fuboTV (FUBO) stock has been hammered over the past year. Shares have been on a continued downward spiral and have shaved off 46% of their value over the past 12 months. Meanwhile, the company has exhibited impressive growth on all fronts, yet the decline has been on account of persistent fears the company will never turn a profit despite the continued growth. However, after posting Q4 preliminary results which exceeded expectations, could a turnaround be in the cards?

The sports-focused streamer said it expects 4Q21’s revenue to come in between $215 and $220 million, amounting to a 105% to 109% year-over-year increase and 5% above the prior guidance of $205 to $210 million. Full-year 2021 revenue is anticipated in the $622 million and $627 million range, once again above the previous estimate of $612 million to $617 million.

Paid subscribers at the end of 2021 are expected to exceed 1.1 million, more than a 100% improvement on last year’s performance and also beating the prior guidance for 1,060,000-1,070,000. Advertising revenue should rise by 90% year-over-year to over $25 million.

At the same time, the subscriber acquisition costs (SAC) are expected to trend south and marking a 13th consecutive quarter of churn improvements, so is sub churn – anticipated to show a 200-basis point year-over-year improvement.

While Roth Capital’s Darren Aftahi notes that FUBO is not yet profitable, he sees plenty of evidence to support the notion it will become so eventually.

“We believe FUBO’s continued subscriber growth outperformance could pave the way to better operating leverage if Ad ARPU continues to perform to the upside and churn/SAC metrics continue to fall y/y,” the 5-star analyst said. “If we take this dynamic and layer on the potential churn/SAC benefits gaming could bring over time, we believe cash burn could be further reduced, along with “minimal incremental spend” set for Molotov expansion could see FUBO continue to maintain solid growth while keeping cash burn trending in the right direction.”

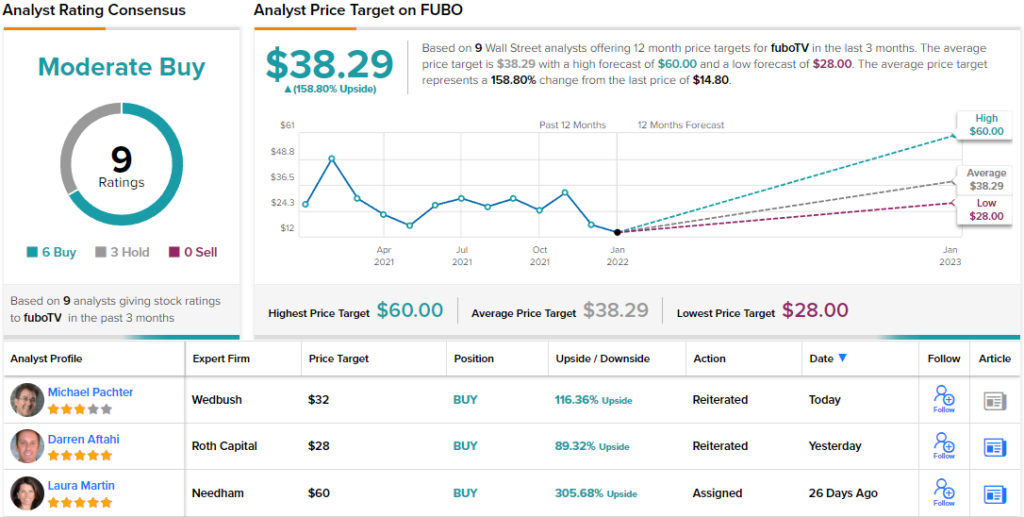

Claiming the risk/reward on FUBO is “attractive,” Aftahi rates the stock a Buy, and has a $28 price target for the shares. Investors could be pocketing gains of 89%, should Aftahi’s thesis play out as expected. (To watch Aftahi’s track record, click here)

Aftahi’s price target appears conservative when compared to his colleagues’ take; the Street’s overall objective stands at $38.29, suggesting 12-month gains of 159%. Overall, based on 6 Buys vs. 3 Holds, the analyst consensus rates the stock a Moderate Buy. (See FUBO stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.