Energy giant Exxon Mobil (NYSE:XOM) is scheduled to announce its first-quarter earnings on April 28. The company recently cautioned that it expects its Q1 2023 earnings to decline compared to the fourth quarter of 2022, as oil and gas prices have cooled off compared to the elevated levels seen last year. Exxon delivered record profits last year, thanks to a spike in oil prices due to the Russia-Ukraine war.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Exxon expects lower oil prices to drag down Q1 upstream earnings by $600 million to $1 billion compared to Q4 2022. It projects lower natural gas prices to have a $400 million to $800 million adverse impact compared to the prior quarter. Oil prices have been under pressure recently as demand concerns due to macro challenges are offsetting the production cuts by OPEC+.

Meanwhile, analysts expect the company’s Q1 2023 adjusted earnings per share (EPS) to rise 25% year-over-year to $2.61. This growth rate marks a deceleration compared to the 66% rise in Q4 2022 adjusted EPS. Analysts expect Q1 2023 revenue to decline 5.4% to $85.7 billion.

Last week, Piper Sandler analyst Ryan Todd slightly lowered his price target for Exxon stock to $134 from $135 and reiterated a Buy rating. Heading into Q1 results, Todd said that sentiment is “notably mixed” across integrated oil companies.

While upstream leverage has rebounded meaningfully from mid-March lows, Todd noted that sentiment has turned bearish on refining due to demand concerns resulting from fears of a potential economic downturn. However, Todd remains constructive on refining.

Technical Indicators Ahead of Earnings

Ahead of the Q1 earnings release, technical indicators reveal that Exxon is a Buy. According to TipRanks’s easy-to-understand technical tool, XOM’s 50-Day EMA (exponential moving average) is 112.04, while its price is $115.45, making it a Buy. Further, XOM’s shorter duration EMA (20-day) also signals an uptrend.

Is XOM Stock a Buy, Sell, or Hold?

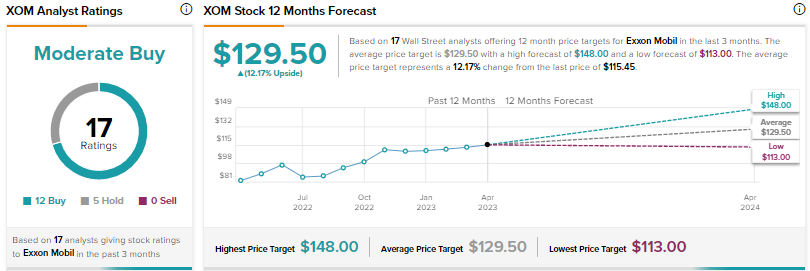

Wall Street is cautiously optimistic about Exxon, with a Moderate Buy consensus rating based on 12 Buys and five Holds. The average price target of $129.50 suggests 12.2% upside. Shares have risen 5% year-to-date.

Conclusion

Energy prices have declined compared to the high levels seen last year. Exxon has already cautioned about sequential decline in its Q1 earnings due to lower oil and gas prices. Management’s commentary about demand outlook is expected to impact the stock over the near term.