I am bullish on DraftKings (DKNG) as it has a strong competitive position, a promising long-term growth runway, Wall Street analysts are generally bullish on the stock, and the average price target implies massive upside over the next year.

On the other hand, the company is far from profitable at this point, so investors might want to keep in mind that it remains a highly speculative investment,

DraftKings is a digital sports entertainment company that provides users with daily fantasy sports, sports betting, and other gaming-related opportunities.

It is also involved in the design and development of casino gaming platform software and retail sportsbook for business-to-business clients. It also generates a significant percentage of revenue from the business-to-consumer segment. The vast majority of its revenue is generated in the United States.

Its B2B segment is mainly concentrated in Asia, Europe, and the U.S. The company’s flagship product is its 1-day Fantasy Sports Contest, where players compete against each other for cash prizes.

The company went public in April 2020 after a merger with Diamond Eagle Acquisition Corp and SBTech. This allowed DKNG to go public without an IPO or direct listing.

Strengths

DraftKings has a well-reputed brand with a growing customer base and many states in the U.S. that it can move into. It has high insider ownership and an impressive balance sheet with over $2.8 billion in cash and a very marginal debt.

CEO Jason Robins set his sights for a pathway to $1 billion in annual earnings in 2021.

Over the years, the company has acquired a dominant position in the online sports gambling industry with strong business acumen from its senior managers. Many experts believe that DraftKings is poised to take control over the entire online sports betting industry.

Recent Results

DraftKings reported Q3 2021 revenue of $213 million, a sizable increase of 60% from $133 million in the same period last year.

Valuation Metrics

DKNG stock is very difficult to value as it is not generating profits but is expected to grow rapidly in coming years.

That said, it trades at a mere 5x on an enterprise value-to-forward revenue basis.

Meanwhile, analysts expect revenue to grow by 49.1% in 2022. As a result, if the company can continue growing at a rapid pace and scale into profitability it should reward investors with attractive long-term returns.

Wall Street’s Take

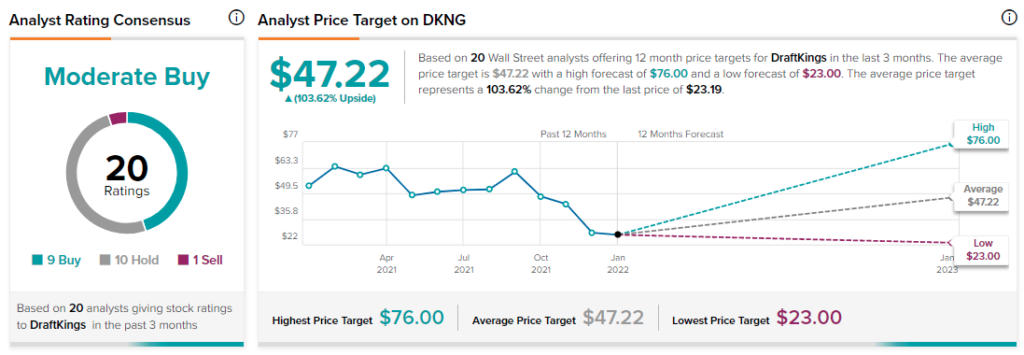

According to Wall Street analysts, DKNG earns a Moderate Buy analyst consensus based on nine Buys, 10 Holds, and one Sell rating over the past three months. Additionally, the average DraftKings price target of $47.22 puts the upside potential at 103.6%.

Summary and Conclusions

DraftKings is an early leader in a wildly profitable and popular industry as it combines fantasy sports with sports betting.

While it does face some competitive and regulatory risks, its growth potential is massive.

Furthermore, Wall Street analysts are generally bullish on the stock, and the average price target implies that the stock could nearly double over the next year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure