General Motors Co. (NYSE:GM) has taken the fierce competition in the EV space a notch higher by introducing the compact all-electric SUV, the Chevrolet Equinox EV. According to the company, this highly affordable offering in the EV space will have a starting price of about $30,000. Notably, the Equinox EV will be launched for sale in the fall of 2023.

Equinox EV Priced Competitively

The low base price of the Equinox EV should fortify GM’s presence in the compact electric SUV category. Data from consumer shopping site Edmunds.com highlights that only three models have a base sticker price of $31,000 or less, out of roughly 35 electric models currently available in the United States (as mentioned in a WSJ article).

Analysts believe that the higher-end models of Equinox EVs can cost well over $40,000. This price still looks competitive given that U.S. buyers had to loosen about $66,000 (up 28% year over year) on average from their pockets to purchase an EV, according to data from a research firm, J.D. Power.

GM aims to ride the high sales volumes from the launch of a low-cost electric SUV. Equinox EV has the potential to firm up General Motors’ grip on the highly lucrative electric SUV market. According to an Acumen Research and Consulting report, the global electric SUV market is expected to see a CAGR of 25.5% from 2022 to 2030.

Is General Motors’ Stock Worth Buying?

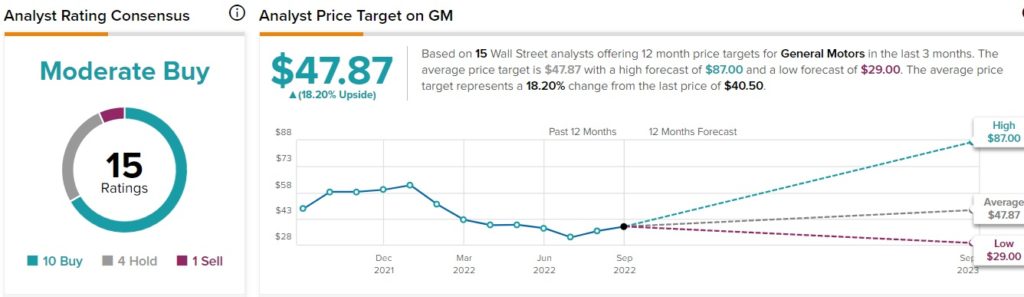

General Motors stock seems like a decent option to grab now. According to TipRanks, the Street has a Moderate Buy consensus rating on the stock, which is based on 10 Buys, four Holds, and one Sell.

Further, TipRanks data shows that financial bloggers are 91% Bullish on GM stock, in comparison to the sector average of 64%.

Despite supply-chain headwinds, General Motors managed to deliver strong revenue growth in the recently reported second quarter of 2022. In August, GM announced its plans to restart dividend payments and share repurchases following a suspension in April 2020.

Bolstering its EV efforts, General Motors recently announced a supply agreement with LG Chem intended to support GM to meet its fast-growing production requirements. The company also informed the stakeholders about a key multi-year sourcing agreement with Livent, whereby the latter plans to supply GM with battery-grade lithium hydroxide produced majorly from lithium extracted at Livent’s brine-based operations in South America.

Final Thoughts

The latest development has already sparked investors’ interest in GM stock. The shares of the company are up 1.6% at the time of writing, during the pre-market trading hours on Friday. The competitive pricing strategy is expected to give wings to the automaker’s goal of selling one million EVs in North America by 2025. Further, GM stock’s average price target of $47.87, highlights an 18.2% upside potential.

Read full Disclosure