Consumers seem to be in a weird spot right now, with high-end luxury goods selling well, while some folks turn their back on McDonald’s (NYSE:MCD) following their price hikes. Indeed, the consumer could continue to be mixed going into the midpoint of this year as inflation and layoffs begin to work their way into sentiment. Despite this, Wall Street still seems quite upbeat on a handful of retail stocks (such as FIVE, BOOT, and TPX), which we’ll cover in this piece with some help from TipRanks’ Comparison Tool.

Five Below (NASDAQ:FIVE)

Five Below isn’t just another discount retailer that’s capable of offering a top-notch value proposition. It’s a discount retailer that’s incredibly popular with the younger generations. Though inflation has essentially rendered the company’s name obsolete (perhaps the firm should change its name to Five Beyond, like the section within certain stores that have goods priced at $5.00 and up), the retailer continues to offer great value on a wide range of intriguing products.

You simply cannot find many of these products at most other discount retailers. For this reason, and because of the fair price tag, I remain incredibly bullish.

Undoubtedly, raising prices and bringing new, pricier goods into stores has not caused consumers to look elsewhere. If anything, the wider selection of goods has drawn in more crowds. Though I believe FiveBelow is one of the best high-growth retailers to own in a mixed economy, not all analysts are upbeat.

Oppenheimer’s Brian Nagel recently downgraded the stock to Hold from Buy due to growth concerns and the stock’s high valuation for a discount retailer. Though Mr. Nagel’s concerns are warranted, I’m still inclined to stick with the rest of the Wall Street crowd, most of whom remain bullish.

Sure, the price tag (38.4 times price-to-earnings) may be rich, but you’ve got to pay a premium for the truly standout industry players. Five Below stands out as one, in my opinion. There just aren’t enough locations across the nation.

As the firm grows its footprint, I think the firm can keep growing at an impressive pace, as it offers fun offerings (primarily toys) at affordable prices. Don’t underestimate Five Below, as it’s not just another dollar store.

What Is the Price Target for FIVE Stock?

Five Below stock is a Strong Buy, according to analysts, with 15 Buys and four Holds assigned in the past three months. The average FIVE stock price target of $220.53 implies 16.3% upside potential.

Boot Barn (NYSE:BOOT)

Boot Barn is a niche retailer that sells (you guessed it) cowboy boots, among other pieces of intriguing western wear, ranging from cowboy hats to western-style shirts to jeans and workwear. Unless there’s a rodeo coming up, you’re probably not going to rush over to the local Boot Barn to get a pair of cowboy boots and a hat.

Still, the styles are timeless, and the company has a pretty wide moat around its corner of apparel retail. With a modest valuation (16.3 times trailing price-to-earnings), I’m inclined to be bullish, as many analysts are these days.

The stock has seen decent gains over the past year, rising by around 11%. From its 2021 highs, though, Boot Barn shares remain down just north of 30%. The recent third-quarter top-line miss (sales were up just 1.1% year-over-year) and lowered guidance caused some to re-evaluate their Buy ratings. However, most analysts are confident in Boot Barn’s future as the firm looks to pull up its bootstraps.

The company’s long-term potential is worth getting behind, so says B. Riley Securities, which highlighted the company’s dominance in the corner of western and workwear. With a wide moat and good footing ahead of a consumer recovery, it’s tough to look past Boot Barn and the many bulls in the Wall Street crowd.

What Is the Price Target on BOOT Stock?

Boot Barn stock is a Strong Buy, according to analysts, with 11 Buys and three Holds assigned in the past three months. Nonetheless, the average BOOT stock price target of $90.69 implies just 0.1% upside potential.

Tempur Sealy (NYSE:TPX)

Tempur and Sealy are two of the biggest brands in the world of mattresses and bedding. The $8.7 billion mattress and bedding company recently broke through to new all-time highs, just north of $50 per share. Higher highs could be in the forecast as the firm looks to benefit from a healing consumer while showcasing new innovations across its bedding lineup.

With smart beds, intriguing temperature-regulating foams, and other sleep-easy innovations to win the business of sleepers, it’s hard not to be bullish on the stock right here. Apart from innovative concepts, the firm has been doing a great job of staying ahead of capitalizing on the direct-to-consumer (DTC) boom with mattress-in-a-box products like Cocoon by Sealy. As far as boxed mattresses go, Cocoon certainly stands out as one of the more fully-loaded offerings out there.

Although mattresses are an expensive discretionary purchase, I’m more inclined to view them as an investment in one’s health and sleep hygiene. In an increasingly health-conscious world, one has to think that Tempur Sealy is in a spot to rise up on the back of a growing industry, with ExplodingTopics forecasting a 5.9% compound annual growth rate for the global mattress market from 2024 to 2030.

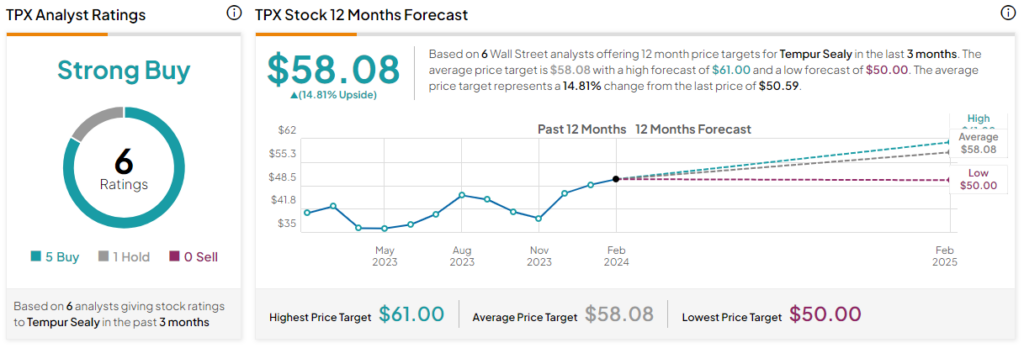

What Is the Price Target on TPX Stock?

Tempur Sealy stock is a Strong Buy, according to analysts, with five Buys and one Hold assigned in the past three months. The average TPX stock price target of $58.08 implies 14.8% upside potential.

The Takeaway

The consumer may be doing okay, but that ultimately depends on who you ask. Moving into year’s end, I’d look for the following retail plays to make up for lost time as market strength keeps working its way into consumer sentiment. Of the trio presented in this piece, analysts expect the most upside (16.3%) from Five Below.