In this piece, I evaluated two computer stocks — Dell Technologies (NYSE:DELL) and HP Inc. (NYSE:HPQ) — to see which is better. These two companies have been competing in the technology and computer hardware industry for many years, so they’re similar in many ways. Upon closer analysis, though, it looks like both stocks are mixed in terms of quality, warranting a wait-and-see approach, but they may still be attractive for dividend investors due to their respectable yields.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, given the turmoil in the technology sector right now, investors will have to choose wisely if they want to invest there at this time. Reports from multiple sources indicate that the computer hardware industry has faced some major setbacks in the last year or so due to growing economic uncertainty. Additionally, with computer sales plummeting, many companies are turning to other revenue streams like services.

Nonetheless, let’s analyze DELL and HPQ’s qualities.

Dell Technologies (NYSE:DELL)

Dell is trading at a trailing price-to-sales (P/S) ratio of 0.3 and a P/E ratio of 17.6, making it look undervalued relative to the technology hardware sector. From a P/S standpoint, the company is back to the level it was trading at in the depths of the 2020 bear market in the early days of the pandemic. Further, Dell’s fundamentals are mixed, making a neutral view seem appropriate until there’s more clarity on when the shares have bottomed out.

The technology hardware sector is trading around its three-year average P/E of 27.3 times and P/S of 5.0 times. However, given the significant uncertainty that’s been sweeping the tech sector recently, it seems likely that a sector-wide de-rating is underway. As a result, there could be more downside for Dell and HP, although both will likely make it through a recession.

On the one hand, Dell is laden with debt, but on the other, it has steadily been paying off more than the new debt it issues. Also, despite its plunging computer sales, the company has managed to grow its revenue from $101.2 billion in the fiscal year that ended in January 2022 to $105.3 billion for the last 12 months.

Additionally, Dell plans to lay off 6,650 employees due to lackluster PC sales, as evidenced by the massive decline in the fourth quarter. Industry analyst IDC told Bloomberg that Dell’s PC sales plummeted 37% year-over-year in the fourth quarter. PC sales represent more than half of Dell’s revenue, so this is a massive problem for the company.

Nonetheless, Dell offers an attractive 3.22% dividend yield, a rarity in the tech industry that could make the company worth holding for income investors.

What is the Price Target for DELL Stock?

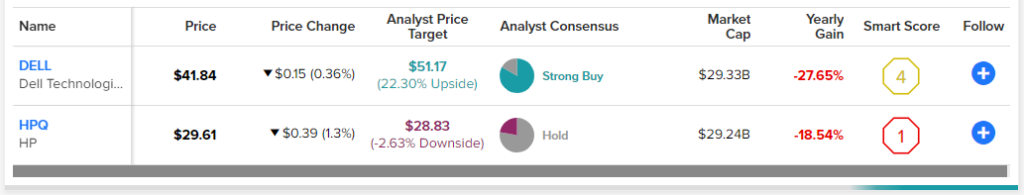

Dell Technologies has a Strong Buy consensus rating based on 10 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $51.17, the average price target for Dell Technologies stock implies upside potential of 22.3%.

HP Inc. (NYSE:HPQ)

HP is trading at a trailing P/S of 0.5 and a P/E of 10 times, making it look even more undervalued than Dell. The company’s P/S ratio is slightly higher than where it stood in 2020 in the early days of the pandemic. Still, HP’s fundamentals are also mixed, suggesting a neutral view could be appropriate until there’s more transparency into sector multiples.

Like Dell and other PC and tech giants, HP laid off almost 6,000 employees in November. Nevertheless, HP’s revenue remained stable in 2022, coming in at $63 billion for the fiscal year that ended in October 2022 versus $63.5 billion for the previous fiscal year. This suggests the company should have no problem surviving a recession.

HP is also generating plenty of free cash flow, at $3.67 billion for the last 12 months, although that’s a decline from $5.83 billion the year before. One concern is that the company has been issuing more debt than it has been paying off in recent years. For the last 12 months, HP repaid $1.1 billion in debt but issued $4.2 billion in new debt. Time will tell whether this will become a serious issue.

Finally, HP also offers an attractive dividend yield at 3.55%, although it looks more stable than Dell’s, as the company has been raising its dividend annually for the last seven years.

What is the Price Target for HPQ Stock?

HP has a Hold consensus rating based on zero Buys, seven Holds, and two Sell ratings assigned over the last three months. At $28.83, the average price target for HPQ stock implies downside potential of 2.63%.

Conclusion: Neutral on DELL and HPQ

Dell and HP are basically neck and neck, although Warren Buffett has established a position in HP rather than Dell. I’m assigning a neutral view on both names because their fundamentals seem equally mixed right now. More clarity into sector-wide multiples and other industry data could tip the balance in either direction.

Importantly, both offer attractive dividend yields, making them both potential dividend plays in the meantime. However, for investors focused on fundamentals, a wait-and-see approach looks appropriate until multiples for the tech sector and computer hardware markets stabilize.