FedEx (NYSE:FDX) kicked off Fiscal 2024 with strong momentum, showcasing robust financial strides in its Q1 results. Despite a dip in revenues attributed to weaker volumes compared to the previous year, the company adeptly navigated through this challenge.

Efficient cost reduction strategies not only bolstered FedEx’s financial standing but also prompted management to raise its guidance. Thus, FedEx has set the stage for another year of exceptional profitability. Combined with shares trading at a reasonable valuation, I am bullish on the stock.

Q1-2024 Results Were Strong, Given the Circumstances

A couple of weeks ago, FedEx posted its Q1 results for Fiscal 2024, with numbers coming in rather strong in the context of slowing demand for deliveries. Let’s take a close look.

Within the FedEx Ground segment, revenues grew 3% year-over-year. This was propelled by a 1% increase in volume and an impressive 3% surge in yield. Conversely, FedEx Express witnessed a 9% year-over-year decline in revenues, attributed to sustained pressure on volumes.

Nevertheless, there was a noticeable sequential easing in total Express volume declines. Notably, International Export Package volumes recorded 3% year-over-year growth, whereas parcel volume declines were predominantly associated with the United States.

The FedEx Freight segment faced its most challenging period, with a 16% decline in revenues primarily driven by a 13% drop in volume. Despite the seemingly lackluster top-line results, FedEx implemented significant measures to efficiently manage costs and unlock internal efficiencies. In particular, at FedEx Ground, adjusted operating income surged by an impressive 61%, accompanied by a 480 basis point expansion in the segment’s adjusted operating margin to 13.3%.

This remarkable improvement was fueled by advancements in yield and cost reductions, including lower line haul expenses and enhanced first and last-mile productivity, resulting in a more than 2% reduction in cost per package.

Similarly, at FedEx Express, the company demonstrated resilience by achieving growth in operating income despite a decline in revenues. This underscores the success of the DRIVE program, which focuses on expense reduction through enhanced efficiency. Specifically, FedEx Express’ adjusted operating income rose by 14%, with its adjusted operating margin expanding by 40 basis points to 2.1%.

FedEx’s accomplishments were backed by strategic moves. The company slashed costs through measures such as cutting flights, adjusting staffing to match volumes, parking its aircraft, and switching to a single daily delivery wave in the U.S. These actions not only offset the blow of reduced revenue but also demonstrated a remarkable ability to handle challenges during a period of high inflation. That’s a notable achievement, given the capital-intensive nature of FedEx’s business.

Revised Guidance Justifies Recent Rally

FedEx has faced challenges with weaker package volumes, which could make one question the stock’s year-long rally. For instance, shares have risen by 79% over the past year. That said, with profits set to come in very strong this year due to FedEx’s cost-cutting initiatives, it would be hard for investors not to be excited.

In Q1, FedEx raised its guidance, now expecting adjusted EPS between $17.00 and $18.50 compared to the previous $16.50 to $18.50. Excluding the pandemic-boosted Fiscal 2021, where EPS skyrocketed to $19.45 due to bloated demand for deliveries, this is going to be FedEx’s most profitable year.

Further, despite revenue struggles, the midpoint of the guidance suggests that shares are trading at a forward P/E of just under 15 at their current levels. The forward multiple drops further to 13.9 when looking out 12 months from now. This not only falls below historical averages but also compares favorably to UPS, whose forward P/E is at 16.5. Thus, I believe FedEx’s recent rally is justified, with the current stock price reflecting investors’ enthusiasm over robust profits in a challenging trading period.

Is FDX Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, FedEx has a Moderate Buy consensus rating based on 14 Buys and five Holds assigned in the past three months. At $297.42, the average FedEx stock price target implies 12.25% upside potential.

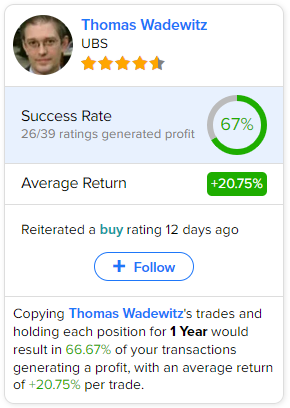

If you’re wondering which analyst you should follow if you want to buy and sell FDX stock, the most accurate analyst covering the stock (on a one-year timeframe) is Thomas Wadewitz from UBS, with an average return of 20.75% per rating and a 67% success rate.

The Takeaway

In wrapping up, FedEx’s Q1-2024 results paint a picture of resilience in the face of delivery demand shifts. Despite a revenue hiccup, the strategic cost-cutting, particularly at FedEx Ground and Express, plays a key role in this success story. Management’s ability to bolster adjusted operating income and widen operating margins speaks volumes about its adaptability. Further, the upgraded guidance is akin to confidently stepping into a promising fiscal year.

Simultaneously, with shares currently trading at a reasonable valuation, I wouldn’t see the recent rally as a cause for concern. If anything, FedEx’s recent rally appears well-founded, reflecting investor optimism about solid profits during a period of market challenges. In fact, with shares trading below their historical average valuation, FedEx appears like a compelling pick at current levels.