General Mills (NYSE: GIS) is an iconic company with a constant presence in America’s grocery stores. Yet, GIS stock wasn’t particularly popular on Tuesday despite a strong financial report. I’m bullish on General Mills stock, as I choose to see value even while other traders see red on their screens.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

General Mills is a well-known U.S. manufacturer and marketer of branded processed consumer foods. Whether you spend any time thinking about it or not, there’s a pretty good chance that the breakfast cereal your family eats was manufactured by General Mills.

GIS stock is one of those assets that retirees and other conservative investors crave: low beta, safe yield, you know the drill. Don’t assume that General Mills stock is boring, though, as there seems to be a prime bargain you just can’t refuse.

Inflation Will Take a Bite out of General Mills’ Bottom Line

In case you didn’t get the memo, the U.S. inflation problem wasn’t solved in 2022 and won’t likely be fully resolved in 2023, either. General Mills is a somewhat recession-resistant business (after all, families still eat cereal during a recession). However, inflation will continue to pose a problem for the company, and General Mills’ management had to acknowledge this in the company’s Fiscal second quarter 2022 financial report.

Looking to Fiscal Year 2023, General Mills expects its input cost inflation to remain quite elevated, at 14% to 15% of total cost of goods sold. The company’s management didn’t say this, but you can be assured that General Mills will have to pass those high input costs on to the customers.

In other words, get ready for your breakfast cereal to take a bigger bite out of your budget. It’s an unpleasant reality that General Mills and its stakeholders will have to face next year. Consequently, some investors simply bailed on Tuesday, as GIS stock dropped by 4.6%.

Was this response overdone, though? It’s a valid question, as General Mills demonstrated strength in the recently reported quarter. Not only that, but the company has a bright outlook for FY2023 despite the negative impact of persistent inflation.

General Mills Posted Street-Beating Results for Fiscal Q2

Instead of focusing too much on the impact of inflation, consider how General Mills overcame this problem and posted outstanding results in the third quarter. Along with that, General Mills’ optimism for the full fiscal year should assuage some of the skeptics’ concerns.

As TipRanks contributor Shrilekha Pethe reported, General Mills beat Wall Street’s expectations in the fiscal second quarter with $5.2 billion in net sales, up 4% year-over-year and $30 million higher than the consensus estimate.

Turning to the bottom line, General Mills reported adjusted diluted earnings of $1.10 per share, up 12% year-over-year and above Wall Street’s forecast of $1.06 per share. As you can see, Americans bought plenty of boxes of cereal from General Mills, even during a time of high inflation.

Management is Preparing for General Mills to Perform Well

Just because General Mills will probably have to raise its product prices next year, this doesn’t necessarily mean the company will disappoint its investors. If you’re not convinced of this, take a look at General Mills’ forward guidance for FY2023.

The company previously anticipated organic net sales growth of 6% to 7% for the full year, but General Mills just raised that range to 8% to 9%. As for Fiscal Year 2023’s adjusted diluted EPS, General Mills had previously forecast 2% to 5% growth on a constant-currency basis but is now expecting growth of 4% to 6%.

General Mills cited “stronger adjusted operating profit growth” in these guidance raises while also acknowledging “higher net interest expense due to increasing rates.” Hence, both inflation and interest rate hikes will create headwinds for General Mills in the coming year – and yet, the company maintains a sunny outlook overall.

Is GIS Stock a Buy, According to Analysts?

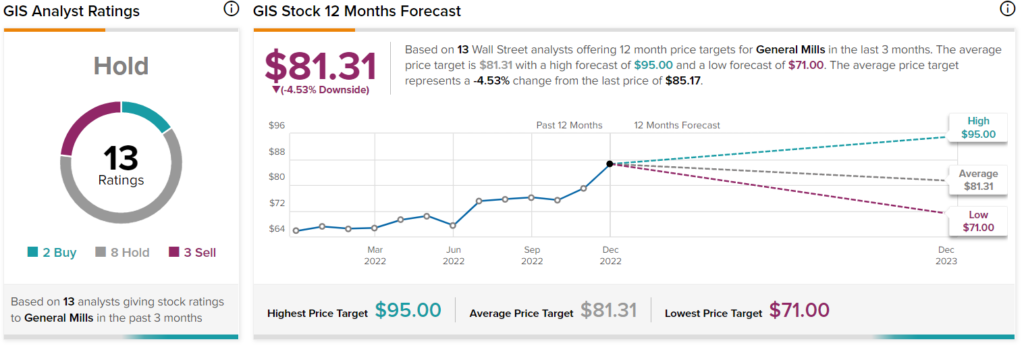

Turning to Wall Street, GIS is a Hold based on two Buys, eight Holds, and three Sell ratings. The average General Mills price target is $81.31, implying 4.5% downside potential.

Conclusion: Should You Consider General Mills Stock?

If GIS stock declined in response to inflation and interest-rate-hike worries, this could be viewed as a buying opportunity. The lower the valuation goes, the better value the stock is, even if General Mills only received a Hold rating on Wall Street.

General Mills’ quarterly results speak for themselves, but apparently, not every financial trader is listening. That’s fine, as it means enterprising investors can grab some shares of GIS stock at a reduced price and hold them for the long term.