Dell Technologies (NYSE:DELL) isn’t the market’s favorite technology company, but a surprise in personal computer (PC) demand could change many people’s minds this year. I am very bullish on DELL stock due to the company’s outstanding financial results.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Dell Technologies was a darling of the market back in the days of the dot-com bubble. The company produced PCs, and believe it or not, I actually wrote this using a Dell PC. I’ll admit that I’m a dinosaur compared to many commentators nowadays. However, don’t assume that Dell is an old fossil that can’t offer value to its shareholders.

As we’ll discover, there’s even an artificial intelligence (AI) angle for DELL stock investors to consider. So, let’s see if there’s a promising story for Dell now, two full decades after the dot-com bubble.

DELL Stock: Get Ready for the Upgrades and Revisions

I’ll bet you never saw this coming. Today, DELL stock is up 21% and hit an all-time high. Prior to today, you might have thought of Dell as an uninspiring technology company that pays a decent forward annual dividend yield (2.1% after today’s rally). What most people haven’t noticed, though, is that Dell has a good track record of beating Wall Street’s quarterly EPS estimates.

Furthermore, Dell just added another win in that category, as the company just delivered a wide earnings beat. We’re talking about EPS of $1.74 for the second quarter of Fiscal Year 2024 versus the analyst consensus estimate of $1.14 per share.

Meanwhile, Dell’s quarterly sales came in at $22.93 billion, which represents a 13.2% year-over-year decline but also beat Wall Street’s forecast by $2.09 billion. Already, we can see why stock traders furiously bid up DELL stock today.

Now, I’m not saying that Dell Technologies should be part of the “Magnificent Seven” group of tech companies. However, investors should at least put Dell on their radars and make it part of their conversations. This company has been ignored for too long, even among dividend investors.

PC Demand Boosts Dell’s Top-Line Results

Here’s the biggest surprise of all, though. Dell’s PC business, known as the Client Solutions Group, reported $12.9 billion in quarterly revenue. That’s down 16% year-over-year, but it’s also up 8% quarter-over-quarter. Plus, this result came in above the consensus estimate of $12.1 billion. Notably, Dell’s Consumer and Commercial PC quarterly revenues were both higher than Wall Street’s forecasts.

In other words, there is demand for PCs (and not just from dinosaurs like me). Moreover, even though Dell is an older company, it’s still enhancing its products with AI compatibility. Indeed, Evercore analyst Amit Daryanani identified “AI centric revenue acceleration” as a potential growth catalyst for Dell.

Citigroup (NYSE:C) analyst Asiya Merchant also weighed in on Dell’s newfound AI focus. According to Barron’s, Merchant “said AI-generated demand offers potential upside” for Dell “alongside positive factors such as an improving commercial PC backdrop and signs of stabilization in server and storage demand.”

Is DELL Stock a Buy, According to Analysts?

On TipRanks, DELL comes in as a Strong Buy based on 10 Buys and two Hold ratings assigned by analysts in the past three months. The average Dell Technologies price target is $57.67, implying 15.9% downside potential.

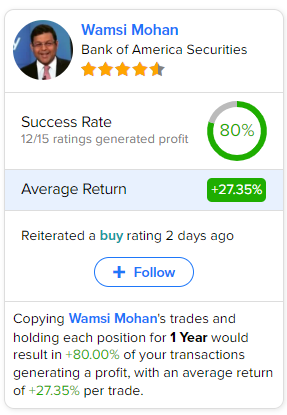

If you’re wondering which analyst you should follow if you want to buy and sell DELL stock, the most profitable analyst covering the stock (on a one-year timeframe) is Wamsi Mohan of Bank of America (NYSE:BAC) Securities, with an average return of 27.35% per rating and an 80% success rate. Click on the image below to learn more.

Conclusion: Should You Consider DELL Stock?

Dell Technologies might not be on your radar in 2023, but it ought to be. The company surprised investors today with Street-beating quarterly results, and people are taking notice of an uptick in PC demand.

Along with that, Dell is modernizing its operations with AI-compatible products. Hence, this isn’t the Dell of the dot-com bubble; it’s an up-to-date technology firm with strong growth potential. Therefore, even after its big rally today, I feel that investors ought to strongly consider DELL stock for a long-term portfolio.