How does Fortescue Metals Group’s (ASX:FMG) massive renewable energy spending plan play into current market dynamics and future expectations?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Perth-headquartered iron ore miner currently powers its operations with fossil fuels, such as diesel and gas. As part of its broader green energy push, Fortescue has detailed plans to shift its operations to renewable energy by 2030. The company plans to spend about AU$9.2 billion on the energy transition, according to a Wall Street Journal report.

However, Fortescue estimates the renewable energy shift will save it more than AU$1 billion in annual costs, delivered through energy and carbon credit purchase savings. The renewable energy shift plan also aligns with Fortescue’s goal to achieve net-zero carbon emissions target by 2030.

A shift toward low-carbon steel

Fortescue Metals is a multinational mining company, mostly focused on producing iron ore, a central raw material in steel manufacturing. The company was founded in 2003 by Andrew Forrest, who now serves as its executive chairman and owns 37% of Fortescue shares.

The heavy use of fossil fuels in iron ore production has been a major source of concern in the steelmaking sector amid climate change.

In shifting its operations to renewable energy, Fortescue hopes to help decarbonise the steelmaking sector. Fortescue has said that customers are willing to pay a higher price for low-carbon products. As a result, the company believes that its iron ore produced with renewable energy will fetch a premium price on the market, which would in turn bolster its profit margin.

Fortescue ranks among the best ASX mining shares for dividends. The stock currently offers a dividend yield of more than 19%, compared to the sector average of about 2%. Fortescue’s next dividend distribution date is set for September 29.

Fortescue share price prediction

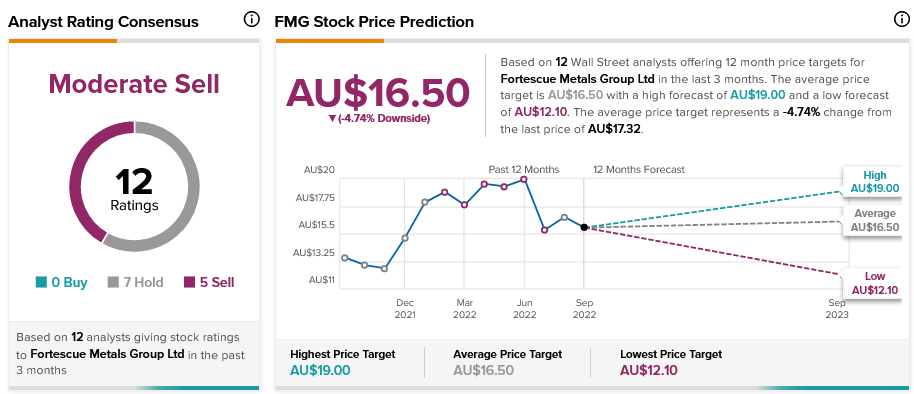

Fortescue’s shares have declined about 13% year-to-date. According to TipRanks’ analyst rating consensus, Fortescue stock is a Moderate Sell based on seven Holds and five Sells. The average Fortescue share price prediction of AU$16.50 implies nearly 5% downside potential.

The company has already been investing in clean energy projects through its Fortescue Future Industries (FFI). However, FFI’s investments drew many questions over lack of public details about the projects that the unit was funding, according to Australian Financial Review reports. As result, there have been some market doubts about Fortescue shares, in part due to the transparency concerns regarding FFI’s projects.

While Fortescue shares are Moderate Sell among analysts, company insiders and bloggers are mostly bullish on the stock. TipRanks’ Insider Trading Activity tool shows the Insider Confidence Signal is currently Positive on Fortescue. In the past three months, corporate insiders have purchased $4,000 worth of shares in Fortescue. Moreover, TipRanks data shows that financial blogger opinions are 86% Bullish on FMG, compared to a sector average of 74%.

Final thoughts

If Fortescue’s renewable energy shift fulfills its promise, it has potential to increase the iron ore company’s profits and provide enhanced dividends for investors.