The food delivery business has seen rapid growth, especially during the COVID-19 pandemic as more people stayed at home and ordered meals and groceries.

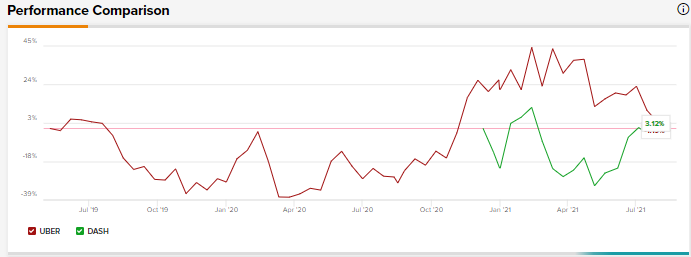

Let’s compare two companies, DoorDash and Uber, using the TipRanks Stock Comparison tool, and see how Wall Street analysts feel about these stocks.

DoorDash (DASH)

DoorDash has built a technology-driven logistics platform. Its key business is Marketplace, which offers customer acquisition, delivery, payment processing, and customer analytics to merchants.

DASH posted Q2 revenues of $1.24 billion, up 83.1% year-over-year. The company reported a quarterly loss per share of $0.30, worse than the consensus estimate of a loss of $0.21 per share. (See DoorDash stock charts on TipRanks)

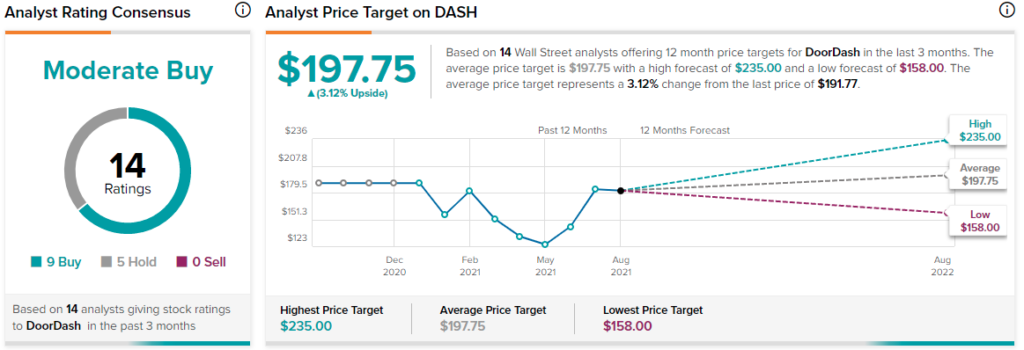

Following the Q2 results, Wells Fargo analyst Brian Fitzgerald raised his price target from $215 to $235 (22.4% upside) and reiterated a Buy on the stock.

Fitzgerald noted that the company’s “profitability is no longer really in question.” He also posited that if DASH can exhibit the same “operational prowess” in international markets that it has shown in the U.S., the company’s “shares have significantly more upside in the coming years.”

DashPass is the company’s key subscription product that provides consumers with zero delivery fees and reduced service fees. The company indicated on its Q2 earnings call that order frequency has been high for both DashPass subscribers and non-DashPass users.

DoorDash has projected adjusted EBITDA to be in the range of $0 to $100 million for Q3, and $150 million to $350 million for Fiscal Year 2021.

Turning to the rest of the Street, consensus is that DoorDash is a Moderate Buy, based on nine Buys and five Holds. The average DoorDash price target of $197.75 implies an approximately 3.1% upside potential from current levels.

Uber (UBER)

Uber Technologies delivered a solid Q2, posting revenues of $3.93 billion, a jump of 105% year-over-year. The company’s Delivery business saw revenues balloon 107% year-over-year to $886 million. EPS came in at $0.58, which compares favorably to the loss of $1.02 in the same period last year.

Dara Khosrowshahi, CEO of Uber stated, “In Q2 we invested in recovery by investing in drivers and we made strong progress, with monthly active drivers and couriers in the US increasing by nearly 420,000 from February to July. Our platform is getting stronger each quarter, with consumers who engage with both Mobility and Delivery now generating nearly half of our total company Gross Bookings.”

Gross Bookings, as defined by Uber, are the total dollar value of Mobility and new Mobility rides, Delivery meal or grocery deliveries, and applicable taxes, tolls, and fees. (See Uber stock charts on TipRanks)

In Q3, Uber projects total Gross Bookings to range between $22 billion and $24 billion and adjusted EBITDA to “to be better than the loss of $100 million.” The company expects to achieve total EBITDA profitability in Q4.

The company’s CEO stated strength in Uber’s Mobility business is driving its Delivery business. He added that “the Rides app is acting like a free marketing engine for our Delivery business. What may be less obvious is that Delivery is now increasingly driving consumer acquisition for Mobility.”

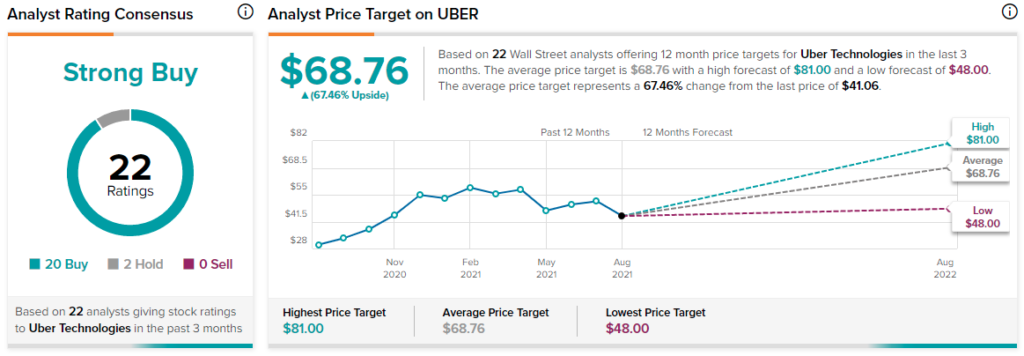

Needham analyst Bernie McTernan approves of this cross-selling strategy, and reiterated a Buy rating on the stock with a price target of $77 (87.6% upside).

Turning to the rest of the Street, consensus is that Uber is a Strong Buy, based on 20 Buys and two Holds. The average Uber price target of $68.76 implies an approximately 67.5% upside potential from current levels.

Bottom Line

While analysts are cautiously optimistic about DoorDash, they are bullish about Uber.

Based on the upside potential over the next 12 months, Uber certainly seems to be a better Buy.

Disclosure: Shrilekha Pethe held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.