Amazon’s (NASDAQ:AMZN) annual shopping extravaganza is almost here. Next week, this year’s Prime Day event will take place on July 11-12, during which shoppers will be able to seek out the best deals and discounts. For U.S. Prime members, Amazon has promised this year will have “more deals on small business products than ever before.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The shopping gala comes at a good time for consumers, says Monness analyst Brian White, who notes the event, will “provide consumers with an opportunity to tap into deals during this global inflationary crisis.”

With every Prime Day boasting a slightly different tone and initiatives, this time around, Amazon says Prime Members will be able to enjoy unprecedented discounts on a range of products from popular brands such as Bose, Hey Dude, and Theragun. These discounts will represent the lowest prices offered by Amazon this year. Additionally, new deals will be released every half an hour during specific time intervals throughout the event, featuring significant markdowns on top products from the hottest brands.

This year, there is also the option for members to get a head start on some deals via ‘invite-only’ offerings. Starting from June 21, U.S. Prime members were given the chance to make direct purchases from specific brands through the Buy with Prime program. Prior to the event, discounts on Amazon devices have also been made available, along with savings on back-to-school items and various digital services such as Prime Video and Amazon Music.

In other Amazon-related news, coincidentally, on the same day that Amazon announced this year’s Prime Day, a complaint against the firm was filed by the Federal Trade Commission (FTC) along with a press release entitled, ‘FTC Takes Action Against Amazon for Enrolling Consumers in Amazon Prime Without Consent and Sabotaging Their Attempts to Cancel.’

Such acts are not something unusual for big organizations, says White, although Amazon appears to be in the FTC’s crosshairs right now. “We believe deceptive digital tactics are common across corporate America,” the 5-star analyst noted. Furthermore, according to a recent report by Bloomberg, the FTC is poised to initiate an antitrust lawsuit against Amazon, specifically targeting its online marketplace.

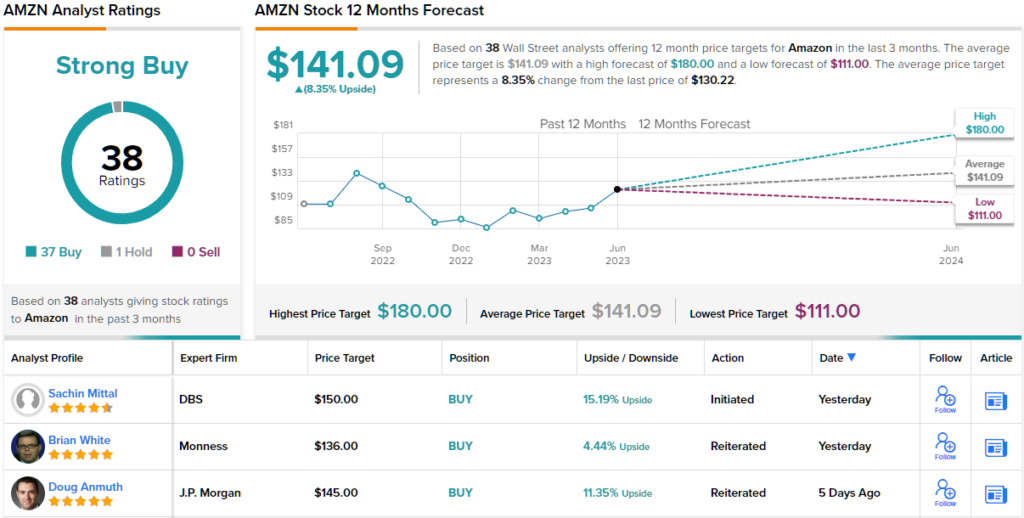

All told, for now, White remains with the bulls. The analyst rates AMZN shares a Buy to go alongside a $136 price target. (To watch White’s track record, click here)

Overall, 38 analysts have chimed in with Amazon reviews recently and barring one skeptic, all are on board, making the consensus view here a Strong Buy. Meanwhile, the $141.09 average target implies ~8% share appreciation from current levels. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.