Reverse psychology can be considered a desired quality in the stock market. It is only natural to gravitate toward the leaders in any field, and an investor’s urge to hop on the latest surging stock in search of those sweet gains is understandable. However, anyone familiar with the ins and outs of investing will repeatedly say that overused mantra: ‘buy low, sell high.’

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In recognizing that low price, investors can turn to Wall Street’s pros for help. The analysts have been busy lately, picking out stocks that are in their lower price range and are primed for strong gains.

With this in mind, we opened the TipRanks database to uncover two such stocks that have retreated by over 40% over the past few months, but which certain Street analysts think are poised to stage a comeback and rebound. In fact, both are rated as Strong Buys by the analyst consensus and are seen to boast potential for big gains. Let’s dig in.

uniQure N.V. (QURE)

The first beaten-down stock we’ll look into is uniQure, a pioneering company specializing in the advancement and commercialization of gene therapies. The company’s approach revolves around harnessing adeno-associated viruses (AAVs) as vectors to precisely deliver corrected genes to patients’ cells, targeting the underlying causes of diseases rather than merely treating symptoms.

The company gained significant recognition for its groundbreaking gene therapy product, Glybera, which was the first gene therapy to be approved in Europe in 2012 (since then withdrawn). It has since continued to expand its pipeline, focusing on genetic disorders such as hemophilia, Huntington’s disease, and metabolic disorders.

It’s been a bit of a mixed year for the company. On the one hand, Q1 saw the commercial launch of Hemgenix, a gene therapy indicated to treat hemophilia B that uniQure licensed to Australian drugmaker CSL. In June, uniQure achieved a $100 million milestone payment following the first sale of the drug.

However, around the same time, the company announced a less pleasing development. uniQure released interim data from its Phase 1/2 study of AMT-130, indicated to treat neurogenerative disorder Huntington’s disease. AMT-130 is designed to reduce the production of the mutant huntingtin protein (mHTT) but patients in the high-dose group displayed an uptick in the level of mHTT. The company laid the blame on the assay responsible for measuring mHTT levels in cerebrospinal fluid for the illogical outcome, but the market was not convinced by that explanation and sent shares down by a massive 40% in the subsequent session. All in all, the shares are down by 58% year-to-date.

Nevertheless, SVB Securities analyst Joseph Schwartz believes the violent drop was excessive, and the stock’s depressed price presents an opportunity.

“We believe that the sell-off is an overreaction and with company now trading slightly above cash we believe there is not enough credit being ascribed to the company’s partnership with CSL for Hemgenyx, cash on hand, manufacturing expertise, and potential to have a win in its pipeline,” Schwartz explained.

“While QURE reported data that raised some questions about the dose response for lowering mutant huntingtin protein (mHTT), which is the main target of the drug, challenges with the assay may have confounded these results. This follows prior challenges with measuring striatal brain volume, so the regulatory path seems to have solidly shifted away from accelerated approval based on biomarkers, towards harder clinical endpoints. Encouraging improvements were reported on clinical/functional metrics, but the market seems unwilling to suspend its disbelief that AMT-130 could actually succeed in such a difficult disease,” Shwartz further said.

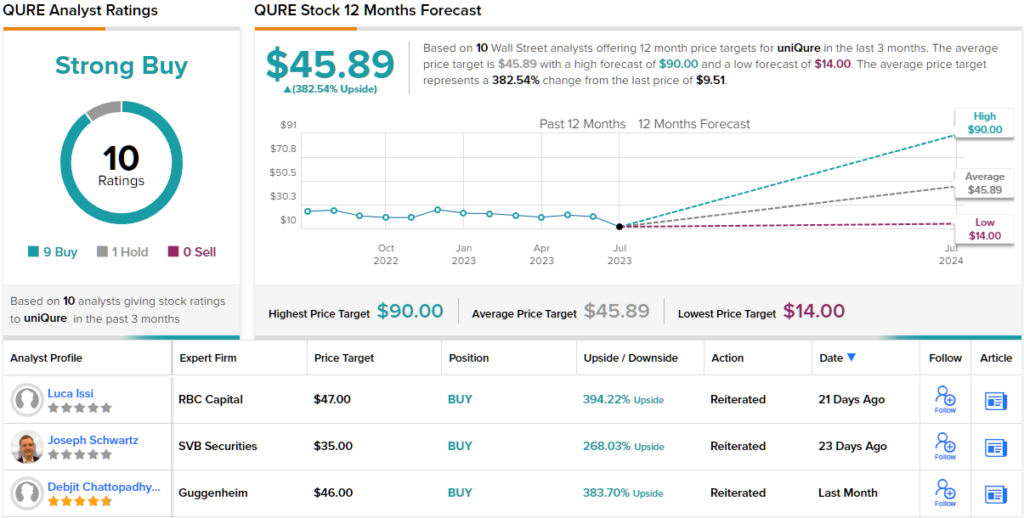

To this end, Shwartz rates QURE an Outperform (i.e., Buy), while his $35 price target suggests upside of a big 268% from current levels. (To watch Shwartz’s track record, click here)

That optimistic forecast is no anomaly. The Street’s average target is even more bullish; at $45.89, the figure provides room for 12-month returns of a huge 382%. Overall, with 10 analyst reviews on file, including 9 Buys and a single Hold, QURE receives a Strong Buy analyst consensus rating. (See QURE stock forecast)

SunOpta Inc. (STKL)

Turning our attention to the snack industry, we come across SunOpta, a company that operates in the health food niche. As a food and beverage company, SunOpta specializes in offering an array of plant-based snacks, nutritional additives, and drinks, which are produced in-house and marketed for distribution through third-party retailers and food service providers. The company’s product lines cater to consumers in the health food market; customers can find roasted seed snacks; fruit products; milk-substitute drinks based on oat, soy, and almond; and broths and stocks for cooking.

SunOpta was first founded in Canada, and today is based in Minnesota. The company opened its headquarters in the state in 2022, and is in the midst of implementing a multi-year plan aiming, by 2025, to double its plant-based business from 2020 levels. This business is already substantial, employing over 1,400 people in three countries, and distributing products under several brand names. SunOpta’s brand names include Sunrise Growers for fruit products; Dream and West Life for plant-based milk replacements; and Sown for plant-based, organic, oat creamers and other non-milk dairy substitutes.

The company delivered a mixed readout in the most recent financial update, for 1Q23. The top line of $223.9 million contained a solid gain of 9.3% in revenues from plant-based products but missed the estimates by nearly $8.2 million. The company’s earnings, an EPS of 5 cents per share by non-GAAP measures, beat the negative forecast by an impressive 7 cents per share.

SunOpta is building a sound position in a growing niche. Health foods are a growth-oriented segment of the snack industry, and recent surveys have shown that consumers are choosing plant-based milk beverages primarily for taste – an indication that the niche has plenty of room for expansion. Nevertheless, the shares have been on the backfoot since the latest report and in total are down by 46% from last November’s high.

However, according to Stephens’ Jim Salera, there’s plenty to like here. The analyst sees SunOpta as a behind-the-scenes player with plenty of room to maneuver as its industry expands.

“SunOpta can be thought of as the ‘brand behind the brand’ when it comes to high growth, plant-based and fruit-based products. The company has a unique portfolio of production assets that allows it to support branded and private label partners that are scaling up their offerings in these attractive segments. With many larger CPG companies hesitant to commit significant capex to supporting these emerging categories, SunOpta is able to fill the gap and help some of the world’s largest food and beverage companies expand their BetterFor-You portfolios,” Salera opined.

“STKL shares offer investors a brand agnostic way to capitalize on these BFY consumption trends,” Salera adds. “SunOpta’s manufacturing expertise and its coast-to-coast supply chain makes it an indispensable partner for high growth brands.”

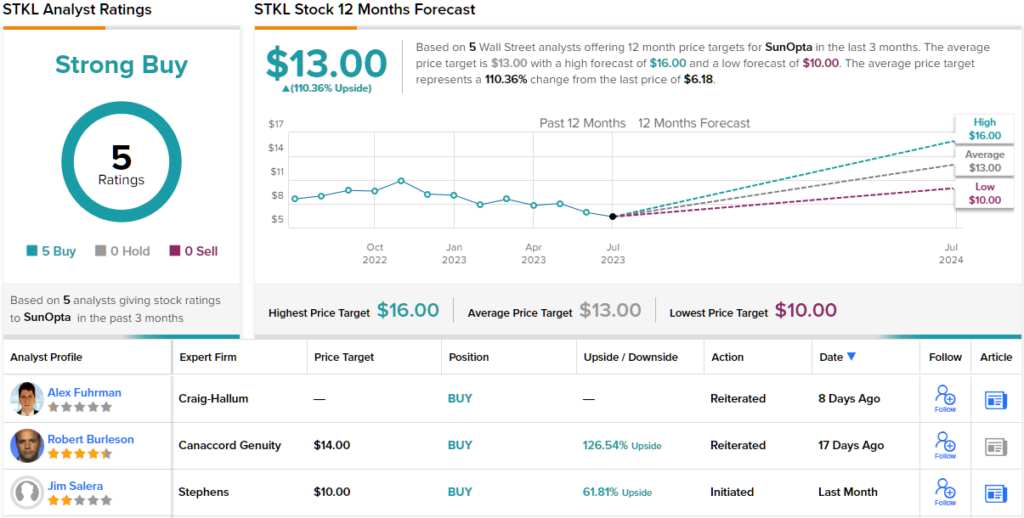

In Salera’s view, this justifies an Overweight (i.e. Buy) rating on the stock, and his $10 price target implies the shares will gain ~62% in the next 12 months. (To watch Salera’s track record, click here)

All in all, there are 5 recent analyst reviews on record for STKL shares, and they are all positive – giving the stock its Strong Buy consensus rating. The shares are trading for $6.18 and the $13 average price target suggests a one-year upside potential of a solid 110%. (See STKL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.