Videogame retailer GameStop (NYSE:GME) is slated to release its first quarter Fiscal 2023 results on June 7, after the market closes. According to an investor note dated June 2, Wedbush analyst Michael Pachter is of the opinion that GME has the potential to beat Q1 estimates. However, Pachter still anticipates a slight decrease in overall revenue. As a result, the analyst maintained a Sell rating on GME stock and a price target of $6.50 per share, implying a 73.3% downside potential to current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, Pachter believes that GameStop experienced positive momentum in terms of collectibles and hardware demand for Sony’s PlayStation 5 during the quarter. Additionally, GameStop’s efforts to reduce costs have contributed to the growth of its bottom line, according to the analyst.

The analyst expects GME management to remain committed to reducing costs and improving its net cash position. This strategic approach should “allow the company to continue operating for several years in the face of multiple headwinds.”

At the same time, Patcher foresees a fall in the company’s store traffic due to a higher percentage of lower-margin hardware sales and changing industry preferences. Overall, for Fiscal 2023, Pachter expects GME “to revert to quarterly losses and cash burns” in comparison to the $48.2 million net income recorded in Q4 FY22.

GME Stock Price – Expectations

GME stock has risen by 41.34% year-to-date. An earnings beat might give it a boost to rise even further; the day after its Q4 2022 earnings beat, GME stock rose by 34.2%.

Currently, the Street expects GameStop to post a loss of $0.15 per share in Q1, compared with a loss of $0.52 per share reported in the prior-year period. Meanwhile, revenue is expected to decline about 3% from the year-ago quarter to $1.34 billion.

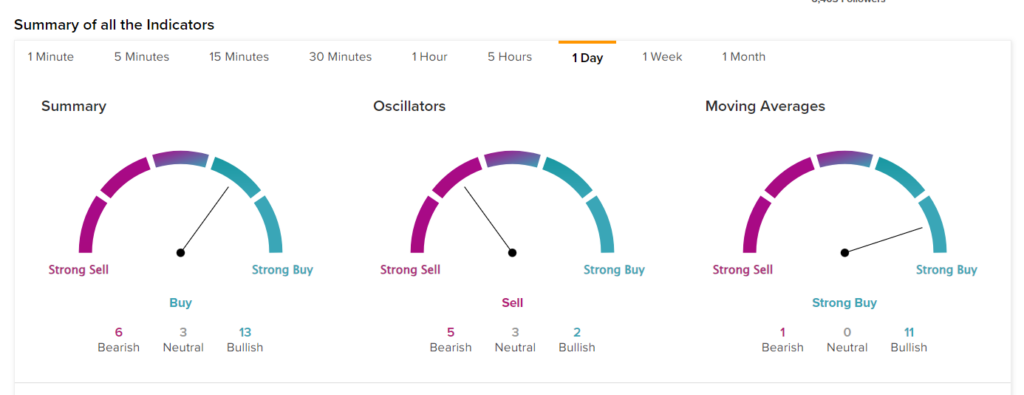

GME Stock’s Technical Analysis Reflects a Bullish Trend

Ahead of the fiscal Q1 earnings release, technical indicators indicate that GME stock is a Buy. According to TipRanks’ easy-to-understand technical analysis tool, the stock’s 50-Day EMA (exponential moving average) is 21.73, while its price is $24.31, making it a Buy. Further, GME’s shorter duration EMA (20-day) also signals an uptrend.

Ending Thoughts

GameStop’s focus on cost control appears to be the silver lining in its forthcoming results. While the management is confident in achieving profitability for Fiscal 2023, declining revenues could continue to be a major concern for investors.