Global Blood Therapeutics (GBT) burst onto the biotech scene with a novel oral treatment for Sickle cell disease (SCD). GBT’s lead product, dubbed Oxbryta (Voxelotor), received US FDA clearance in November of 2019, ushering in a new treatment paradigm for SCD.

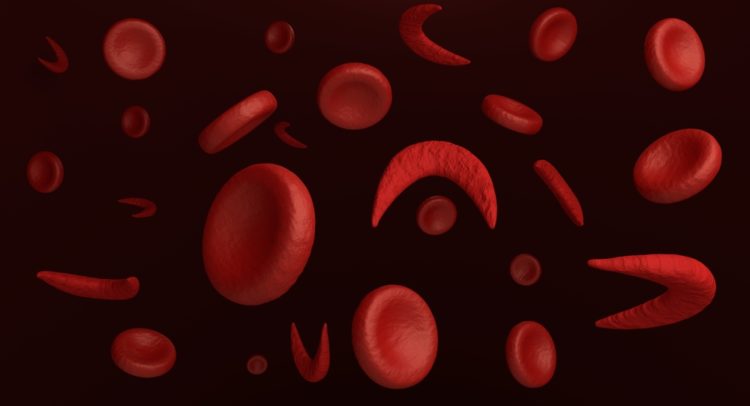

Oxbryta was designed to reduce the amount of misshapen or otherwise crescent-shaped red blood cells in the patient’s body. In SCD, the misshapen cells can create a blockage (vaso-occlusive crises) in the patient’s veins, leading to a stroke and organ damage. The abnormal cells also lose their binding capacity for hemoglobin, depriving the patient of adequate oxygen, saddling the patient with chronic fatigue.

The therapy helps tackle the disorder at its root by inhibiting the process of deoxygenated sickle-hemoglobin polymerization. By preventing the cells from becoming misshaped, the therapy’s goal is to reduce the side effect profile of patients while simultaneously improving the quality of life. SCD reduces the average lifespan of a patient by thirty years as the effects of the disease begin to manifest themselves at a young age.

It should also be noted that Oxbryta therapy is relatively straight-forward, with the recommended dose of three capsules (500mg each) taken once a day with or without food.

Commercial Progress

Oxbryta seemed poised for rapid commercial success, with a clear path to sustained growth. However, just when GBT began to ramp up its marketing efforts, COVID-19 placed unforeseen burdens on its progress.

The SCD patient population is considered high-risk for contraction of COVID-19, which dampened initial uptake. Practitioners are often reluctant to change therapies to a newer, commercially untested product as they want to ensure that patients do not suffer adverse effects.

To this end, the impact of the pandemic has hampered prescription growth, with Q3 2020 quarterly numbers underwhelming investors. One of the culprits was slower patient uptake, with roughly 1,000 new patients added in Q3. Q4 2020 numbers were also lackluster as the winter months led to more caution on the part of the patient population when it came to seeking new treatment options.

As such, the multi-quarter disappointments hurt the share price, with the security trading at levels last seen in December of 2018 before Oxbryta was approved. The optimistic case is uptake will accelerate significantly once mass vaccination takes place throughout the US in the next few months.

In this case, patients will likely be more open to receiving a new treatment, with the estimated value of the SCD market in the US pegged at $5 billion. Therefore, GBT seems poised to capture a large amount of the market.

Potential Challenges Holding The Company Back

Healthcare is often never as clear-cut as it seems. Based on the ease of use and the easy to understand mechanism of action of Oxbryta, GBT seems well-positioned. However, over the last three years, shares have declined 7%.

The delay in uptake has cost GBT precious time to cement its position in the market. What’s more, there could be additional disruption, assuming the FDA is open-minded with gene-therapy. Sangamo (SGMO) and Sanofi (SNY) have joined forces to develop a potential gene therapy for SCD, which, if approved, could potentially offer a one-time cure for the genetic abnormality.

Interestingly, SNY has entered into an agreement with GBT, which will see GBT investigate SNY’s two early-stage programs, with one compound providing a promising anti-sickling mechanism and the other reducing inflammation and oxidative stress. The partnership may serve as an initial step towards a takeover as the management teams get to know each other, the corporate culture, and the strength of the scientific backbone of GBT.

Analysts Weigh In

Looking at the consensus breakdown, 7 Buys and 4 Holds have been assigned in the last three months. At $78.38, the average analyst price target puts the upside potential at 84%. (See Global Blood Therapeutics stock analysis on TipRanks)

Concluding Thoughts

GBT has some exciting technology, with the potential to grab a large share of the SCD market. That said, the pandemic has hampered initial uptake, which may shorten the time GBT has to establish its dominance before other gene-therapy players can potentially disrupt it.

Disclosure: Alexander Poulos held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.