A pair of longstanding, actively managed, value-oriented mutual funds, the Dodge & Cox Stock Fund (DODGX) and the Oakmark Fund (OAKMX), look well-positioned for the current market environment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tech and growth stocks with steeper valuations have sold off sharply this summer, punctuated by the S&P 500 (SPX) and Nasdaq (NDX) each suffering their worst day since 2022 Monday. At the same time, more defensive value stocks trading at more modest multiples are holding their own.

This summer’s market rotation is reminding investors of the importance of maintaining a well-balanced portfolio and not putting all of one’s eggs into the tech and growth basket, however tempting that may seem at times.

I’m bullish on both DODGX and OAKMX based on the inexpensive valuations of their portfolios and the attractive mixes of stocks they hold. Plus, both funds are dividend payers, and Wall Street analysts believe that both have considerable potential upside ahead. Let’s take a look at these two popular mutual funds below.

Dodge & Cox Stock Fund (DODGX)

DODGX is a massively popular mutual fund that has been around since 1965 and accumulated an impressive $109.8 billion in assets under management (AUM).

According to Dodge & Cox, the fund “offers investors a highly selective, actively managed core equity mutual fund that invests in businesses based on our analysis of long-term fundamentals relative to current valuations.”

The fund generally invests in large-cap and mid-cap U.S. stocks that “appear to be temporarily undervalued by the stock market but have a favorable outlook for long-term growth.”

What I like about the fund right now is that its portfolio is considerably cheaper than the broader market, making it an attractive place to be as investors retreat from the market’s most expensive stocks and sectors.

DODGX’s portfolio trades at an inexpensive valuation of just 13.9 times earnings compared to the S&P 500’s much higher average valuation of 23.6 times earnings.

And it’s not like DODGX is investing in a bunch of slouches. The fund holds 78 stocks, and its top 10 holdings make up 30.7% of the portfolio. One of its top holdings is Alphabet (GOOGL), and the fund invests in a mix of reasonably priced tech and growth stocks like Microsoft (MSFT), along with value stocks from sectors like financials, including Wells Fargo (WFC) and Fiserv (FI).

The strong performance of these stocks this year shows why it’s important not to count value stocks out. Wells Fargo is up 29.8% for the year, while Fiserv is up 28.8%. You might be surprised to hear that these performances put them on par with more illustrious names in the fund’s top 10 holdings, like Alphabet and Microsoft, which have gained 31.3% and 24.4%, respectively, over the past year. Another prominent holding, defense stock Raytheon (RTX), has also returned an impressive 33.6% over the past 12 months.

DODGX also features an attractive dividend yield of 1.9%, pipping the S&P 500’s yield of 1.4%. However, investors should note that the level of DODGX’s payout can vary widely from quarter to quarter.

Investors who are more accustomed to investing in stocks and ETFs should note that investing in a mutual fund like DODGX can be a bit different. For example, the fund requires a minimum investment of $2,500 to get started (although for IRA investors, this requirement is a lower threshold of $1,000). Furthermore, there is a minimum investment of $100 for subsequent investments.

I’m bullish on DODGX. I like the fact that it invests in a well-selected, reasonably valued portfolio without eschewing tech leaders entirely. We know that at some point, growth and tech stocks will come back into vogue, making DODGX well-suited to navigate a fluid environment.

Is DODGX Stock a Buy, According to Analysts?

Turning to Wall Street, DODGX earns a Moderate Buy consensus rating based on 63 Buys, 16 Holds, and zero Sell ratings assigned in the past three months. The average DODGX stock price target of $295.63 implies 16.4% upside potential from current levels.

Oakmark Fund (OAKMX)

Oakmark Fund hasn’t been around as long as DODGX, but it is a fairly longstanding fund itself, dating all the way back to 1991. OAKMX is smaller than DODGX but is still a force to be reckoned with, as it has $22.3 billion in AUM.

According to Oakmark, OAKMX is “a diversified fund that seeks long-term capital appreciation by generally investing in larger capitalization U.S. companies.”

While DODGX’s holdings are cheap, the Oakmark Fund’s holdings are even cheaper, trading at an average price-to-earnings multiple of just 11.8 (roughly half the market multiple). Looking further out, its holdings are even cheaper, trading at just a paltry 10.2 times forward earnings estimates.

Like DODGX, OAKMX isn’t simply investing in cheaply valued junk. The fund holds 55 stocks, and its top 10 holdings make up just 26.4% of the fund. Its portfolio is a well-rounded mix of reasonably valued tech and growth-oriented stocks. For instance, its top holding is Alphabet (GOOGL), but it also carries more traditional value plays like CitiGroup (C), Charles Schwab (SCHW), Wells Fargo (WFC), and ConocoPhillips (COP).

Therefore, like DODGX, OAKMX seems well-suited to the turbulent market environment investigators are navigating through this summer.

Bill Nygren, the longtime manager of the fund, wrote, “We are finding attractive investment opportunities across a diverse group of industries amid the unusually wide spread between high P/E

and low P/E stocks that exists today.”

Like DODGX, OAKMX also pays a dividend but features a lower yield of 1.0%. Note that OAKMX features an expense ratio of 0.91%, higher than DODGX’s 0.51%. Unlike DODGX, however, OAKMX doesn’t require a minimum investment.

I’m bullish on OAKMX based on the diversified combination of attractively-valued stocks it invests in.

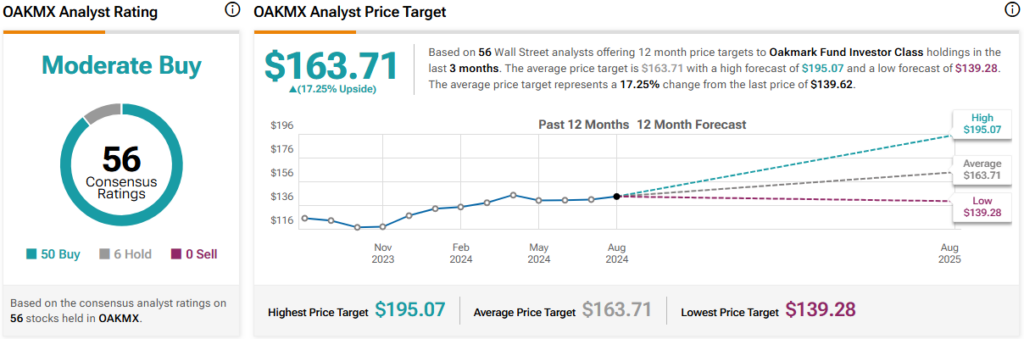

Is OAKMX Stock a Buy, According to Analysts?

Turning to Wall Street, OAKMX earns a Moderate Buy consensus rating based on 50 Buys, six Holds, and zero Sell ratings assigned in the past three months. The average OAKMX stock price target of $163.71 implies 17.25% upside potential from current levels.

Investor Takeaway

Both DODGX and OAKMX are popular, longstanding mutual funds with considerable AUM. I’m bullish on DODGX and OAKMX because they both feature well-rounded, actively managed portfolios. These portfolios combine top tech stocks with reasonable valuations and bona fide value stocks. The funds focus on traditional value-oriented sectors like Financials and Energy, making them well-suited to the current market landscape.