Japanese stocks have lagged behind their U.S. and developed market counterparts for a long time, but they started to turn things around with a nice rally in 2023. In fact, the iShares MSCI Japan ETF (NYSEARCA:EWJ) is up just over 20% year-to-date. EWJ looks well-positioned to build on these gains in 2024. I’m bullish on the ETF based on the ongoing corporate reforms in Japan that are creating value for shareholders and the inexpensive valuations of Japanese equities.

What is the EWJ ETF’s Strategy?

EWJ allows investors to “access the Japanese stock market in a single trade” and gives investors exposure to large-cap and mid-cap companies in Japan. Launched in 1996, this ETF from BlackRock’s iShares is the largest Japan ETF, with $13.6 billion in assets under management (AUM).

A “Game Changer” for Japanese Stocks

For years, Japanese stocks languished for various reasons, including opaque corporate governance and the fact that many companies let large sums of cash pile up on their balance sheets, where it wasn’t earning any return for investors. This year, the Tokyo Stock Exchange began to address this issue through corporate governance reforms that analysts from Goldman Sachs (NYSE:GS) recently hailed as “a game changer for the Japanese equities market.”

The Tokyo Stock Exchange has mandated companies to increase their earnings and valuations, and stocks now face the risk of being delisted if they don’t show that they are using their capital efficiently. This should incentivize companies to stop hoarding cash and put it to work in ways that benefit shareholders, whether in the form of shareholder returns via dividends and share buybacks, accretive M&A activity, or organic investment in areas like R&D.

Cross-shareholding has been another issue in Japan. Japan’s major conglomerates will often own significant positions in other Japanese firms in order to maintain strong business relationships with them. This has hurt perceptions of corporate governance and reduced liquidity for these stocks. However, the ongoing reforms mean that these positions are beginning to be untangled, which should be another positive catalyst going forward.

In March of 2023, the TSE took the unprecedented step of asking companies to disclose how they plan to increase their return on capital above their weighted average cost of capital, specifically focusing on companies whose stocks trade below book value.

Neuberger Berman portfolio manager Kei Okamura writes that this move was “pivotal” because poor capital allocation is a primary factor for why Japanese stocks are undervalued. In addition, it highlights share price and cost of capital as key priorities that management teams must focus on going forward.

These changes have made a tangible impact as Japanese companies accelerated share repurchases (hitting an all-time high in May 2023) and began to decrease cross-shareholding.

Goldman Sachs analysts believe that the TSE will keep up the pressure for further improvements in 2024. Based on the significant inflows of foreign investment and the market’s strong performance in 2023 after these changes were implemented, companies will likely be receptive.

EWJ has an Inexpensive Valuation

Another reason that EWJ looks appealing is that Japanese stocks are cheap compared to their U.S. peers. EWJ sports an average price-to-earnings ratio of 15.3. This represents a considerable discount to the S&P 500 (SPX), which currently features an average price-to-earnings ratio of 21.8. There is plenty of room for Japanese equities to narrow this gap.

What Companies are in the EWJ ETF?

EWJ is a well-diversified fund that owns 225 stocks. Its top 10 holdings make up just 24.5% of assets, so this ETF isn’t overly concentrated in its top positions. Below is an overview of EWJ’s top 10 holdings using TipRanks’ holdings tool.

U.S. investors will be familiar with EWJ’s top holding, Toyota (NYSE:TM), plus high-profile Japanese conglomerates like Mitsubishi UFJ (OTC:MBFJF), Hitachi (OTC:HTHIF) and Sumitomo. Sumitomo and Mitsubishi are among the stocks that famed investor Warren Buffett began buying heavily this summer. Other notable holdings include electronics and entertainment giant Sony (NYSE:SONY), gaming titan Nintendo (OTC:NTDOY), semiconductor production equipment maker Tokyo Electron (OTC:TOELY), and high-profile investment holding company Softbank (OTC:SFTBY).

EWJ is also well-diversified by industry. Industrials make up the largest weighting within the fund at 22.2%. This is followed by Consumer Discretionary, with a weight of 18.9%; Information Technology, with a weight of 15.1%; and Financials, with a weight of 12.2%. No other sector has more than a double-digit percentage weighting.

Looking at EWJ’s Past Performance

EWJ has not been a strong performer in recent years, with a five-year annualized return of 4.1% and a 10-year annualized return of 4.2% (as of November 30). However, I view this more as a turnaround play based on the factors discussed above rather than an investment in a proven winner that has compounded returns over the long term.

How Much Does EWJ Charge?

EWJ has an expense ratio of 0.50%. While this isn’t necessarily cheap, it’s important to remember that international ETFs are often more expensive than domestic index ETFs. As such, EWJ’s expense ratio isn’t out of line with other major international equity ETFs.

EWJ’s expense ratio of 0.50% means that an investor in the fund will pay $50 on an investment of $10,000 annually. Assuming the fund returns 5% per year and maintains this current expense ratio, this same investor will pay $628 in fees over 10 years.

Does EWJ Pay a Dividend?

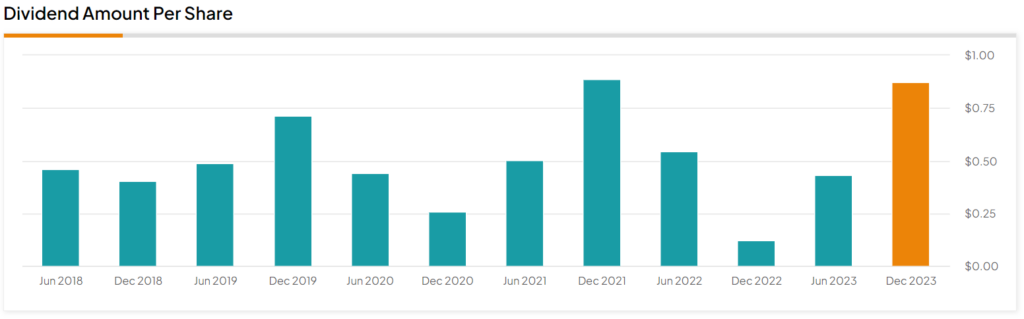

EWJ is also a dividend payer. While its 2% dividend isn’t a showstopper, it is still north of the 1.5% yield offered by the S&P 500 and a nice bonus for holders. Furthermore, the fund has paid dividends for 15 consecutive years. Investors should note that this dividend is paid semiannually rather than quarterly.

Looking Ahead: EWJ Positioned to Continue Delivering Returns

After many lackluster years, EWJ began to bounce back in 2023. The ETF looks well-positioned to add to these gains in 2024 and beyond based on the ongoing shareholder-friendly reforms that should help unlock more value for Japanese stocks going forward. EWJ also looks attractive based on the relative inexpensiveness of Japanese stocks. Furthermore, EWJ is a well-diversified fund and features the added bonus of a 2% dividend yield.