Our modern world tends to divorce us from our food supply, and that’s unfortunate. A stronger understanding of the sources of the food we eat, and the complexity of the supply chain that brings that food to our tables, would bring us a myriad of benefits – not the least of which is a clear view of some sound investment opportunities.

In order to reach our tables, food must be prepared, preserved, and packaged, a set of interrelated processes that takes time, extensive facilities, and a trained labor pool. This food sector faces numerous challenges, even in good times, in the form of tight margins, high overheads, and intense competition. Add to that the current persistent inflation, and the outlook wouldn’t necessarily seem fertile for buying in.

A recent report from Citi analyst, Thomas Palmer, lays out the difficult situation. Yet, while Palmer is cognizant of the present issues, that doesn’t mean all sector stocks should be tarred with the same brush. “We are not overly bullish the group, despite depressed trading multiples. Pricing actions are fading, volumes remain in decline, and price competition could soon step up,” Palmer explained, before adding, “But we do see plenty of opportunities.”

Going from there, Palmer has picked out 3 packaged food stocks, companies positioned to survive and even thrive in a tough retail sector, diamonds in the rough, if you will. Are these choices also supported by the broader analyst community? To answer that, we turned to the TipRanks database. Let’s delve into it.

BellRing Brands (BRBR)

We’ll start with BellRing Brands, a food company focused on active nutrition. BellRing got its start as a division of Post Foods, a parent company best known for its line of breakfast cereals. The spin-off of the active nutrition branch was completed in 2022 and Post has since divested its interest in BellRing. Since then, BellRing has been free to focus on its own core business and brands, which include Premier Protein supplements, Dymatize sports nutrition, and the iconic and popular Power Bar.

BellRing started out with one big advantage, in the proven success of the Power Bar line. The nutrition bars are popular with long-endurance athletes at all levels, from hobbyists to professionals, as a quick and useful snack for refueling on the run. The company has maintained the quality of the product, and successfully marketed its other lines, to create a sound reputation for itself.

The company will announce its next set of financial results, for fiscal 1Q24 (December quarter) tomorrow (February 5), but we can look back on the last report, covering fiscal 4Q23, to see where the firm stands for now. That report showed $472.6 million at the top line, representing a year-over-year gain of 24.6% and coming in $11.79 million over the forecast. The company’s bottom line, a non-GAAP EPS of $0.41, was a penny better than had been expected. For the full fiscal year 2023, BellRing’s revenue total of $1.67 billion was up 21.5% year-over-year, and the company generated $215.6 million in cash from operations for the year.

Looking ahead, the company has guided toward a revenue range of $1.83 billion to $1.91 billion for fiscal year 2024. The Street’s analysts are expecting to see approximately $408 million in revenue in the fiscal 1Q24 report.

Analyst Palmer, writing up the Citi coverage for BellRing, is somewhat upbeat. He expects the company to maintain its growth, and believes the stock is a sound choice for investors. As Palmer puts it, “We look for BRBR to sustain double-digit sales growth for at least the next couple of years, driven by continued category growth and share gains by BRBR. With the cost environment turning more in BRBR’s favor and volume growth likely to accelerate, we also see the potential for margin upside in FY24E. BRBR shares admittedly trade at a sizable valuation premium to other US food producers, but the company’s robust topline growth, coupled with its high free cash flow conversion, warrants a premium valuation, in our view. Based on precedent transactions in the food space, we do not think the current valuation is too lofty to scare away potential acquirors.”

Palmer’s outlook comes with a Buy rating, and his $67 price target on the stock implies a one-year upside potential of 18%. (To watch Palmer’s track record, click here)

Overall, BellRing gets a Strong Buy consensus rating from the Wall Street analysts, based on 11 recent Buy reviews and 3 Holds. That said, the shares are currently trading for $56.82 and their average price target, $56.08, suggests the stock is fully valued. (See BRBR stock forecast)

Lamb Weston Holdings (LW)

For the next stock on our Citi-backed list, we’ll look at Lamb Weston Holdings, an Idaho-based company that focuses on potatoes. That is, the company lives and works in the ‘industrial spud space,’ and is a global leader in the preparation, production, and shipment of frozen French fries, waffle fries, and other processed potato products. Lamb Weston is domiciled in the right place, given that Idaho is the leading US producer of potatoes, growing as much as 1/3 of all the country’s spuds.

Lamb Weston has over 7,000 employees around the world, at processing plants, in shipping, and in management and marketing, and is a leading supplier of frozen potato products to the restaurant and food service industry. The company has been in business for over 70 years, and its product line includes fries, extra crispy fries, waffle fries, hash brown patties, crinkle fries, sweet potato fries, potato wedges, mini tater tots, frozen mashed potatoes – the list is nearly endless, and highlights the versatility of the potato.

The company’s work also highlights the enduring popularity of potatoes and potato products. The humble veggie has made a solid foundation for Lamb Weston to build on, and in its last complete fiscal year – fiscal 2023, which was reported back in July – the company reported annual revenues of $5.35 billion, up 31% from the prior year.

The most recent set of financial results from Lamb Weston covered fiscal 2Q24 and was released on January 4. The company showed a top line of $1.73 billion, beating the forecast by $30 million and growing 36% year-over-year. The firm’s bottom-line adj. EPS came to $1.45, up 15% y/y and 3 cents per share better than had been expected.

In his Citi note, Thomas Palmer gives several reasons why Lamb Weston should be attractive to investors, writing of the company, “We look for continued gross margin expansion, aided by (a) pricing actions (price hikes occurred for some customers at the start of calendar 2024), (b) mix tailwinds, and (c) lapping discrete items (e.g., an inventory write-down and ERP-related disruptions in FY24E). We also look for volumes to inflect higher, aided by new customer wins and capacity additions. With the shares trading near their historical lows on both P/E and EV/EBITDA, we think a volume inflection could lead to higher multiples.”

Palmer goes to give the stock a Buy rating, with a $132 price target that suggests a 24% gain for the shares in the next 12 months.

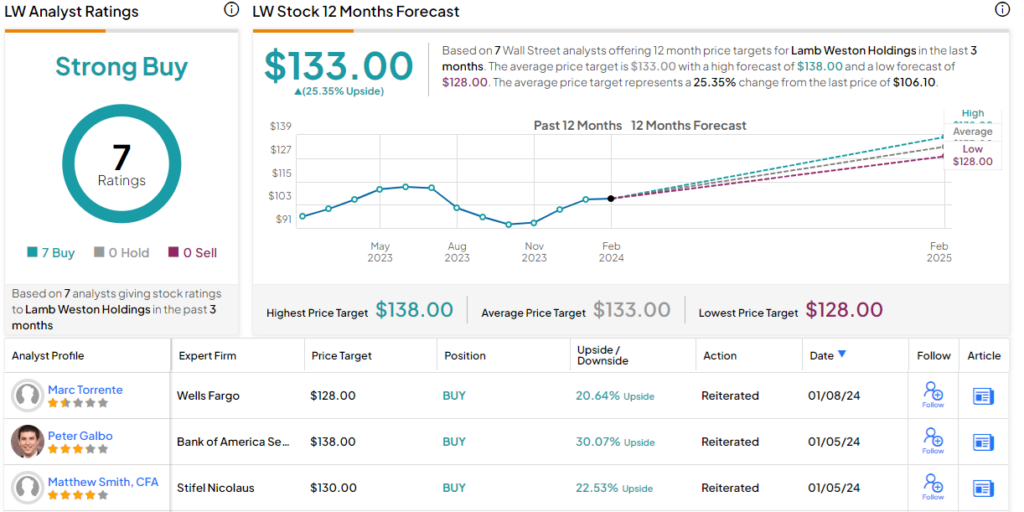

Wall Street clearly agrees with the bullish take on this stock, as the Strong Buy consensus is unanimous, based on 7 recent positive analyst recommendations. The shares are trading for $106.10, and their $133 average price target implies a 25% increase from that level. (See Lamb Weston’s stock forecast.)

JM Smucker (SJM)

The last Citi-endorsed name we’ll look at traces its roots to the 1890s, and has become one of the better-known makers of jams and jellies on the US food scene. In fact, this author must confess to fond childhood memories of Smucker’s concord grape jelly. That’s only a small part of JM Smucker’s product portfolio, however; the company produces and distributes a wide range of products across multiple well-known brands. These include fruit preserves, jellies, peanut butter, and ice cream toppings under the Smucker’s label, and other labels include Foglers coffee, Knott’s Berry Farm, Jif, and the recently acquired Hostess snack food label.

Hostess is one of the nation’s largest and best-known brands of snack foods. JM Smucker acquired the snack company late last year, in a cash and stock transaction that was valued at $5.6 billion. The move brought some famous food items into the Smucker family, including Twinkies, Ho Hos, and Ding Dongs, as well as several food processing and manufacturing facilities employing some 3,000 people.

Also last year, JM Smucker divested itself of several private label pet food brands, including 9 Lives, Kibbles ‘n Bits, and Gravy Train. The divestiture saw Smucker sell the brands to Post Holdings in a deal worth $1.2 billion, of which $700 million was in cash and the remainder in Post Holdings stock.

The net effect of these moves was to streamline JM Smucker’s product line, and focus it more firmly on human foods, particularly sides and snacks. The pet food sale had an important impact on the company’s financial results for fiscal 2Q24, which were released in early December.

In that fiscal quarter, JM Smucker reported revenues of $1.94 billion. This was down 12% from the prior year period, and reflected ‘noncomparable net sales in the prior year of $385.0 million from the divested pet food brands.’ In addition, the company’s top line suffered from $2.5 million in unfavorable currency exchanges. The fiscal 2Q24 revenue was in-line with analyst expectations. We should note that the quarterly bottom line, of $2.59 per share by non-GAAP measures, was up 8% y/y and was 12 cents per share better than the forecast.

Checking in one last time with Citi’s Thomas Palmer, we find the analyst listing several reasons that SJM shares should continue to grow, saying, “We see a variety of sales and EPS growth drivers for SJM, including (a) continued double-digit growth at Uncrustables (now 10%+ of total sales), (b) accretion from recently acquired Hostess Brands (we think the recent slowdown is transitory), and (c) the elimination of stranded costs following its pet divestiture (SJM is limited here until its TSA winds down). There is a negative correlation between food multiples and debt loads, so SJM’s multiples could also benefit from planned debt reduction.”

The Citi view gives JM Smucker shares a Buy rating, with a $153 price target that indicates a potential 16% upside by the end of this year. (To watch Palmer’s track record, click here)

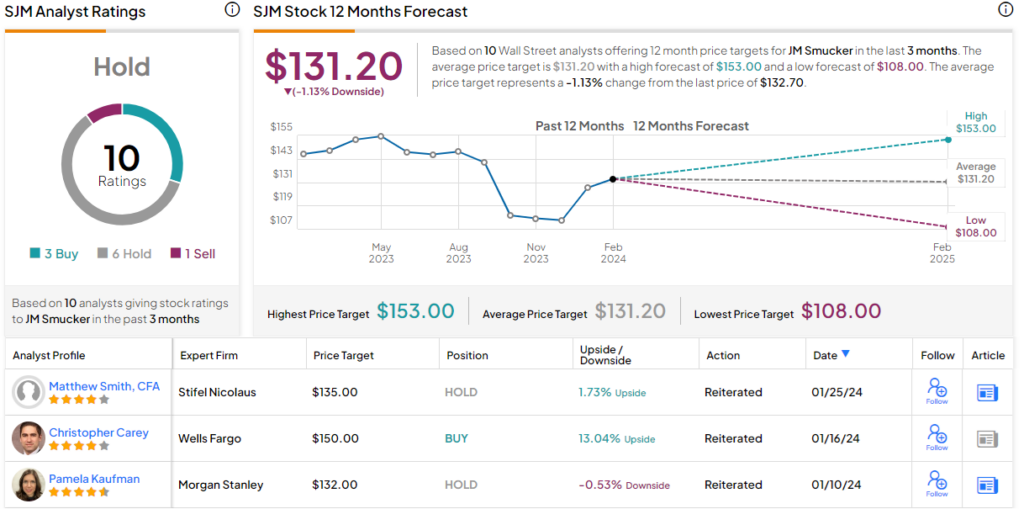

That’s the bullish take. The Street is somewhat cautious on SJM, giving the stock a Hold consensus rating based on 10 reviews that include 3 to Buy, 6 to Hold, and 1 to sell. The stock is currently trading for $132.70 and its $131.20 average target price imples the shares will stay rangebound for the time being. (See SJM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.