Logistics giant FedEx (NYSE:FDX) is scheduled to announce its fiscal first-quarter results after the market closes on Wednesday, September 20. Analysts expect the impact of macro headwinds on consumer spending to weigh on the company’s Q1 FY24 revenue and volumes. However, they project higher earnings, driven by the company’s cost reduction and productivity initiatives. Ahead of the fiscal first-quarter results, most Wall Street analysts are bullish on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Expectations from FedEx’s Q1 Earnings

FedEx reported mixed results for the fourth quarter of FY23 (ended May 31, 2023). Revenue declined 10% to $21.9 billion, while adjusted earnings per share (EPS) fell 28% to $4.94. Analysts were expecting adjusted EPS of $4.85 on revenue of $22.5 billion.

Coming to Q1 FY24, analysts expect adjusted EPS to rise 8% to $3.72, reflecting the benefits of the company’s cost reduction efforts even as revenue is projected to decline 6% to $21.7 billion.

Heading into Q1 FY24 results, Evercore analyst Jonathan Chappell raised his price target to $276 from $275 and reiterated a Buy rating on FDX stock on Monday. The analyst noted that the company benefited from two “meaningful events” in the quarter, namely the labor negotiations of United Parcel Service (NYSE:UPS) that led to market share gains for FedEx and the bankruptcy of trucking company Yellow.

In particular, Yellow was one of the largest competitors for the company’s FedEx Freight unit, and the analyst believes that its bankruptcy “also likely supported both volumes and pricing in that segment.” The analyst raised his Q1 FY24 EPS estimate to $3.53 from $3.33.

Like Chappell, Goldman Sachs analyst Jordan Alliger also highlighted the positive impact of the UPS labor negotiations and Yellow bankruptcy on FedEx’s fiscal first-quarter results. Additionally, he expects the quarter to benefit from the company’s productivity initiatives.

That said, Alliger expects challenging macro conditions to impact the parcel businesses of FedEx’s Express and Ground units. The analyst projects EPS of $3.65 for Q1 FY24 and believes that investors would focus on the company’s long-term cost-saving efforts and the volume trajectory as we wrap the calendar year 2023 and head into 2024.

Alliger raised his FDX price target to $278 from $269 and reiterated a Buy rating, as he remains positive about the company’s $4 billion DRIVE program that aims to reduce $4 billion in costs by FY25 and the Network 2.0 plan that is targeting an additional $2 billion in cost savings from FY26 to FY27.

Is FedEx Stock a Good Buy?

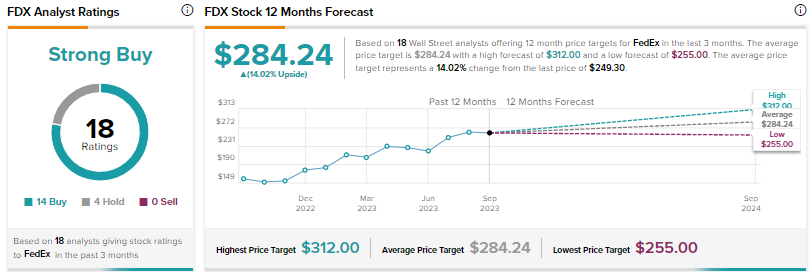

Wall Street’s Strong Buy consensus rating on FedEx stock is based on 14 Buys and four Holds. The average price target of $284.24 implies 14% upside potential. Shares have risen 44% year-to-date.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/– 5.19% move on FedEx earnings. FDX shares have averaged a 0.6% move in the last eight quarters. In particular, the stock fell 2.51% in reaction to the Q4 FY23 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Conclusion

FedEx is expected to report higher earnings for the fiscal first quarter even as macro challenges are expected to impact the top line. Despite near-term headwinds, Wall Street remains bullish on FedEx’s long-term growth potential.