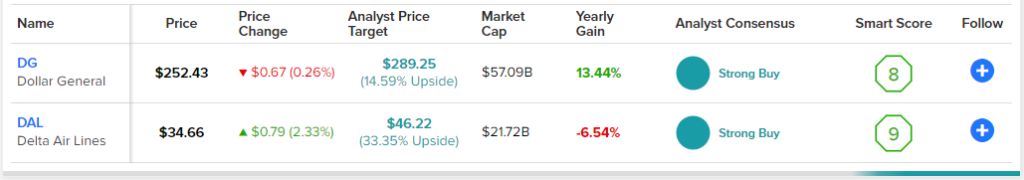

Keeping a view beyond the near term and choosing the right stocks is key to successful investing. TipRanks’ Analysts’ Top Stocks tool eases the process of choosing stocks by offering a comprehensive view of the stocks that are winning over Wall Street analysts. Dollar General (NYSE:DG) and Delta Airlines (NYSE:DAL) are two stocks that have been most recommended by Wall Street analysts over the past two days.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Dollar General (DG)

Discount retailer Dollar General is a compelling stock in the retail space due to its growth initiatives, defensive product mix, and real estate growth strategy. The company is giving the inflation-weary Americans what they need —cheaper options of essential and non-essential items. It is committed to better pricing and effective inventory management, and other initiatives that are driving sales.

Importantly, dollar stores are the more recession-resilient lot in the retail space, making me anticipate a solid quarterly report for Dollar General on December 1.

What is the Price Target for DG Stock?

Ahead of the quarterly results, Oppenheimer analyst Rupesh Parikh maintained a Buy rating on DG stock and even increased his price target to $285 from $275. Parikh sees lesser earnings potential but solid top-line performance during the print, supported by strong uptrends in grocery. Also, five Wall Street analysts (including Parikh) have unanimous Buy ratings on DG, giving the stock a Strong Buy consensus rating. Its average price target is $289.25, implying 14.55% upside potential.

Although a forward P/E of 20.3x (based on earnings estimates for the next 12 months) seems to be a premium valuation, investors might bet on the solid sales growth runway that lies ahead for DG, and this may lead to stock price appreciation.

Delta Airlines (DAL)

Improved air-travel demand, particularly domestic, is providing the winds beneath the wings of U.S.’ legacy carrier, Delta Airlines. The company is also embracing cargo revenue tailwinds. Still, DAL has lost around 16% of its valuation this year.

Buoyant air-travel demand helped the airline company deliver a double-digit operating margin in both the second and third quarters of this year. Importantly, Delta Air remains on course to deliver $7 in adjusted earnings per share and $4 billion of free cash flow in 2024.

Interestingly, the company’s thoughtfulness about the environment is also attracting ESG-focused investors. To align its interests with the business, in August, Delta inked a partnership with hydrogen and biogenic-based fuel developer DG Fuels to hasten the production of sustainable aviation fuel.

What is the Price Target for DAL Stock?

Nine analysts unanimously have a Strong Buy rating on DAL stock. The average DAL price target of $46.22 indicates 33.5% upside potential.

Takeaway: DG and DAL Look Like Winners

Both Dollar General and Delta Airlines are thriving despite a broader market slowdown. Even with high costs, the companies are poised to take advantage of shallower pockets in a reopened economy. In the near and long term, these two stocks appear to be winners.