.” WW International (WW), better known as WeightWatchers, has abandoned its previous defiance of obesity medicines after it saw its shares tumble; the firm bought a telehealth provider prescribing drugs like Wegovy and Ozempic.

Notably, as obesity-drug patients consume less food overall – becoming less interested in fatty and sugary foods – food retailers have felt the heat, too. In October, the U.S. largest retailer Walmart (WMT), said that it has seen a slight pullback in food consumption resulting from weight-loss drugs. However, WMT has also seen an increase in sales in its pharmacy chains; it is other food stores that should be worried.

As the supply of drugs like Wegovy and Mounjaro is projected to rise significantly in the coming months, retailers, food producers, as well as snack and sugary drinks makers – basically, all firms that benefit from weak impulse control and sugar addiction – will be under fire. The biggest risks are faced by fast-food restaurant chains and “junk-food” producers. Thus, Krispy Kreme (DNUT) has seen its shares downgraded by analysts citing GLP-1 drugs’ impact on packaged food and sugary snacks. Generally, all “unhealthy” firms, from Hershey (HSY) to Coca-Cola (KO), have been pressured by the breakneck rise of these crave-reducing drugs, and their outlook continues to be uncertain.

Conversely, some food companies see GLP-1 drugs as carrying potential benefits for their business. Thus, Mondelez (MDLZ), one of the largest snack companies in the world, has been acquiring healthy snack and premium food producers by the pound in recent years, fortifying its non-junk product suite. The yogurt empire Danone (DANOY) is expected to be one of the largest benefactors of the demand for healthy protein consumption.

Nestle SA (NSRGY), the world’s biggest packaged food maker, has begun developing “companion products” to weight loss drugs, i.e., foods and supplements that would help patients combat the loss of muscle mass (a common effect of GLP-1 use) and help prevent the rapid regain of weight after quitting the drug. The company also forecasts a strong lift in vitamin, protein, and other health supplement sales, benefiting Nestle’s nutritional product line.

The Investing Takeaway

While Big Pharma’s obesity bonanza is just in its early stages – some experts project that within a decade, half of the world’s adults will be taking some kind of slimming medication – the ripple effects of the GLP-1 drugs are widening by the hour. However, at the moment, the price of these drugs, reaching hundreds of dollars per month, is a strong limiting factor, as it makes them much less accessible to the lower socioeconomic groups, which are statistically much more at risk of obesity and its accompanying illnesses.

Ultimately, the full potential of the drugs will be clearer when the supply catches up with the demand and they become more affordable. Conversely, if obesity drugs gain wide government and private insurance coverage, the effect of this development would be transformative for the healthcare sector and its investors.

Investors looking to participate in the GLP-1 boom should closely follow these and other developments concerning obesity-fighting medicines. Although this investment theme is very new, meaning that its specifications are established, broken, and re-established as we speak, fundamental analysis of the prospective investees should remain the central chapter in the investment handbook. When all is said and done, while there is now an easy (if expensive) way to a narrower waistline, there is no such shortcut for financial decisions. Still, help is available: TipRanks tools and database, as well as research and analysis produced by Wall Street’s leading analysts, make it easy to review companies’ fundamental, business, and technical indicators, and compare stocks with ease, distinguishing quality companies that are able to capitalize on new developments: