Under a narrow framework, athletic shoes and apparel retailer Foot Locker (NYSE:FL) may offer a short-term upside wager. However, those interested in such speculation must know exactly what they’re doing. Otherwise, most retail investors should probably steer clear of the company due to worrisome fundamental factors. Given the split nature of the entity, I am neutral on FL stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A Not-Impossible Upside Story Exists for FL Stock

Not shockingly, Foot Locker finds itself under the microscope of many skeptical investors. Long a popular retail establishment, FL stock recently weathered a series of financial setbacks that have cast shadows over its potential for recovery. Still, the idea of short-term upside is a not-impossible story.

Initially, the headwinds facing Foot Locker are palpable. Notably, TipRanks reporter Shrilekha Pethe highlighted that Foot Locker’s revenue for the second quarter declined by a concerning 10.2% year-over-year, settling at $1.86 billion. This figure missed analysts’ benchmark of $1.88 billion. To further compound the gloomy sentiment, comparable store sales in the same quarter took a 9.4% hit.

When the company released its guidance, optimism was in short supply. Foot Locker’s leadership team forecasted a year-over-year decline in Fiscal Year 2023 sales by 8% to 9%. This grim prediction was a sharp contrast to its previous estimate, which only anticipated a decline ranging from 6.5% to 8%.

Confirming these challenges, TipRanks’ website traffic chart revealed a conspicuous drop in the total estimated viewership since July of last year.

Nevertheless, not all have lost faith in Foot Locker’s potential. The options market recently buzzed with activity, with both bullish and bearish sentiments emerging for FL stock. One particularly eye-catching move involved the purchase of 3,000 contracts of the January 17 ’25 20.00 put.

This trade, intriguingly, saw the seller pocketing a premium of $1.41 million. Essentially, this trade suggests confidence that FL stock might rise, or at the very least, not plummet severely enough to offset the received premium. Yet, a word of caution remains crucial: retail investors should consider treading carefully and not hastily jump on this bandwagon.

Don’t Ignore the Margins (or Lack Thereof)

In the financial world, seeing institutional players back a particular trade can be a beacon of hope for smaller investors. However, there’s a distinction that needs emphasis: the financial titans have deeper pockets and a greater ability to absorb potential losses. Unfortunately, the average investor doesn’t share this luxury. Thus, it’s crucial to consider the broader picture before making investment decisions.

A significant concern for Foot Locker is its gross profit margin. Beyond the reported 10.2% decline in revenue year-over-year, there’s a deeper issue. The company’s gross margin has shrunk to 27.2%, down from nearly 32% during the same period last year. This suggests Foot Locker might be heavily relying on price reductions or promotional drives to bolster sales, a tactic that can be risky for long-term profitability.

Essentially, FL stock grapples with a two-fold problem. Revenues are slipping, and concurrently, its gross margin is eroding. This dual challenge emerges amid an already-precarious consumer landscape.

With Americans burdened by over $1 trillion in credit card debt, there’s a decreased appetite for discretionary spending on premium brands. The financial strain on households means luxury or non-essential purchases, like those at Foot Locker, are often the first to be curtailed.

Moreover, current inflationary trends add another layer of pressure. Rising costs of living mean consumers are tightening their belts further, which spells potential trouble for businesses built on non-essential retail experiences like Foot Locker.

Layoffs Could Hurt the Narrative Substantially

To be sure, it’s difficult to ignore the bold bet that a major trader placed on FL stock. Unfortunately, the narrative could crumble if mass layoffs continue to accelerate. Sadly, the latest data suggests that more workers are likely to lose their jobs. If so, buying stuff at Foot Locker would be one of the first items on the family budget to cut.

It’s really an obvious point. Yes, people need shoes and clothing. However, hurt consumers will almost surely not go for premium items, making FL stock vulnerable to the trade-down effect.

Is FL Stock a Buy, According to Analysts?

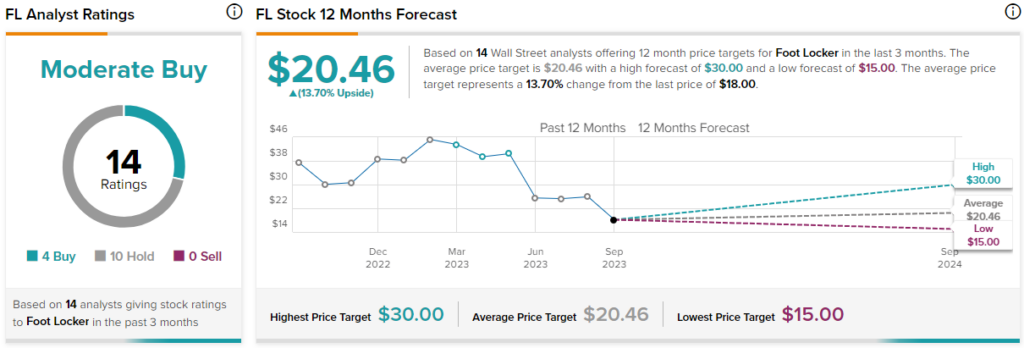

Turning to Wall Street, FL stock has a Moderate Buy consensus rating based on four Buys, 10 Holds, and zero Sell ratings. The average FL stock price target is $20.46, implying 13.7% upside potential.

The Takeaway

While Foot Locker may offer short-term speculative appeal due to notable options market activity, its longer-term outlook raises concerns. Declining revenues coupled with a significant dip in its gross margin suggest that the company is possibly relying on discounts and promotions to drive sales. In a challenging consumer environment, FL stock looks very questionable.