Computer hardware maker and storage and networking solutions provider Dell Technologies (NYSE:DELL) will report its first quarter financial results for Fiscal 2024 on June 1, 2023. DELL stock has rebounded on hopes of an impending cyclical bottom in the PC/Server market. However, economic uncertainty and a slowdown in IT spending could hurt its Q1 financials, especially the Client Solutions Group (CSG) segment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the Q4 Fiscal 2023 conference call, Dell stated it expects its top line to decline sequentially. The company said that due to weak demand trends, Q1 revenue could be seasonally lower than average and decline by 17% to 21%.

This reflects an adverse impact of 3% from currency movements. Further, the company expects its Infrastructure Solutions Group (ISG) segment to decline quarter-over-quarter in the mid-20s. Meanwhile, CSG revenue could drop by a mid-teens rate in Q1.

Overall, analysts expect DELL to post revenue of $20.27 billion, reflecting a year-over-year and sequential decline of 22% and 19%, respectively.

Despite the weakness in sales, its gross margin could stay flat on a quarter-over-quarter basis. Further, the company expects its Q1 EPS to be $0.80, plus or minus $0.15.

The guidance reflects a steep sequential decline due to the weakness in its top line. Wall Street analysts expect DELL to post earnings of $0.86 per share, compared to EPS of $1.84 in the prior year quarter and $1.80 in the previous quarter.

Ahead of Q1 earnings, on May 19, Evercore ISI analyst Amit Daryanani raised DELL’s price target to $55 from $50. Daryanani is bullish about the stock and added it to the firm’s “Tactical Outperform” list. The analyst expects DELL to meet or slightly exceed consensus estimates in Q1. Further, Daryanani sees stabilization and recovery in the PC market in the coming quarters.

While Daryanani is optimistic, let’s check what the consensus rating indicates about DELL stock.

Is Dell a Buy or Sell?

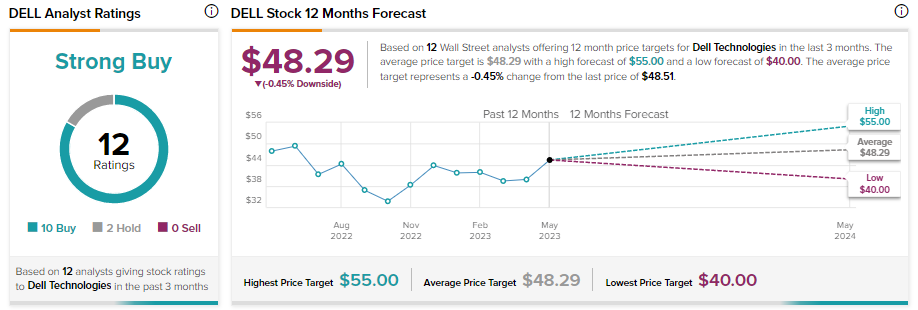

DELL stock has 10 Buy and two Hold recommendations for a Strong Buy consensus rating ahead of Q1 earnings. However, its average price target of $48.29 implies 0.45% downside potential.