If you’re having concerns over buying in on the king of e-retailers, Amazon (NASDAQ:AMZN), it’s time to put those concerns to bed. Why? Because as it turns out, not only has Amazon diversified like no tomorrow, it’s even got plans to properly tackle any economic slowdown that may be ahead.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Investors Shouldn’t Worry about Strikes at Amazon

Let’s get the elephants in the room to move over toward the door first. What if a strike hits? Well, the good news about that is that strikes are already hitting, and workers’ moves to unionize are likewise continuing. Teamsters are already in mid-picket out at the San Bernardino, California warehouse, expanding their strike from Palmdale. Yet Amazon carries on. In fact, as of April—based on a report from The Guardian—union victories at Amazon are dwindling rapidly. Amazon puts up a united anti-union front, while the Amazon Labor Union itself is increasingly fractious and disagreeable over just what it should do from here.

Meanwhile, let’s also consider the impact of a UPS (NYSE:UPS) strike. At last report from Fox Business, one strike was already averted as management brought a better offer out that even the union thought reasonable, if not complete. Losing UPS as a delivery vector would have been rough, but Amazon has been visibly pulling back from UPS since March. In 2022, notes Retail Dive, UPS handled 1.3 billion Amazon packages. In 2021, that was 1.41 billion.

Naturally, a UPS strike would mean quite a few Amazon packages delivered much more slowly as Amazon tries to absorb or subcontract the overage, but it may be able to cope with a short strike, maybe even a long one. And right now, a UPS strike looks less and less likely thanks to movement from management.

Amazon Has Diversified Its Operations

Granted, there’s a real concern that discretionary spending may drop, which is what retailers count on. With the Supreme Court’s latest move to nix any student loan cancellation that the Biden Administration may have wanted, that ups the chances of shoppers cutting back. But with around half of Americans planning to shop this year’s Prime Day—up from around 30% in 2021—the concerns about cutbacks may be overwrought. Still, Amazon is ready for a retail slowdown. Why? Because it has plenty of other options. Just back in February, Amazon Web Services accounted for 13% of Amazon’s bottom line. And Amazon has been rapidly working to expand that line, too.

Amazon has put AWS to work in the growing AI market as well. AWS offers a means for users to bring AI services into the fold without requiring a lot of machine language experience. That means a potentially big new market as AI services take hold.

Moreover, as of June 12, Amazon pulled in roughly $25.21 billion from Prime Video and the rest of the Prime service lineup. And with the average Prime subscriber dropping about $1,400 per year, Prime is big business by itself.

Is Amazon a Buy or Sell?

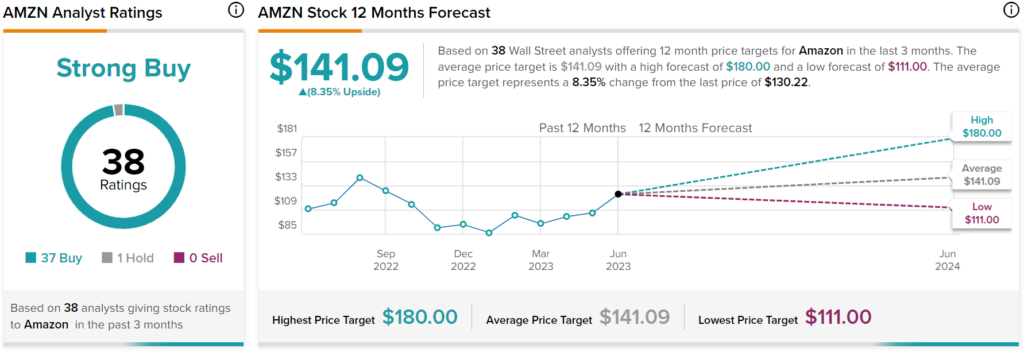

Amazon enjoys no shortage of analyst support. With 37 Buy ratings against just one Hold, Amazon is considered a Strong Buy nearly unanimously. However, perhaps its only real downside is its upside potential or lack thereof. With an average price target of $141.09, Amazon stock offers a gain of 8.35% from current levels.

Conclusion: Amazon is the Total Package

So, take a landscape where the risks are present but commonly overblown, and the potential rewards could be growing from here. That’s Amazon’s landscape right now. It’s expanding its delivery operations and having some impact with unions. It’s growing its product line into tomorrow’s next big thing and beyond. And it’s bringing all of that together with a lot of room for more.

.