Energy Transfer (NYSE:ET) and Air Products and Chemicals (NYSE:APD) are known for their solid dividend payments and growth histories. Moreover, these high-yield dividend stocks have consistently outperformed the broader markets over the past several years. Investors should note that corporate insiders have recently increased their holdings of these stocks.

Interestingly, TipRanks offers daily insider transactions as well as a list of the top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

With this background, let’s delve deeper into these dividend stocks.

Energy Transfer

Energy Transfer is engaged in natural gas and propane pipeline transport. The stock has a solid dividend yield of 8.81%. ET’s payouts seem sustainable due to its strategic acquisitions of Lotus Midstream (closed in May 2023) and Crestwood Equity Partners (completed in November 2023), which are expected to keep supporting its cash flow.

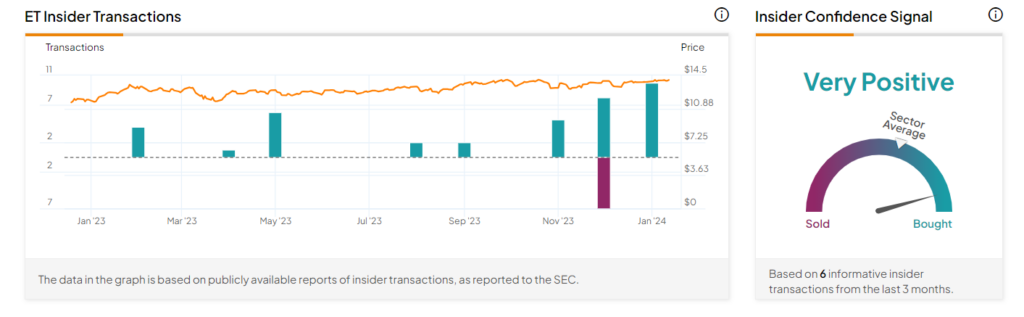

According to the Insider Trading Activity tool, the insider confidence signal is “Very Positive” for ET stock. In the past three months, the stock witnessed 23 informative buy transactions from several insiders, including its Director, Thomas Long. Further, insiders bought ET shares worth $27.9 million in the last three months.

Is ET Stock a Good Buy?

With five Buy and one Hold recommendations, Energy Transfer stock has a Strong Buy consensus rating on TipRanks. These analysts’ average price target of $18.33 indicates 30.8% upside potential. Shares of the company have gained 22.1% over the past year.

Air Products and Chemicals

APD provides essential industrial gases and related equipment. It offers a dividend yield of 2.65%. Looking ahead, the company’s ability to increase prices and a promising pipeline of hydrogen projects may drive its earnings and dividend payouts.

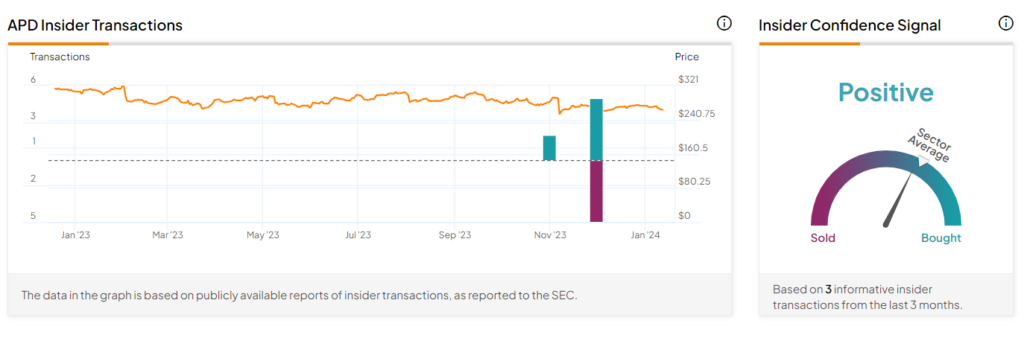

The Insider Trading Activity tool shows that the insider confidence signal is “Positive” for APD stock. In the last three months, the stock witnessed seven informative buy transactions from several insiders, including its Chairman and CEO, Seifi Ghasemi. Further, insiders bought APD shares worth $5.4 million in the last three months.

Is APD a Good Stock to Buy?

APD stock has a Moderate Buy consensus rating based on nine Buy, four Hold, and one Sell recommendations from Wall Street analysts. The average price target of $301.86 implies 14.28% upside potential. The stock has declined 11.6% in the past year.

Ending Note

Tracking insiders’ activities helps investors make sound investment decisions, especially if trades are informative. The corporate insiders are positive about both ET and APD stocks. However, investors should take a closer look before adding these stocks to their portfolios.