While we don’t know what 2024 has in store for investors, it’s worth remembering that a good dividend growth ETF never goes out of style. As such, I’m bullish on the iShares Core Dividend Growth ETF (NYSEARCA:DGRO) based on its compelling portfolio of top dividend growth stocks, strong historical performance, track record of dividend growth, and low expense ratio.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What is the DGRO ETF’s Strategy?

DGRO is a $25.1 billion ETF from BlackRock’s (NYSE:BLK) iShares that “seeks to track the investment results of an index composed of U.S. equities with a history of consistently growing dividends.” These companies are “broadly diversified across industries.”

Stocks that increase their dividends on a consistent basis often make for sound investments because if a company has the ability to grow its dividend year after year, it’s likely growing its earnings on a consistent basis as well, meaning that the stock should offer an attractive mix of returns from both dividend income and capital appreciation.

A Diversified Portfolio of Top Dividend Growth Stocks

DGRO offers investors a nice mix of dividend stocks with ample diversification. The fund holds 421 stocks, and its top 10 holdings account for just 26.7% of assets, so there is minimal concentration risk here. Below is an overview of DGRO’s top 10 holdings from TipRanks’ holdings tool.

The fund holds many blue-chip companies that have grown their dividend payouts for years. While the fund’s top holding, Microsoft (NASDAQ:MSFT), is more often thought of as a growth stock than a dividend stock, it has increased its payout for 19 years in a row.

Microsoft is a good example of why investing in dividend growth stocks is a sound strategy. While Microsoft’s dividend yield of 0.7% doesn’t sound like much to get excited about, the growing dividend combined with the stock’s strong performance over the years has generated excellent results for its shareholders. Microsoft has produced a total return of over 1,200% over the past decade.

Given this dazzling total return, I don’t think many Microsoft shareholders are complaining about the 0.7% dividend yield.

Broadcom’s (NASDAQ:AVGO) performance tells a similar story. Broadcom’s dividend yield of 1.9%, while higher than Microsoft’s, doesn’t really sound like much to write home about. However, Broadcom has increased its dividend payout for 13 years in a row. Plus, Broadcom’s incredible total return of 2,610% over the past decade surpasses even Microsoft’s gaudy performance.

The strong performances of Microsoft and Broadcom illustrate why looking for consistent dividend growth can be a more effective strategy than simply looking for high yields.

Meanwhile, additional top 10 holdings like ExxonMobil (NYSE:XOM), Johnson & Johnson (NYSE:JNJ), and Procter & Gamble (NYSE:PG) are Dividend Aristocrats/Dividend Kings that have increased their payouts for 25, 61, and 67 consecutive years, respectively.

DGRO is also diversified when it comes to market sectors. Its heaviest exposure is to financials, although this sector accounts for a weighting of just 18.4%, so less than one-fifth of the fund. Healthcare has a weighting of 17.7%, information technology weighs in at 17.0%, industrials come in at 11.9%, and consumer staples make up 10.6% of assets. No other sector accounts for a weighting of more than 10%.

DGRO’s top holdings are also highly rated by TipRanks’ Smart Score system. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Eight out of DGRO’s top 10 holdings boast Outperform-equivalent Smart Scores of 8 or higher. Even better, AbbVie (NYSE:ABBV) and Broadcom feature ‘Perfect 10’ Smart Scores, placing them on the list of Top Smart Score Stocks. DGRO features an Outperform-equivalent ETF Smart Score of 8.

Another nice thing about DGRO’s portfolio is that while it features many blue-chip dividend growth stocks, it isn’t overly expensive from a valuation perspective. The ETF’s P/E ratio of 18.7 isn’t incredibly cheap, but it’s noticeably cheaper than the S&P 500’s (SPX) P/E ratio of 21.6.

Solid Long-Term Performance

DGRO’s strategy of investing in companies that grow their dividends sustainably has translated into solid results over time. As of December 31, 2023, the fund posted an annualized return of 8.8% over a three-year time frame and an impressive annualized return of 12.9% over a five-year time frame.

On a cumulative basis, the fund has posted a nice total return of 83.3% over the past five years and an impressive 170.3% since its inception in 2014.

An Enticing Expense Ratio

Cost is another area where DGRO shines. Its ultra-low expense ratio of just 0.08% means an investor will pay just $8 in fees on a $10,000 investment annually. Assuming that this expense ratio stays constant at 0.08% and the fund returns 5% per year, an investor allocating $10,000 into the fund will pay just $103 over a 10-year investment time frame. Low-cost ETFs like DGRO help investors save money and build their portfolios over time.

Is DGRO Stock a Buy, According to Analysts?

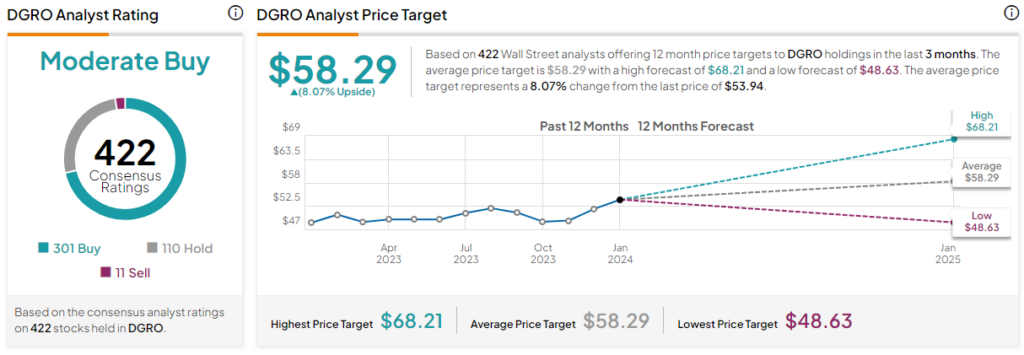

Turning to Wall Street, DGRO earns a Moderate Buy consensus rating based on 301 Buys, 110 Holds, and 11 Sell ratings assigned in the past three months. The average DGRO stock price target of $58.29 implies 8.07% upside potential.

Investor Takeaway

The iShares Core Dividend Growth ETF is a sound choice for investors looking to park some of their money, no matter what the market may bring in 2024. The fund owns a large and diversified selection of blue-chip dividend growth stocks that have both appreciated in value and increased their dividend payouts over time.

The popular ETF has grown its own dividend payout for nine years in a row and put up double-digit annualized returns over the last five years (as of December 31). The fund is also viewed favorably by analysts and is rated highly by TipRanks’ proprietary Smart Score system.

Lastly, DGRO offers investors an extremely cost-effective expense ratio of just 0.08%, making it an appealing holding for the long term. For these reasons, I’m bullish on this strong dividend growth ETF for 2024 and beyond.