Investors closely follow news on stock performance, hoping for stock price gains. Dividends, a substantial additional source of investment returns, shouldn’t be overlooked, as they increase total returns, also offering inflation protection, stability during market downturns, and portfolio risk reduction. However, finding quality companies with sound fundamentals that will be able to prosper and grow their payouts for years to come requires thorough research. Thankfully, TipRanks can help investors make the right choice while picking stocks for income investment portfolios.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Are Dividend Stocks?

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders, usually in the form of regular cash payments. Basically, some companies choose to share a part of their earnings with their investors, paying them a specific amount of money per each stock they hold.

Companies that pay dividends are perceived as more stable and financially stronger than non-dividend-paying firms, projecting a higher degree of certainty regarding the company’s fundamental well-being. Thus, if a company has sufficient net income to cover its financing needs, invest in business growth, pursue any other strategic or tactical goals, and also pay dividends to its shareholders, it will attract more investors wishing to participate in its profits, thus supporting stock performance. Investors view dividends as a sign of the company management’s positive outlook for future business and financial performance, as well as its alignment with shareholder interests.

Dividend-paying stocks appeal to investors because of their ability to generate consistent long-term income. While dividends certainly can be cut or canceled, companies strive to avoid these steps at almost any cost, as they shatter investor sentiment toward the firm and usually lead to a significant decrease in its stock price. In contrast, a company that continues with consistent cash payouts even through economic hardship may retain most of its shareholders as they get compensated for losses brought on by declines in stock prices.

Why Choose Dividend Stocks?

Dividend-paying stocks can be an important part of any investment portfolio because they provide a steady and reliable source of income, increasing the potential for long-term capital appreciation. However, there are additional reasons to invest in these stocks. They can also help reduce the risk of an investment portfolio and add stability to its medium- to long-term performance.

In low-growth, low-interest-rate environments, dividends can offer higher income than the yields on Treasurys, CDs, or investment-grade bonds. In a high-inflation environment, dividends can compensate for the loss of purchasing power resulting from inflation.

Dividend stocks reduce overall portfolio risk as the payments mitigate losses stemming from stock price declines. In addition, research shows that historically, dividend payers outperform non-dividend-paying stocks during bear market periods. This shouldn’t be a surprise given that dividend-paying firms – and especially those that have consistently increased dividends over time – tend to be mature, established, higher-quality businesses, which historically have weathered downturns better than others.

Moreover, dividend stocks reign supreme not only during bear markets – their performance is better overall in the long term. According to research, dividend-paying companies that have increased their payouts over time have outperformed non-dividend payers as well as the broader market, while showing lower volatility. Simply put, with quality dividend stocks, investors get better long-term performance with lower risk.

Which Dividend Stocks Are Better?

There are vast differences among different dividend stocks. Some companies have a long history of consistently paying and increasing their dividends, while others may have a more volatile dividend record. Some pay a high dividend yield (described as the ratio of the dividends paid by a company to its shareholders relative to its current stock price), while the yields of some dividend-payers may look meager compared to others.

Some investors are often drawn to “Dividend Aristocrats,” companies that have increased their dividends for at least 25 consecutive years. Although their dividend yield is often low compared to others, companies that have proven their ability to provide stable and rising dividends over a long period are the go-to option for aspiring income investors, allowing for easy decision-making; this popularity leads to higher demand and, consecutively, higher prices of these stocks. Stocks that are expensive compared to their peers typically have less space for share price appreciation, which can result in lower total returns over time.

Other investors seek high-dividend-yield stocks. However, many dangers are lurking below the glittering surface of high yields, and it’s very important to understand the reason for this generousness. High dividend yield may originate from a decline in a company’s share price, which can be due to some kind of distress. Other high-yield payers may use dividends to compensate for lack of growth, creating a vicious circle where generous dividend payouts don’t leave enough means for investment in business expansion. High-yield stocks may not be in the most stable financial condition, which can increase the risk of a dividend cut or suspension. Simply put, a high dividend yield doesn’t warrant future dividend growth or income stability.

Although some investors tend to think that all dividend stocks with meaningful yields are safe, that is not always the case. History holds many examples of companies that paid very high dividends, and then cut or eliminated them altogether after running into difficulties. That’s why it is important to choose quality companies with sound fundamentals and a track record of consistent dividend payouts, paying attention to their valuations, as well as earnings growth prospects.

How to Find the Dividend Winners

So how can an investor find high-quality stocks that pay substantial yield, but are not overvalued so that they still have a decent upside which, together with dividends, will comprise an attractive total return?

One way is to perform a thorough analysis that would incorporate quality metrics, such as profitability, earnings stability, free cash flow generation, sector outlook, and relevant macroeconomic factors while evaluating the company’s dividend history and checking its dividend payout ratio for signs of sufficient dividend coverage. It isn’t an easy task, but it is of utmost importance when choosing long-term income-generating portfolio stocks.

Alternatively, investors can rely on TipRanks for help. TipRanks provides investors with access to research done by Wall Street’s leading analysts, which can be easily utilized to their benefit. In addition, TipRanks has several handy tools that employ the vast amounts of data and research stored in its database, helping discerning investors pick the best stocks according to their outlook, risk tolerance, and financial goals. For example, investors can use the Dividend Aristocrats screener; the Best High Dividend Stocks and Highest Dividend Stocks comparison tools; or the Best Dividend Stocks list, which features dividend stocks with the highest Smart Score.

In addition to all that, investors can subscribe to the TipRanks Smart Dividend Newsletter, which offers investment ideas for safe-bet quality stocks that are also outstanding dividend payers compared to their industry. Subscribers of the Newsletter receive weekly recommendations for high-quality stocks from different industries, that feature robust financial health, solid growth prospects, and consistently pay higher yields than their peers.

Dividend Winners: Practical Examples

Using the above-mentioned tools, let’s look at some examples of stocks that can be recommended as quality dividend stocks for 2024.

1. AstraZeneca (AZN)

AstraZeneca Plc is a multinational pharmaceutical and biotechnology company, the world’s ninth-largest drugmaker by revenue, and eighth-largest by market capitalization.

AstraZeneca has one of the world’s most extensive treatment pipelines, with 167 projects in varied stages of clinical development, including new molecular entities in late-stage development or under review. The company constantly invests in cutting-edge science and technologies to fast-forward drug discovery. Thus, AZN leverages advanced medical science in the fields of cell-based therapy, antibody therapeutics, and nucleotide-based therapeutics, as well as technological developments such as data science and artificial intelligence (AI).

The company’s shareholders are generously rewarded through dividends, which AstraZeneca has paid for the last 23 years. The company’s current dividend yield of 2.2% is much higher than the average for the U.S. Healthcare sector (1.5%). The company’s commitment to compensating its shareholders, coupled with the modest payout ratio of 39.5%, a more-than-sufficient coverage provided by earnings, and a strong revenue growth outlook, permits an optimistic forecast with regard to AZN’s future dividend-per-share growth.

In the past three years, the company has been growing revenues at a CAGR of 20%, and earnings-per-share at a CAGR of 26%. In the past year, AstraZeneca’s earnings-per-share surged 188%, thanks to the successful incorporation of the acquired companies’ products, as well as to AZN’s key blockbuster drugs. Analysts project continued strong growth of the company’s revenues in 2024 and beyond.

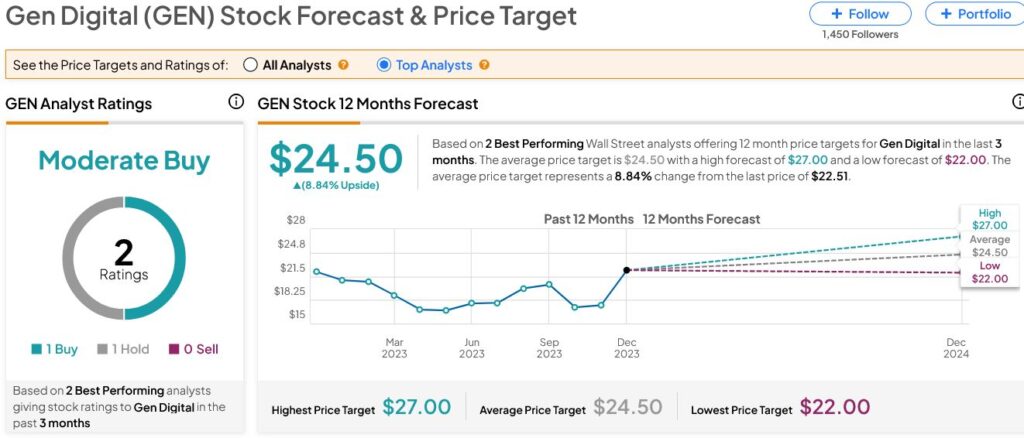

TipRanks-scored top Wall Street analysts see an average upside of 25% for the stock in the next 12 months. AZN carries a TipRanks Smart Score rating of 9/10 (“Outperform”) with a “Strong Buy” recommendation:

2. LyondellBasell (LYB)

LyondellBasell Industries N.V. is a multinational chemical producer and one of the world’s largest plastics, chemicals, and refining companies. It is the world’s largest producer of polypropylene compounds as well as the largest licensor of polyolefin technologies. LYB also produces ethylene, propylene, polyolefins, oxyfuels, and other chemical products. LyondellBasell’s products are essential ingredients in a large number of industries, including electronics, packaging, construction materials, automotive components, motor fuels, biofuels, textiles, medical supplies, and more.

LyondellBasell has been paying dividends since 2011; the dividends have been steadily increasing since 2014. In the past decade, LYB’s dividend payouts have grown at a CAGR of 12.8%. The latest dividend increase was in May 2023, when the payout rose by 5%; in March last year, it grew by 5%, as well. The high dividend yield places LYB in the top 25% of dividend payers in the U.S. market.

The company’s dividend yield stands at 5.3%, versus the sector’s average of 1.9% and the industry’s average of 4.2%. With its reasonably low payout ratio of 44%, LYB’s dividend payments are well-covered by both earnings and free cash flow, while the company retains enough profit to invest in growth opportunities and reduce debt. The company’s solid management and efficient operating model support the outlook for further dividend growth.

In the past three years, the company has been growing revenues at a CAGR of 14%, and earnings-per-share at a CAGR of 26%. TipRanks-scored top Wall Street analysts see an average upside of 9.5% for the stock in the next 12 months. AZN carries a TipRanks Smart Score rating of 8/10 (“Outperform”) with a “Moderate Buy” recommendation:

3. Cigna Group (CI)

The Cigna Group provides a broad range of insurance and related services within the United States through its two divisions. Cigna Healthcare is a health benefits provider that offers a variety of services such as medical, pharmacy, behavioral health, dental, and more for both insured and self-insured customers. Cigna’s Evernorth Health Services division provides a range of coordinated health services including pharmacy benefits, home delivery pharmacy, specialty pharmacy services, and care delivery and management solutions.

Cigna Group awards its shareholders with quarterly dividends, which have been consistently increasing over the last 14 years. The company’s current dividend yield is 1.7%; the company’s low payout ratio of 20.1%, sound financials, and robust cash-generating abilities provide for further growth in payouts to investors.

Cigna Group’s revenues surged from $40 billion in 2016 to $180 billion in 2022; in the same period, its earnings more than tripled. This swift expansion is attributed to both the company’s significant investment in organic and inorganic growth, and the secular trend of an aging population and the rising prevalence of chronic health conditions. In the past five years, Cigna has been growing its revenues at an average annual rate of 25.7%; earnings grew by 16.6% per annum.

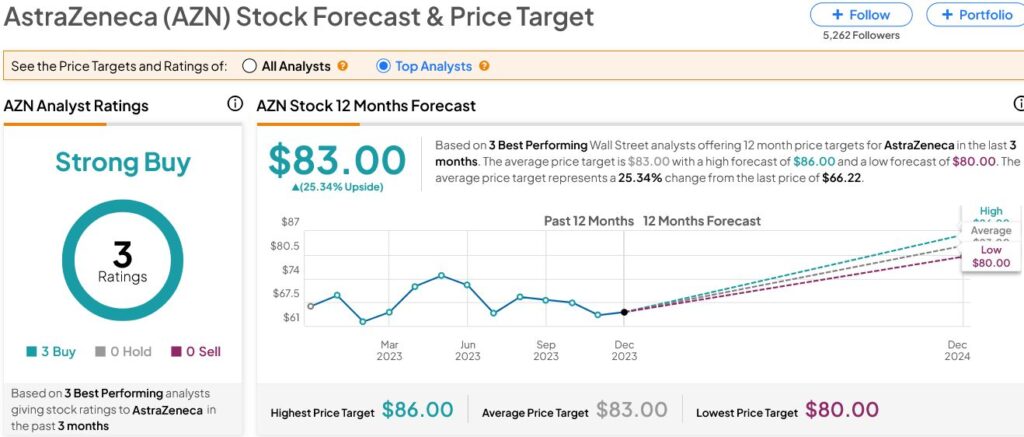

TipRanks-scored top Wall Street analysts see an average upside of 27% for the stock in the next 12 months. CI carries a TipRanks Smart Score rating of 10/10 (“Perfect 10”) with a “Moderate Buy” recommendation:

4. Gen Digital Inc. (GEN)

Gen Digital Inc. is a leading global cybersecurity software and service company. Its solutions portfolio offers protection across three cybersecurity categories: security, identity protection, and online privacy. As opposed to the well-known names in the enterprise cybersecurity field, GEN focuses on consumer cybersecurity, a market offering large growth opportunities.

Gen Digital has been consistently paying dividends since 2013. Its current dividend yield of 2.4% is more than double the average for the technology sector. The company’s commitment to compensating its shareholders, coupled with the low payout ratio of 27% and a more-than-sufficient coverage provided by earnings, permits an optimistic outlook with regard to GEN’s future dividend-per-share growth.

In the past three years, the company has been growing revenues at a CAGR of 15%, and earnings-per-share at a CAGR of 19%. Its fiscal Q2 2024 (ended September 29, 2023) featured its 17th straight quarter of revenue and EPS growth.

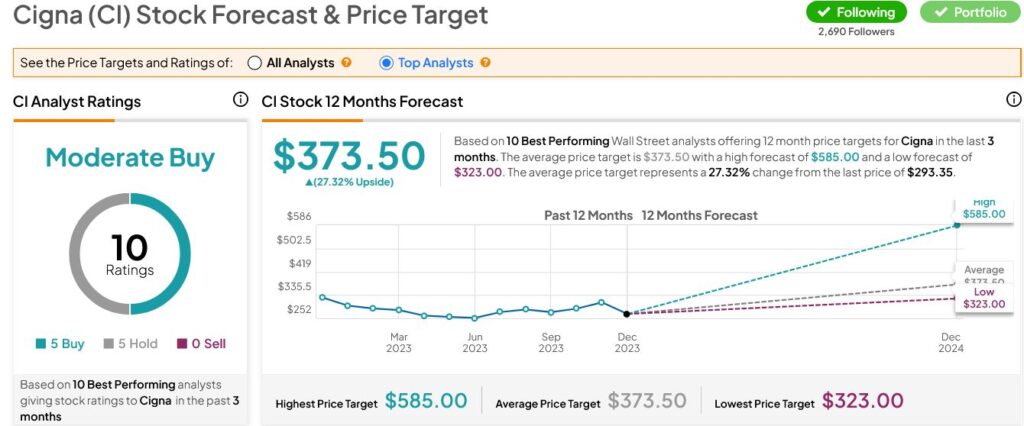

TipRanks-scored top Wall Street analysts see an average upside of 9% for the stock in the next 12 months. GEN carries a TipRanks Smart Score rating of 8/10 (“Outperform”) with a “Strong Buy” recommendation: