With the rise of generative artificial intelligence (gen AI) and the metaverse, also known as virtual and augmented reality, the video game market looks poised for greater growth as companies take the immersive factor to the next level. Therefore, in this piece, we’ll talk about these catalysts and use TipRanks’ comparison tool to analyze two video game stocks (EA and NTDOY) and see which one stands out as a better bet.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Given that there are only so many hours in the day, active entertainment (video games) could begin to cut further into the turf of passive entertainment services (think video and audio streaming) over time, especially as experiences become more profound.

Video Game Market to Benefit from the Metaverse and Gen AI

With Apple’s (NASDAQ:AAPL) spatial computer (Vision Pro) poised for an early February launch, I believe the way we think about gaming will be changed forever. Though Apple Vision Pro isn’t a gaming device per se, I think it’s just a matter of time before its app store is populated with incredibly profound games and experiences that turn spatial computers (and headsets) from a fun, nice-to-have gadget for rich enthusiasts to a product that’s a must-have for your average consumer.

Though video game firms may gradually ease a toe into the waters of virtual reality, game-changing (forgive the pun) products like Vision Pro could make the underlying economics of virtual reality game development much better. Indeed, it’s hard to justify pouring millions in resources on a game that most people wouldn’t have the opportunity to play, given the sky-high hardware requirements (best-in-breed headsets are not cheap, folks).

As headsets become more commonplace in the latter half of the decade, however, I think it’s a mistake to sleep on gaming companies, which stand to benefit greatly from the Metaverse boom, even if there aren’t any prominent virtual reality projects in the pipeline currently.

Finally, the rise of gen AI could curb development costs on even the most ambitious projects. Of course, there’s sure to be designer and development backlash in response to what gen AI can bring to the video gaming community. Regardless, I view gen AI as a potentially massive catalyst that could drive appreciation over the next five to 10 years.

Without further ado, let’s see how the two previously mentioned gaming powerhouses stack up.

Electronic Arts (NASDAQ:EA)

Electronic Arts is a video game firm behind popular sports titles like NHL (National Hockey League), UFC (Ultimate Fighting Championship), Madden, WRC (a racing game), and EA FC (Football Club). Sports fans need to get their fix, and EA has been helping deliver next generation experiences that they crave. Additionally, EA’s recent non-sports titles (think Star Wars Jedi: Survivor) are intriguing and were good enough to be nominated at the year’s video-game awards in two categories.

Though EA may not be the most loved player in the industry, I still think it’s worth staying bullish on, given its footing in a potentially explosive market.

After flatlining over the past two years, EA stock seems like an intriguing value play (18.1 times trailing price-to-earnings) right here. Looking ahead, the firm’s poised to launch its much-awaited Plants vs. Zombies 3 title in addition to its annual sports titles.

EA FC, in particular, has done profoundly well and demonstrates that the firm may not need a license to resonate with gamers. All considered, 2024 could be a prosperous year for EA, especially as it gains more traction in the front of virtual reality.

Reportedly, EA Sports WRC will have virtual reality support for PCs. That’s a big deal that could forever change how racing games are played. Arguably, racing was built for virtual reality, and as the franchise evolves in EA’s hands, I’d bet that EA could become a profound force in the age of spatial computing.

Is EA Stock a Buy, According to Analysts?

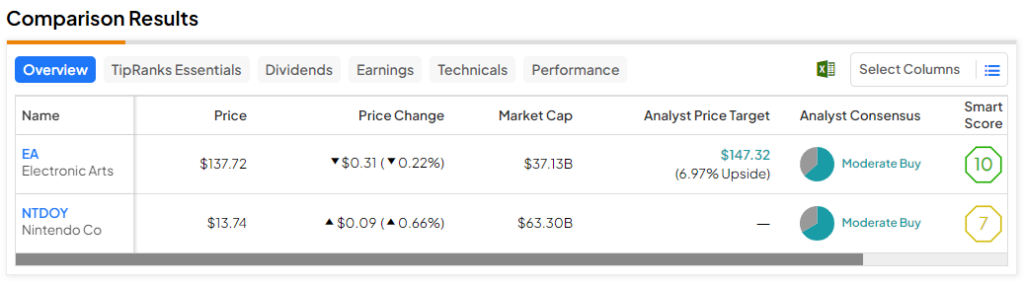

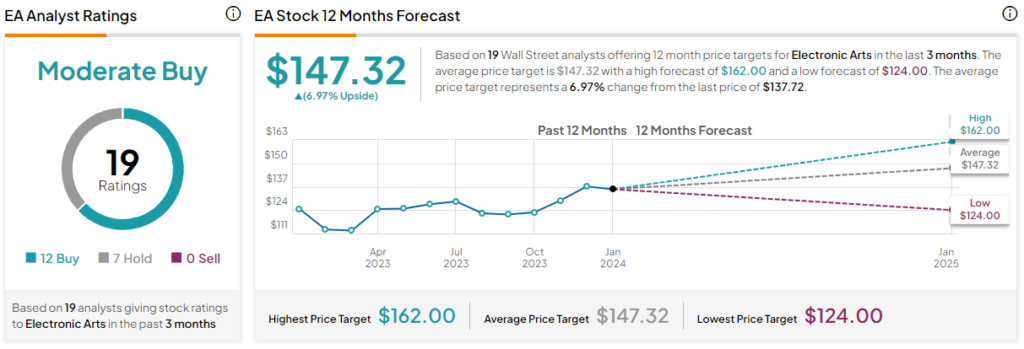

EA stock is a Moderate Buy, according to analysts, with 12 Buys and seven Holds assigned in the past three months. The average EA stock price target of $147.32 implies 7% upside potential.

Nintendo (OTC:NTDOF)

Nintendo is a video game powerhouse that’s worth navigating into the OTC markets for, in my opinion. The company is hard at work on its next-generation console, the Switch 2, and it could release a tad quicker than originally expected, at least according to fellow TipRanks contributor Steve Anderson.

Undoubtedly, the Switch console is long overdue for a massive upgrade, and the Switch 2 is what Nintendo fans have been asking for. As the product hits the market, I view Nintendo as a stock to stay bullish on over the coming years.

While Nintendo may not have the hardware lead (at least not yet), given that it’s been one-upped by rivals in the console scene of late, it does have incredible content. Nintendo consistently produces highly-rated titles, and with its impressive intellectual property, Nintendo stands out as a company that can benefit a great deal from any sudden growth surges in the video game market.

Despite its old age, Nintendo remains as relevant as ever in gaming. And its more than 46% surge since last March’s lows suggests the stock could be on the cusp of blasting off to new highs by year’s end. In a prior piece covering AAPL stock, I suggested it’d be a good idea if Apple bought Nintendo to beef up its gaming presence, a move that’d give its spatial computing product a nice launch pad. I still think Apple should give Nintendo a close look if it’s serious about leveling up its gaming services segment.

Is NTDOY Stock a Buy, According to Analysts?

On TipRanks, NTDOY stock comes in as a Moderate Buy based on two Buys and one Hold assigned in the past three months. However, it does not have a price target assigned to it.

The Takeaway

Video gaming is shaping up to be an investing theme that could fare well over the coming years as emergent technologies (like virtual reality and gen AI) come to be. At this juncture, EA and Nintendo are standout stocks to expose yourself to some of the very best the gaming development scene has to offer. Between EA and Nintendo stock, I’d have to go with the latter, as the Switch 2 release could act as a major catalyst.