Tesla (NASDAQ:TSLA) stock has risen significantly (see the chart below) so far this year thanks to its record deliveries. However, the growth rate of EV (electric vehicle) sales slowed in the U.S. during the first half of 2023, indicating that Tesla could implement more price cuts to stimulate demand. This could pressure margins further and limit the upside in its stock price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Citing data from Motor Intelligence, a Wall Street Journal report highlighted that EV sales increased by 50% in the first half of 2023 compared to a 71% increase in the first half of 2022. Furthermore, the first-half sales growth rate was lower than the 65% increase in EV sales in 2022.

The moderation in sales growth rate has led to an increase in unsold EV inventory at dealerships. This comes as a surprise, as Tesla and other EV makers announced price cuts and promotions to accelerate demand.

More Price Cuts on the Horizon

Tesla implemented price cuts this year to drive volumes. However, its focus on pushing volumes higher came at the cost of its margins. While Tesla boasts of industry-leading margins, these margins have consistently trended lower over the past several quarters.

Even though Tesla’s deliveries remained strong, they have trailed production numbers for the past five consecutive quarters, suggesting that the company could announce more price cuts in the future.

Tesla’s CEO Elon Musk is ready to let go of some automotive margins to drive volumes. During the Q1 conference call, Musk said the company could recover margins from service, autonomy, supercharging, and improved production efficiency.

Commenting on Tesla’s deliveries and margins, Mark Delaney of Goldman Sachs said that he expects pricing to decline further to support volume. Delaney reiterated a Hold rating on TSLA stock on July 2. He added that his Hold recommendation reflects “additional pricing reductions and full valuation.”

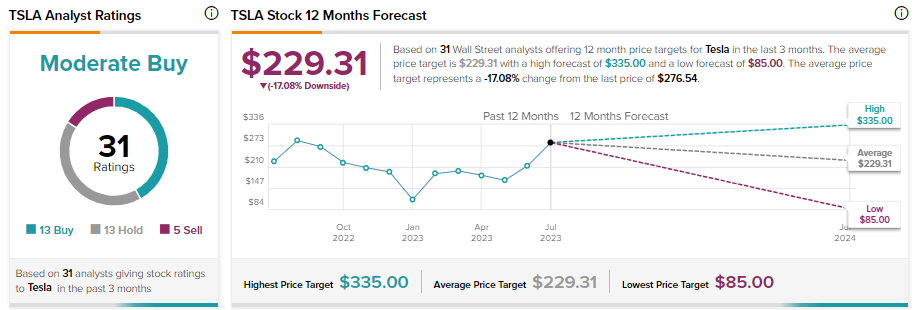

What is the 12-Month Price Target for Tesla?

While pressure on margins remains a concern, Tesla’s leadership in the EV space, benefits from the ramp-up in production and deliveries, and improvement in China (the world’s largest EV market) are positives. The EV giant is also expected to gain from in-house battery production, supercharging opportunities, and the launch of lower-priced models that position it well to deliver strong growth in the long term.

TSLA stock has received 13 Buy, 13 Hold, and five Sell recommendations for a Moderate Buy Sell rating. The average TSLA stock price target of $229.31 suggests 17.08% downside potential from current levels.