Technology giant Apple (NASDAQ:AAPL) has accelerated the production of its mixed-reality Vision Pro headset, paving the way for a potential release by February 2024, Bloomberg reported. The company introduced Vision Pro at its Worldwide Developers Conference in June 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Per the report, headset production is in full swing at Chinese facilities. Moreover, Apple is encouraging developers to get ready for the Vision Pro release.

Apple Ventures into New Product Category

Apple is venturing into a new product category with the Vision Pro. However, its steep retail price of $3,499 might affect its adoption rate. While Goldman Sachs analyst Mike Ng remains skeptical about its near-term adoption rate, the analyst is upbeat about Vision Pro’s long-term prospects.

Following its launch event, the analyst noted that the mixed reality headset market is challenging and that most companies have struggled to gain ground. However, the analyst said that Apple’s extensive iPhone user base, successful track record in consumer product launches, and compelling content and features position it well to succeed in this segment.

Ng stated that his hypothetical model assumes Apple could ship five million headsets in Fiscal year 2024. Furthermore, the analyst foresees the company delivering 8-13 million units between Fiscal 2025 and 2028. The analyst is bullish about Apple stock and currently has a price target of $213.

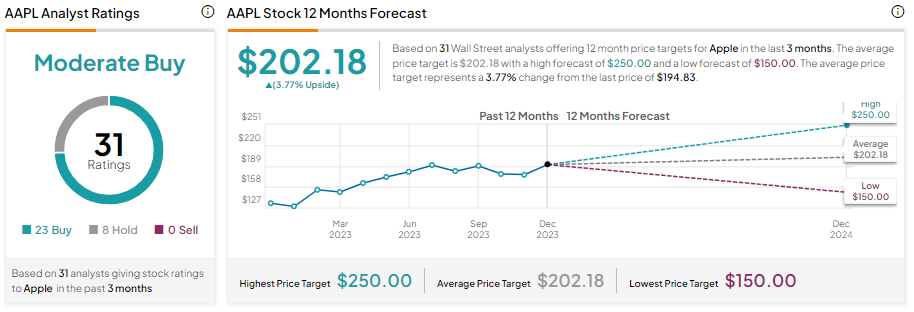

Is Apple Stock a Buy or Sell?

Whether Apple’s Vision Pro headset could create significant consumer demand remains to be seen. Meanwhile, Wall Street analysts maintain a bullish outlook on its shares.

With 24 Buys and eight Holds, Apple stock has a Strong Buy consensus rating. Further, analysts’ average AAPL price target of $202.18 implies 3.77% upside potential from current levels.