The U.S. consumer is strong and resilient. At least, that’s the narrative that kept economists from officially declaring a recession in 2022 and 2023 despite elevated inflation. Will a resilient consumer continue to keep DraftKings (NASDAQ:DKNG) afloat in 2024? That’s awfully hard to predict now, so I am staying neutral on DKNG stock.

Boston-based DraftKings is a digital sports entertainment and gaming company. DraftKings’ offerings include online sports betting, casino games, sportsbooks, and other similar services.

If any company relies heavily on a strong consumer, it would be DraftKings. Most people don’t gamble unless they’re confident that they can continue to spend money after paying their essential bills. So, if you plan to hold DKNG stock throughout 2024, ask yourself the big question: “Do I feel lucky?”

The Good News About DraftKings

Despite my neutral stance on the stock, I can’t deny the good news about DraftKings. For one thing, DraftKings has consistently beat Wall Street’s quarterly EPS estimates.

I’ll have to insert a reality check here, though. DraftKings has posted one unprofitable quarter after another. This may be a deal-breaker for some investors. On the other hand, Wall Street expects DraftKings to report a profit of $0.10 per share for 2023’s fourth quarter.

Here’s where it gets really interesting. DraftKings is expected to release its quarterly earnings on February 15. Today, the market pushed DKNG stock up by 5% even though DraftKings hadn’t released its Q4-2023 financial results yet. Is the market overly optimistic about DraftKings?

That’s a question that eager investors ought to seriously consider. Bear in mind that DraftKings stock tripled in price last year. That’s a whole lot of future earnings growth baked into the shares, wouldn’t you agree?

Let’s continue with the bullish argument, though. In 2023’s third quarter, DraftKings generated revenue of $790 million, up 57% year-over-year and above the $706.8 million that analysts had expected. Furthermore, DraftKings posted a net loss of $283.1 million, or $0.61 per share; this beat Wall Street’s call for a net loss of $0.69 per share and demonstrated improvement over the year-earlier quarter’s loss of $450.5 million or $1 per share.

Again, though, I’m going to have to mix the good news with some hard questions. Those Q3-2023 results occurred because DraftKings’ monthly unique payers increased by a whopping 40% year-over-year, reaching 2.3 million. So, yes, the consumer was strong in late 2023.

This begs the question of whether DraftKings’ user base can realistically continue to grow at this pace. Will Americans keep on spending and gambling like this? Can they really afford it? Given the tripling of DKNG stock last year, it feels like the best-case scenario has already been priced into the shares.

Vermont, Cramer, and the Madness of Crowds

My point is that everybody and their uncle seems to be in the bull camp when it comes to DraftKings’ future growth. I’m reminded of the old quote about the “madness of crowds” and how, when too many people are on one side of a boat, that boat is liable to tip over.

Again, I won’t deny the good news and the positive feelings surrounding DraftKings. Morgan Stanley (NYSE:MS) envisions DKNG stock going to $40; BMO Capital sees it heading to $43. They both published Buy-equivalent ratings on the stock, as well. Morgan Stanley even went so far as to name DraftKings as one of the firm’s two “Most Preferred Overweights.”

Moreover, television personality Jim Cramer is absolutely gushing about DraftKings. “If you don’t already own DraftKings, you should consider adding a position, especially for the next couple weeks as seemingly the whole country is watching the NFL,” Cramer declared a couple of days ago.

By now, the ultra-efficient market has undoubtedly priced in the expected financial tailwind of the NFL season. This isn’t a surprise or an unknown factor. If Cramer’s yelling about it, it’s been part of the stock’s price for a while.

Is DraftKings Stock a Buy, According to Analysts?

On TipRanks, DKNG comes in as a Strong Buy based on 25 Buys and four Hold ratings assigned by analysts in the past three months. The average DraftKings stock price target is $42.16, implying 14% upside potential.

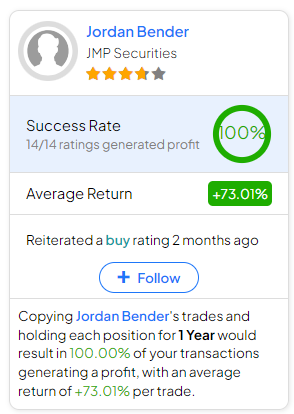

If you’re wondering which analyst you should follow if you want to buy and sell DKNG stock, the most profitable analyst covering the stock (on a one-year timeframe) is Jordan Bender of JMP Securities, with an average return of 73.01% per rating and a 100% success rate. Click on the image below to learn more.

Conclusion: Should You Consider DraftKings Stock?

Don’t get the wrong idea here. I’m not trying to promote a “fade Cramer” investment strategy. Besides, we can’t just overlook DraftKings’ impressive user-base growth.

That growth, however, has surely been factored into DraftKings’ share price, in my opinion. Just look at the chart, and think about how vulnerable the stock is. A pullback could happen at any moment, and it would actually be healthy for the long term. So, I don’t recommend assuming that the U.S. consumer will continue to be extremely strong in 2024, and I’m not considering a long position in DKNG stock today.