Legacy automaker General Motors (NYSE:GM) is scheduled to announce its first-quarter earnings on April 25. Earlier this month, the company reported about an 18% rise in its U.S. Q1 deliveries to 603,208 vehicles. GM grew its market share by about 1.5 points in the first quarter. While a strong deliveries report reflects higher revenue expectations, analysts anticipate a decline in Q1 2023 profits due to pressure on margins.

GM’s Q1 Earnings Expected to Decline

General Motors has recovered well from the supply chain issues experienced last year. The company sold over 20,000 electric vehicles (EVs) in the first quarter and assured that its inventories “are in very good shape.”

The company is confident about manufacturing 50,000 EVs in the first half of the year and 100,000 in the second half. It expects these production targets to be backed by a ramp-up of Cadillac Lyriq production, continued demand for Chevrolet Bolt EV and Bolt EUV, and the beginning of the shipments of the Chevrolet Silverado EV Work Truck in late spring.

It is important to note that while General Motors’ Q1 2023 deliveries increased year-over-year, they declined compared to Q4 2022.

As per TipRanks’ Website Traffic Tool, visits on gm.com declined 18.7% in Q1 2023 compared to Q4 2022 and were down 28.8% on a year-over-year basis. Declining online traffic in Q1 2023 does not bode well for the company’s overall revenue in the quarter.

Analysts expect the company’s Q1 revenue to rise over 7% to $38.5 billion compared to the prior-year quarter. However, they expect earnings per share (EPS) to decline about 19% to $1.70 due to the impact of higher costs on margins. Earlier this year, General Motors smashed Wall Street’s Q4 2022 revenue and earnings estimates.

Is GM a Good Stock to Buy?

Last week, Barclays analyst Dan Levy stated that there is scope for favorable market reaction, as he sees a “low bar” set for Q1 2023 earnings for the U.S. auto and mobility sector. He feels that automakers will likely reaffirm their outlooks.

While end markets have “held in,” Levy believes that there is a need for further improvement. The analyst lowered his price target for General Motors stock to $45 from $46 and reaffirmed a Hold rating.

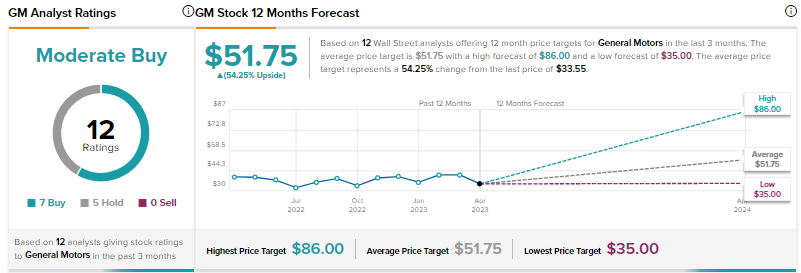

Wall Street is cautiously optimistic about General Motors, with a Moderate Buy consensus rating based on seven Buys and five Holds. The average price target of $51.75 suggests 54.3% upside potential. Shares are flat on a year-to-date basis.