Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) is the undisputed leader in the global technology industry, with a wide range of products and services that are familiar to billions of people. That alone sums up the case for Alphabet; it has no equal in what it does, and it is far ahead of the competition. The company is also making huge investments in its AI segment and reaping the benefits. Don’t let the market’s reaction to some of its growth figures fool you; Alphabet remains unparalleled.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

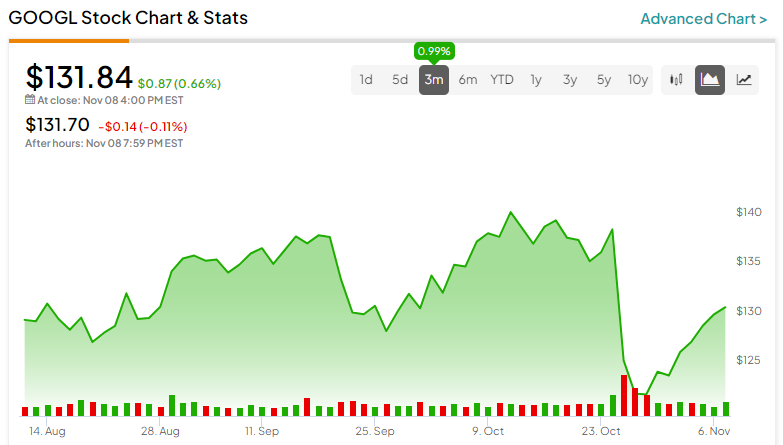

However, the market seems to have a short-term memory and a tendency to overreact to minor setbacks. Alphabet’s stock price has fallen in the past month due to a lower-than-expected growth rate in its Cloud business, as well as regulatory challenges in various markets. These factors have overshadowed the company’s strong fundamentals and long-term potential and have created a buying opportunity for savvy investors, in my opinion.

In this article, I will argue that Alphabet is potentially a Strong Buy for long-term investors based on its impressive growth and competitive advantages. I am bullish on Alphabet, and I believe that the company is well-positioned to capitalize on its “moat” (competitive advantage) and continue to deliver superior returns to shareholders.

Slowing Cloud Growth Disappointed Investors

Google delivered a solid earnings report for the third quarter of 2023, beating analysts’ expectations for both revenue and earnings per share. However, the market was not impressed by the performance of its Cloud business, which grew by 22% year-over-year.

Now, let’s attempt to understand why the cloud growth is so disappointing. The primary culprit seems to be that it lagged behind its main rival, Microsoft (NASDAQ:MSFT), which reported a 29% increase in its Cloud revenue on the same day.

To be fair, Google’s cloud growth was still faster than Amazon’s (NASDAQ:AMZN) AWS, which grew by only 12%. However, analysts had anticipated a higher growth rate for Google Cloud, given that it is the third-largest player in the cloud market and has been investing heavily in expanding its infrastructure and offerings.

The Lesson Wall Street Never Learns

Google has been facing regulatory challenges in various markets, such as the antitrust lawsuits in the U.S. and Europe. It also faced downward pressure from the disappointing cloud growth mentioned above. It seems that no matter how many times these sorts of things happen, the lesson doesn’t stick.

Alphabet has faced lower-than-expected earnings, growth, and other hiccups since its inception, and it’s clear that no amount of those hiccups will ever mitigate the cold, hard facts. Google is utterly dominant in its space, and little can stop or even slow this behemoth.

Google still has a durable moat that protects its core business and enables it to generate high returns on invested capital regardless of those headwinds. Google’s moat is based on several factors, such as its unparalleled scale and reach, with over four billion users across its platforms and over 96% market share in global search. Additionally, network effects create a virtuous cycle of more users, more data, more advertisers, and more revenue, reinforcing its dominance and creating barriers to entry for competitors.

Its innovation and diversification allow it to create new products and services that enhance its ecosystem and expand its addressable market, such as Google Cloud, YouTube, Google Play, Google Maps, and numerous other services. Another component is its brand value and reputation, which make it one of the most trusted and recognized names in the world and attract top talent and partners.

The ideas above are probably not surprising to investors, but their importance seems to be understated year after year. These factors give Google a sustainable edge over its rivals like Microsoft’s Bing and enable it to generate consistent growth, profitability, and cash flow despite the regulatory challenges. Therefore, I believe that Google’s moat is still very much intact and that it will continue to deliver value to its shareholders in the long run.

Google Cloud’s Growth Slowdown Isn’t a Reason to Panic

Despite the Cloud growth slowdown, I think the market is overreacting and missing the bigger picture regarding Google Cloud’s potential and performance.

The key question that investors should ask is not how fast Google Cloud is growing but how much market share it is gaining. Google Cloud is growing faster than the overall cloud market, meaning that it’s taking market share from its competitors.

In fact, Google Cloud and Microsoft are the only two players that are gaining share, while Amazon is holding steady and the rest are losing ground. Google, Microsoft, and Amazon together account for 66% of the cloud market.

Now, we need to understand how big this opportunity is for Google Cloud. Based on current projections, the cloud computing market is expected to grow at 14% annually through 2030, according to Research and Markets, reaching a whopping $1.6 trillion in size. Google Cloud is projected to grow at 21% annually through 2028, reaching $81 billion in revenue. That’s just the Cloud business.

Onto profitability, we know that Amazon and Microsoft are making lots of money from the cloud, but Google has been lagging behind. Maybe all that revenue growth will come at the expense of margins and earnings?

Not so fast. Google Cloud is not only growing, but it’s also profitable. It reported an operating profit of $1.2 billion in 2023, and it is expected to grow that figure to nearly $18 billion by 2027. That’s a staggering 15-fold increase in operating income from Cloud in four years.

So, let’s get this straight. Google Cloud is growing faster than the market, gaining share from its rivals, generating huge revenue and profits, and becoming the main driver of Google’s future growth, but the market’s reaction is to sell the stock?

That makes no sense, in my opinion. Google Cloud looks like a great reason to buy Google, not to sell it. I believe the market is being irrational about Google Cloud’s growth slowdown, and I think it is a great opportunity to buy Google at a discount.

Is GOOGL Stock a Buy, According to Analysts?

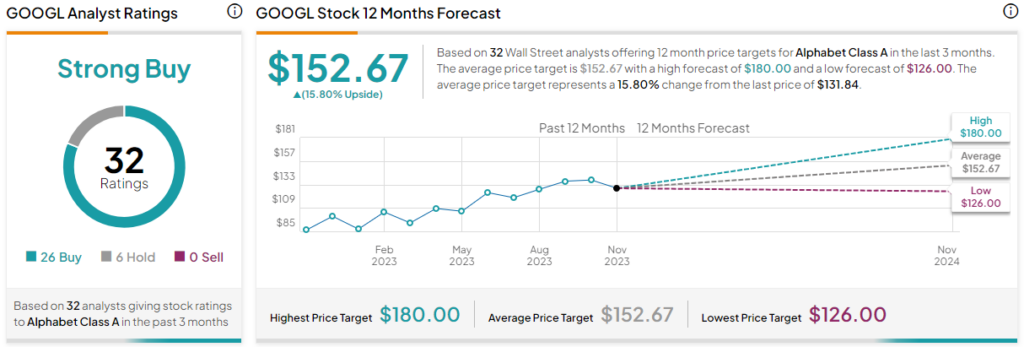

Turning to Wall Street, GOOGL has a Strong Buy consensus rating based on 26 Buys and six Holds assigned in the past three months. At $152.67, the average GOOGL stock forecast implies 15.8% upside potential.

Conclusion

Warren Buffett once said, “Be fearful when others are greedy and greedy when others are fearful.” I believe that the fear surrounding Google’s regulatory environment and competitive landscape creates an opportunity to buy a great company at a reasonable price.