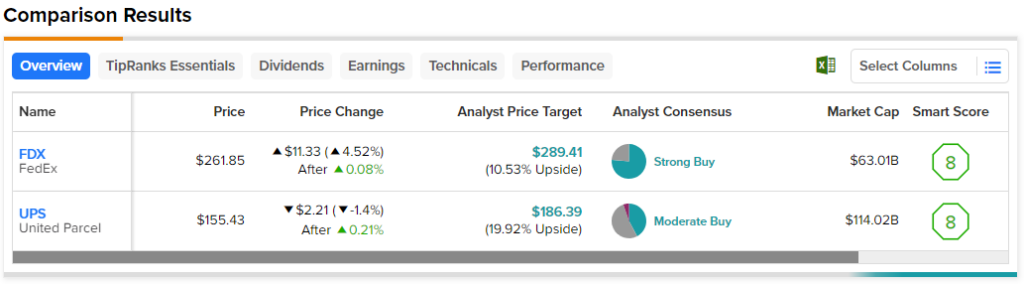

In this piece, I evaluated two logistics stocks, FedEx (NYSE:FDX) and United Parcel Service (NYSE:UPS), using TipRanks’ comparison tool to determine which stock can deliver more gains from here. FedEx is a U.S.-based multinational conglomerate holding company focused on transportation, e-commerce, and business services. UPS is a U.S.-based multinational shipping and receiving and supply-chain management company.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

FedEx shares are up over 44% year-to-date and 67% over the last year, while UPS shares are down 6% year-to-date and 9.3% for the last 12 months.

With such a huge difference in stock-price performance, it comes as no surprise that FedEx’s valuation is significantly higher than UPS’s valuation. Since both are profitable, we’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other. For comparison, the logistics industry is trading at a P/E of 14.9 versus its three-year average of 19.9.

FedEx (NYSE:FDX)

At a P/E of 16.3, FedEx now looks overvalued versus its industry following its massive year-to-date rally. However, it is significantly undervalued versus the industry’s three-year average P/E. Thus, a neutral view seems appropriate for now, pending a re-rating of the logistics industry closer to its three-year average or any significantly positive news specifically for FedEx.

In its latest earnings report released on Wednesday after the closing bell, FedEx smashed earnings-per-share estimates but came up a bit short on revenue. Earnings rose 32% year-over-year to $4.55 per share. The company also reported that it had won back market share from United Parcel Service amid the company’s ongoing labor dispute (more on this below), and it even benefited from trucking group Yellow’s (NASDAQ:YELL) bankruptcy filing.

Moreover, FDX boosted its earnings guidance for the next quarter but cut its revenue guidance. On a broader view, FedEx’s revenue fell 3.6% from the May 2022 fiscal year to the May 2023 year. Meanwhile, its net income plunged from $5.2 billion in the year that ended in May 2021 to $3.8 billion in the May 2022 fiscal year, although it rose to $4.2 billion for the last 12 months.

On the one hand, FedEx is taking a hit from declining delivery demand since the pandemic ended, but on the other, its revenue and net income margin are still significantly better than its pre-pandemic numbers. Thus, the company is worth monitoring for a better entry point.

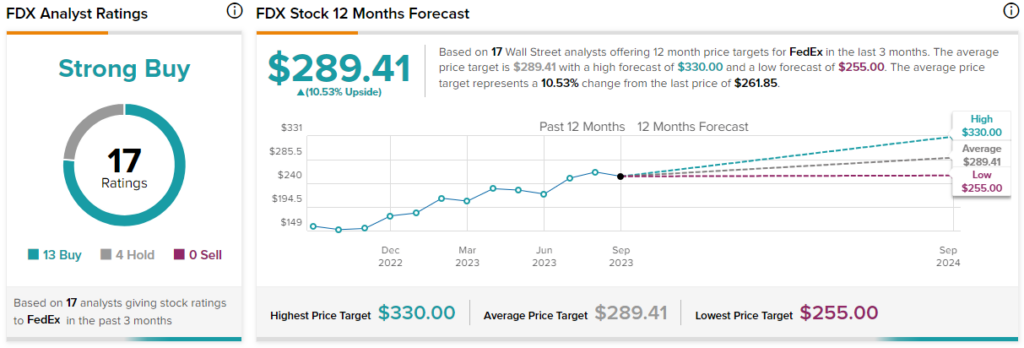

What is the Price Target for FDX Stock?

FedEx has a Strong Buy consensus rating based on 13 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $289.41, the average FedEx stock price target implies upside potential of 10.5%.

United Parcel Service (NYSE:UPS)

At a P/E of 13.7, United Parcel Service is undervalued relative to its industry and FedEx. However, as mentioned earlier, the company has been struggling with a labor dispute over the last several months. In fact, UPS’ management warned in early August that the company’s profits would decline after it reached a deal with its labor union. Thus, a bearish view seems appropriate, at least for now.

UPS reached a tentative deal with its Teamsters union in late July, hoping to avoid a strike that could have crippled supply chains in the U.S. In late August, the Teamsters union voted to approve the deal, officially averting a strike. However, as mentioned earlier, this will affect UPS’ income.

Unfortunately, profits aren’t the only thing the company is worrying about now. In April, UPS shares recorded their largest sell-off in 17 years after the company came up far short of revenue expectations due to “significantly lower” volumes than expected.

While United Parcel Service did manage to beat the consensus estimate for earnings per share in the most recent quarter, it missed the revenue consensus, coming in at $22.1 billion versus the $23.1 billion that had been expected. Thus, while the company isn’t going anywhere any time soon, there may be limited upside and possibly further downside for UPS shares until its financial situation stabilizes.

What is the Price Target for UPS Stock?

United Parcel Service has a Moderate Buy consensus rating based on eight Buys, 10 Holds, and one Sell rating assigned over the last three months. At $186.39, the average United Parcel Service stock price target implies upside potential of 19.9%.

Conclusion: Neutral on FDX, Bearish on UPS

FedEx and United Parcel Service both face financial challenges right now, although neither is going anywhere anytime soon. Nevertheless, UPS faces significantly more uncertainties due to the expected negative impacts from its new union deal, so FedEx stock is the clear winner here.