Every investor would naturally like to see the stocks that make up their portfolio show a consistent upward curve, but that, as everyone learns eventually, is just not the way it works.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Peaks and troughs are part of the investing game, and even the stock market kings go through periods of serous pullbacks for one reason or another, be it macro developments or some news item that spooked investors. And every so often, despite sound fundamentals, the pendulum swings too far into negative terrain, and that is when investors are presented with golden opportunities.

With this in mind, we delved into the TipRanks database and pulled up the details on a pair of stocks that fit a specific criteria; both have retreated by more than 50% in recent months, but are considered to be oversold and ripe for the picking now by some of the Street’s stock experts. In fact, the analyst consensus rates both as Strong Buys. So, let’s see why the time might be right to add these names to a portfolio.

Air Transport Services (ATSG)

The first beaten-down stock we’re looking at is Air Transport Services, a leader in the provision of aircraft leasing and air cargo transportation services. Since being founded in 1980, the Wilmington, Ohio-based firm has grown to become a major player in the air freight industry and the company operates a fleet of over 100 in-service aircraft, including Boeing 767s, 757s, and 777s, which are used for both passenger and cargo transport. The company’s customers include some of the world’s largest e-commerce and logistics companies, such as Amazon, DHL, and UPS.

Nevertheless, despite being a well-established and respected firm in the air freight industry, the stock has been through the wringer over the past year, having shed 51% over the duration.

Weak quarterly results such as the ones on display in the recently released Q1 print have done little to help matters. The company generated revenue of $501.1 million, amounting to a 3.1% year-over-year increase yet falling shy of the consensus estimate by $9.7 million. Adj. EPS of $0.36 also missed the $0.47 forecast.

Further dampening enthusiasm, ATSG now expects FY 2023 adj. EPS in the range between $1.55 to $1.70, down from the prior $1.85 to $2.00. Consensus had $1.96 in mind.

So, is it time to bail out, given the disappointing results and outlook? Not at all, says Stifel analyst Frank Galanti. Despite conceding the Q1 numbers were “not good,” Galanti sees plenty to like here, and thinks the shares’ low price is enticing at current levels.

“Despite weaker ACMI (aircraft, crew, maintenance and insurance) cash flows, the leasing business is continuing to grow steadily. While there will likely be continued near term pressure on the shares as the investor base churns, we think the stock offers a compelling opportunity,” Galanti opined.

“Ultimately our confidence is based on the stable, long duration cash flows from the leasing segment. While we think it is too conservative, if you assume the ACMI business is worth nothing, the leasing business is trading at 7.5x 2023 segment EBITDA. Public leasing peers trade at 9-10x. As there is more clarity on the leasing segment, and capex results in growing leasing cash flows, we expect valuation to expand from the current over-sold levels,” the analyst added.

To this end, Galanti rates ATSG shares a Buy while his $26 price target suggests they will add 74% of muscle over the coming months. (To watch Galanti’s track record, click here)

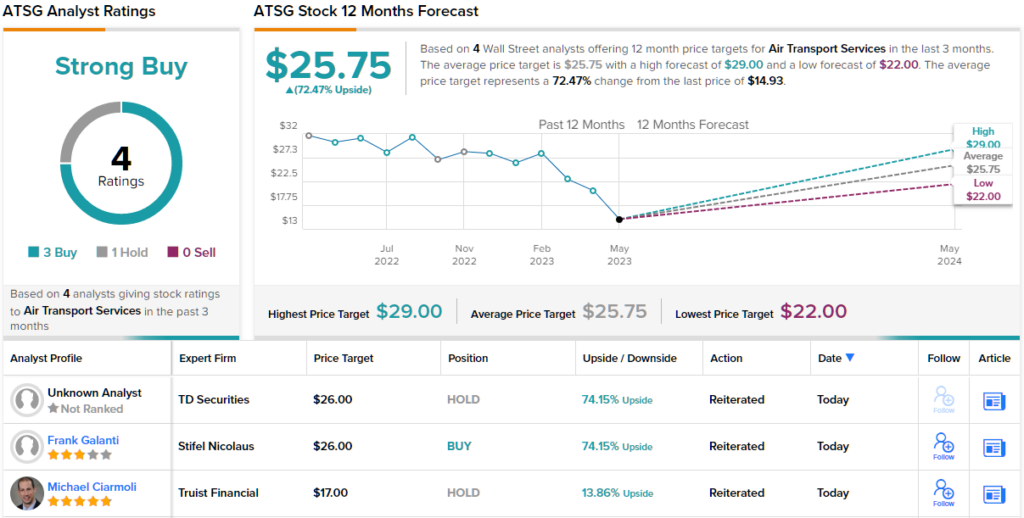

Turning now to the rest of the Street, where ATSG’s Strong Buy consensus rating is based on 3 Buys vs. 1 Hold. Additionally, the analysts see plenty of growth ahead; the average target stands at $25.75, implying room for ~72% upside over the next year. (See ATSG stock forecast)

Grid Dynamics Holdings (GDYN)

Next up on our oversold stocks list, we have Grid Dynamics Holdings, a digital transformation services specialist. Essentially, the company helps its clients reach their business goals by leveraging the latest advancements in technology. The company provides services such as cloud transformation, data science, omnichannel customer experience, and DevOps engineering and touts its expertise in emerging tech such as artificial intelligence, machine learning, and blockchain as helping its clients stay ahead of the competition. Grid also has an enviable client list which includes Apple, Google, Merck and Macy’s, amongst others.

However, GDYN shares have been on the backfoot over the past year and the slide picked up more downward momentum recently following the release of the company’s Q1 report. The 20% post-earnings slip means the total loss since August’s 52-week peak stands at 59%.

In the quarter, revenue increased by 12.1% to $80.08 million, fractionally edging ahead of the consensus estimate. On the bottom-line, adj. EPS of $0.08 met Street expectations. So far, so good. Yet as happens often, Grid came unstuck with its outlook. For Q2, the company sees revenue coming in between $76.0 million and $78.0 million, even at the top end, some distance below consensus at $80.90 million.

With the shares having retreated by such a large amount, Needham analyst Mayank Tandon now views the risk-reward as “favorable for LT-focused investors.”

“Despite the mixed quarter and outlook, we believe GDYN is well-positioned to continue to scale and become a leading pure-play digital transformation services provider,” the analyst said. “While we expect the macro environment to pressure demand over the next 2-3 quarters, we believe that execution remains solid and GDYN’s strong competitive position intact. In addition, GDYN has a well-stocked balance sheet (~$256 million in net cash, over $3 per share), setting up GDYN to weather the storm and be a potential share gainer, both organically and through M&A in this more challenging environment.”

These comments underpin Tandon’s Buy rating and $14 price target. The implication for investors? Potential upside of 55% from current levels. (To watch Tandon’s track record, click here)

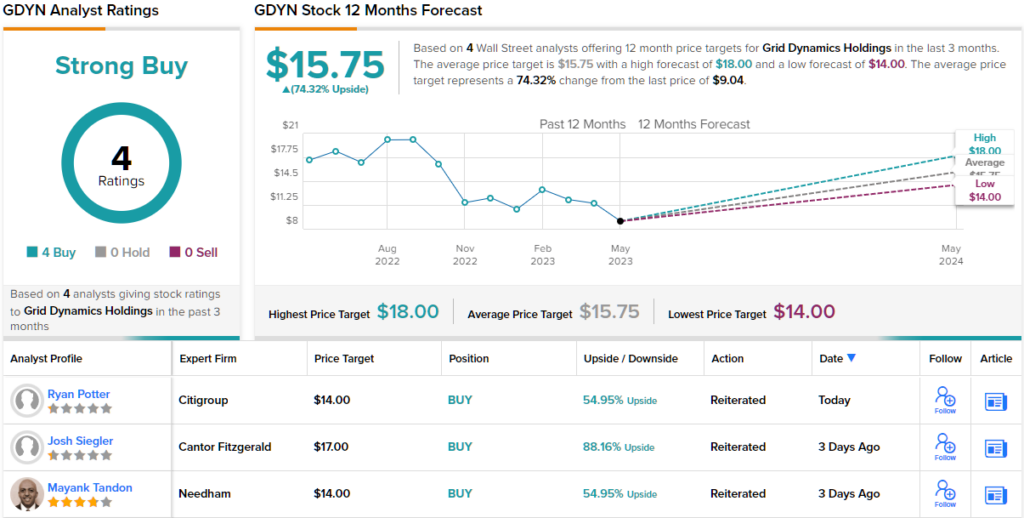

Tandon’s colleagues agree here. All 4 recent analyst reviews are positive, making the consensus view a Strong Buy. The $15.75 average target is more bullish than Tandon will allow and represents potential upside of 74% from current levels. (See GDYN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.