Walt Disney (NYSE:DIS), under the leadership of CEO Robert Iger, is making every effort to enhance business performance. Its cost-cutting and other initiatives are encouraging signs for the company’s future growth. Hedge fund managers have increased their holdings of DIS shares as a result of these initiatives.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

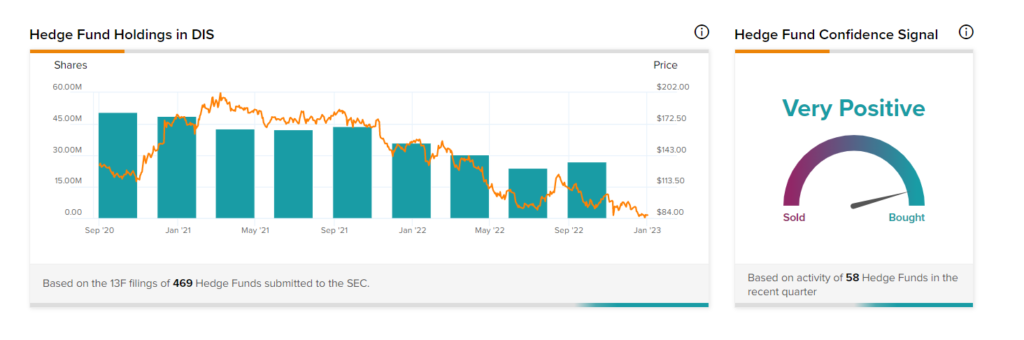

TipRanks’ Hedge Fund Trading Activity tool shows that hedge funds bought 2.9 million DIS shares last quarter. Buyers include Ken Fisher of Fisher Asset Management LLC and Joel Greenblatt of Gotham Asset Management LLC, among others. Overall, Disney has a very positive Hedge Fund Confidence Signal at present.

Recent Developments at Disney

In its annual filing, the company said that Iger would undertake “organizational and operating changes.” Iger plans to focus on the distribution of content through direct-to-consumer (DTC) streaming services rather than traditional sources. Further, Disney is expected to release about 20 films in the Fiscal Year 2023. This should revive its movie business, which saw a setback, especially during the pandemic.

The company launched its affordable, ad-supported subscription plan for Disney+ last month to boost subscriber growth. Moreover, Disney’s parks segment continues to perform well even after the company raised some prices at its parks in 2022.

The stock appears to be undervalued in terms of valuation. Its current price/sales ratio is trading at 1.92x, reflecting a 44.1% discount from the sector’s median of 3.42. This represents a great buying opportunity for investors.

Is DIS a Good Stock to Buy?

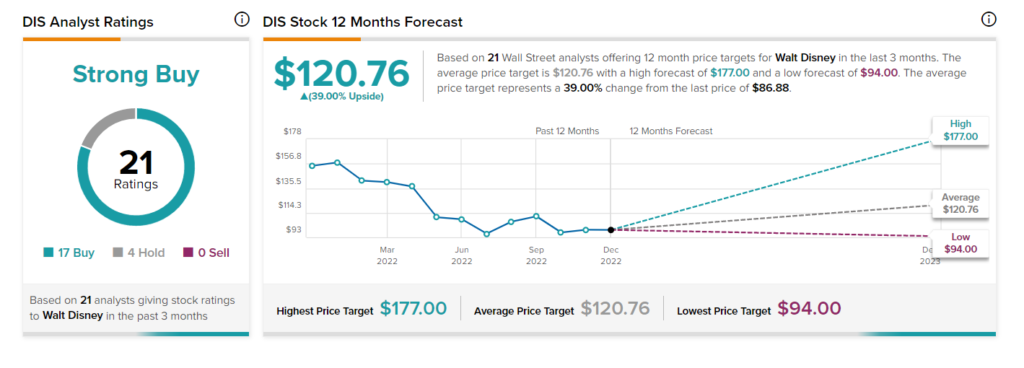

On TipRanks, DIS stock commands a Strong Buy consensus rating based on 17 Buys and four Holds. The average Disney stock price target of $120.76 implies 39% upside potential.

Moreover, insiders also bought shares of Disney worth $2.5K shares in the last three months. Overall, DIS scores 8 out of 10 on TipRanks’ Smart Score rating system, pointing to its potential to outperform.

Find out which stock the biggest hedge fund managers are buying right now.