I am bullish over the long term for Doximity (DOCS).

Doximity is an exciting, relatively new, publicly traded company. It uses and develops digital technology to quicken communication among medical personnel and patients. DOCS deserves my bullish rating, its Strong Buy from analysts, and more attention from investors and media.

The 11-year-old company’s cloud-based digital platform lets doctors network, send HIPAA-secure messages, read peer articles, and conduct telehealth with patients. Telehealth is the fast-growing means of medical communication and knowledge sharing with impetus from the pandemic.

According to one survey, “More than 63 million virtual visits were conducted on Doximity’s platform in the fiscal year ending March 31, 2021. According to Doximity’s State of Telemedicine, $106 billion of current U.S. healthcare (spending) could be virtualized by 2023.”

Almost 2 million Doximity members securely communicate with one another and share information with patients. (See Analysts’ Top Stocks on TipRanks)

Doximity is user-driven. A co-founder of the company is a physician. Medical journal articles read through Doximity can earn personnel category 1 CME credits.

Growing Support, but Several Risks

Q2 2022 revenue hit nearly $80 million, exceeding analysts’ expectations. Net income more than tripled from the previous year. The EBITDA margin jumped to about 41% from 28% quarter-over-quarter.

Its telehealth platform grew to 330,000 active providers. FY 2021 revenue skyrocketed 78% over FY 2020. DOCS’ assets top $860 million and liabilities are about $97 million. The company has no debt.

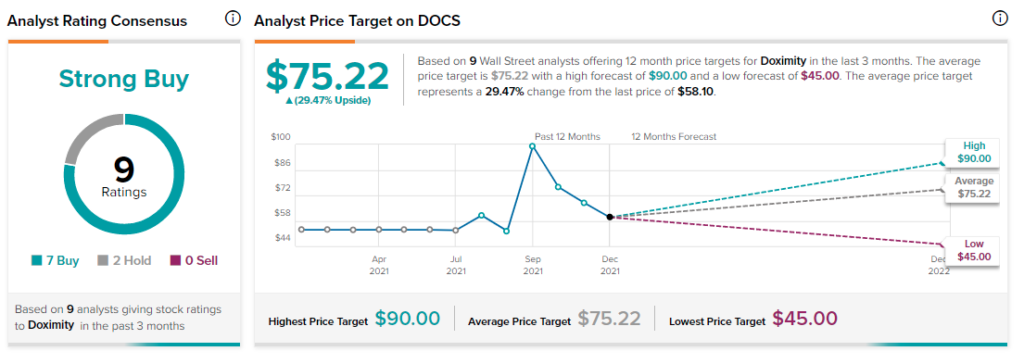

Analysts rate DOCS a Strong Buy. Bloggers are bullish. Hedge funds added 814,300 thousand shares to their portfolios last quarter. The stock gets a 9 out of 10 Smart Score from TipRanks that expects the stock to outperform the market.

Seven Wall Street analysts encourage buying shares. Two recommend holding if you own them. The average Doximity price target is $75.22, with a high forecast of $90 and a low of $45. The average price target implies 29.5% potential upside.

DOCS’ volatility scares some investors. The stock will be volatile but should settle down with time. Three founders launched Doximity in 2011. Shares skyrocketed 104% when DOCS went public in June 2021.

Bad economic news about new variants is good news for DOCS, generating more ad revenue and less face-to-face medical information sharing.

Other risks investors face in the short term include the uncomfortably high short interest holding at 21.8%. The forward P/E is 120.6x, while the healthcare service industry ratio is 191.9x.

Shares of one of DOCS’ industry challengers, Teladoc (TDOC), have also taken a beating. TDOC is down 53.8% over the last 52 weeks. Analysts only give TDOC a Moderate Buy recommendation. Short interest on TDOC is 13.3% and its market cap is $14.6 billion. DOCS’ market cap is $11 billion.

The Takeaway

Doximity is on the leading edge of the digital revolution in medical and healthcare services. There are not enough physicians in most developed nations. Maximizing their time and expertise digitally makes the system more efficient.

Doximity membership is free for medical personnel. It generates revenue from drug maker ads and services. The medical services Doximity plans to provide are in a $106-billion market.

Physicians reporting telemedicine as a skill are nearly doubling annually. Older physicians are not shy about using telemedicine. The pandemic sparked a massive rise in its use.

Doximity is positioned to capitalize on the trends, but management must manage expectations. Now it has to design and implement a working plan to monetize more services and expand ad revenue.

Disclosure: At the time of publication, Harold Goldmeier did not have a position in any of the securities mentioned in this article

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >