Walt Disney (NYSE:DIS) stock has been a colossal disappointment for investors over the past five years, going virtually nowhere in the timespan. It’s been such a brutal slog for Disney stock that activist investor Nelson Peltz has gotten involved in an attempt to unlock the magic.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With a proxy battle between Peltz and the firm, Disney makes for a very interesting turnaround play for investors willing to give the beaten-down media gem another look. I, for one, am bullish and think Peltz could be what the doctor ordered despite backlash from the firm.

With Bob Iger taking the place of Bob Chapek as CEO, the company may already have the tools it needs to climb out of its rut. Still, Iger doesn’t exactly have a stellar track record, given Disney stock’s woes started well before Chapek took the reins during the most uncertain part of the pandemic.

Activist Nelson Peltz Takes Aim

Activist involvement is no guarantee of an imminent turnaround. In some circumstances, such involvement may slow progress down. Disney went as far as to say Nelson Peltz “lacks skills and experience” to help the company as it continues to tread water. Undoubtedly, investors will get to have their say. Still, in the meantime, recent action in the stock suggests a board shuffle could be the best way to combat what Peltz views as a “crisis.”

Indeed, a crisis may be a stretch for some, but for the Disney shareholders who bought at or around the peak, Disney has been an investment nightmare as shares fell by more than 55% from peak to trough. The company has had enough time to move on from the worst of the pandemic, and its messy succession planning has also been difficult to ignore, with Iger coming out of retirement to stop the sinking ship of a stock.

In any case, I view Peltz as a man throwing shareholders a life raft by looking to secure a board seat for his firm, Trian Capital Management, rather than someone who could complicate matters further.

Disney already has a lot going on behind the scenes, and with hefty losses piled up from the Disney+ platform, a fresh pair of eyes may be what the House of Mouse needs to be dominant again in the modern era.

Disney Stock: Tough to Value amid Profound Uncertainty

Disney stock’s price-to-earnings (P/E) ratio of 63 times is historically stretched. Yes, there are headwinds, but overspending on streaming is doing the firm no favors as the industry falls to its knees. Despite the lofty P/E, DIS stock looks much cheaper based on a price-to-sales (P/S) and price-to-book (P/B) basis. The 2.4 times sales and 2.0 times book multiples are well below the broadcasting industry average of 5.3 and 2.1 times, respectively.

Given the violent crash streaming stocks endured over the past year or so, it’s tough to gauge how much investors ought to pay for streaming exposure. Streaming has become a challenging game to play, and management under Iger needs to make moves to steer the firm back on track in this era of high rates.

Indeed, Iger needs to stay focused while Peltz and Trian look to show some board members to the door. I think it’s hard to argue that Disney has waned due to sub-par management moves. The purchase of 20th Century Fox seemed ill-timed, as did the acquisition of ESPN many years prior. Simply put, Disney has had many opportunities to prove itself to investors.

Peltz Looking to “Restore the Magic” at Disney

Peltz noted several goals to help “restore the magic” (based on Trian’s RestoretheMagic.com site that outlines company issues and proposed solutions) back at the company. The first goal is to find a suitable top boss to eventually replace Iger within two years. Indeed, Disney has had issues with succession planning, and such a move with a reasonable time window could help Disney get things in order without the pressure that would have been caused by an immediate CEO replacement.

Reducing CEO pay is another goal that I’m sure many shareholders can get behind. While higher compensation may be justified for performance, Disney has been anything but a top performer of late. It’s been one of the Dow Jones’ (DJIA) biggest laggards.

Additionally, Peltz wants to transform Disney+ into a “niche” platform. Indeed, such a move represents a huge shift and could bring considerable risks. Disney+ may be a prime target for cancelation in such a shift.

Is DIS Stock a Buy, According to Analysts?

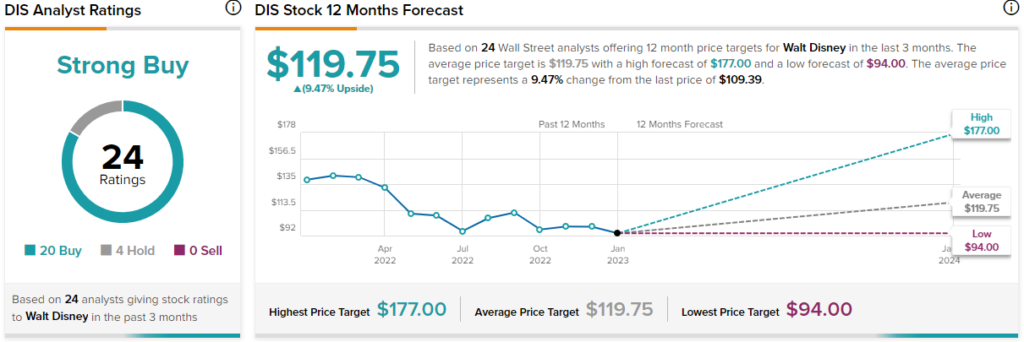

Turning to Wall Street, DIS stock comes in as a Strong Buy. Out of 24 analyst ratings, there are 20 Buys and four Hold recommendations. The average Disney price target is $119.75, implying upside potential of 9.5%. Analyst price targets range from a low of $94.00 per share to a high of $177.00 per share.

The Takeaway: It’s Going to be a Wild Ride

Peltz’s move into the stock could help, but investors should continue to expect plenty of volatility (DIS stock has a 1.23 beta, which makes shares choppier than the market) over the coming months.

Ultimately, Disney needs to make a drastic shift, with or without help from Peltz, but I think Peltz is a much-needed catalyst to help restore the magic over at Disney stock.