Enterprise Products Partners (NYSE:EPD) has a stellar track record of dividend payments and growth (25 consecutive years), which makes it a Dividend Aristocrat (learn more about Dividend Aristocrats here). Further, it offers an attractive forward yield of about 7.6%. Besides its solid payout history and high yield, Wall Street analysts are bullish on EPD stock, making it look like a solid bet.

EPD offers midstream energy services to natural gas, NGLs (natural gas liquids), and crude oil producers. These services include transportation and storage, gathering, treating, and processing.

On July 10, Enterprise Products Partners increased its quarterly dividend to $0.50 per share. The new dividend represents a year-over-year increase of 5.3%. With this in mind, let’s delve into EPD.

EPD: A Solid Income Stock

The durability of the company’s dividend reflects its ability to deliver strong financials in all market conditions. For instance, the company’s resilient business, diversified assets, and steady demand for its services have enabled it to grow its adjusted EBITDA at a compound annual growth rate (CAGR) of 8.4% since 2017. Thanks to its growing earnings base and sustainable payout ratio, EPD emerges as a solid income stock.

The company plans to invest in midstream energy infrastructure, which can offer attractive long-term returns. Such investments can bolster its cash flows and dividend distributions. Additionally, EPD’s multi-billion-dollar capital projects, set to be operational in the coming years, should enhance its earnings.

Furthermore, EPD’s fixed-rate debt, its focus on lowering its leverage ratio, strong balance sheet, and financial flexibility position it well to grow organically and inorganically.

Is EPD Stock a Buy, According to Analysts?

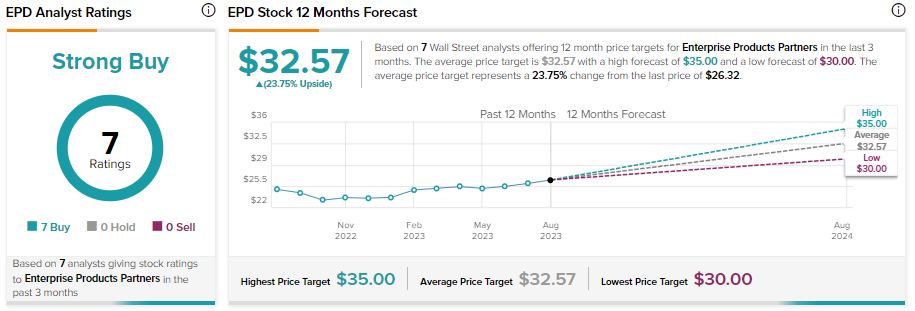

Thanks to its high-quality asset base, ability to grow earnings, and robust dividend payments, Wall Street analysts maintain a bullish outlook on EPD stock. It has received seven unanimous Buy recommendations for a Strong Buy consensus rating.

The average EDP stock price target of $32.57 implies 23.75% upside potential from current levels.

Interested in learning more about dividends? Join in on the conversation on the TipTalks podcast.