TipRanks introduced a new feature called the Ownership Tab that offers an in-depth look at the ownership composition of a stock. Using this tool, let’s decipher the tech giant Meta Platforms’ (NASDAQ:META) ownership puzzle to know who owns the company. But before that, it’s important to understand why investors must know a company’s ownership structure.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What is the Significance of Knowing the Ownership Structure?

A company’s ownership structure impacts its governance, strategic decisions, and risk profile. For example, large institutional investors can sway management’s decisions and affect the company’s stock price with their buy and sell transactions. Thus, it is essential for investors to know this structure for making informed decisions.

Coming to investors’ aid, TipRanks’ Ownership Tab provides an in-depth look at the ownership composition of stocks. This comprehensive feature shows the ownership breakdown into four distinct segments, including corporate insiders, other Institutional investors, individual investors and private companies, and mutual funds, making it easier for investors to understand a company’s ownership structure.

With this background, let’s examine the ownership structure of Meta Platforms.

Who Owns Most of Meta Stock?

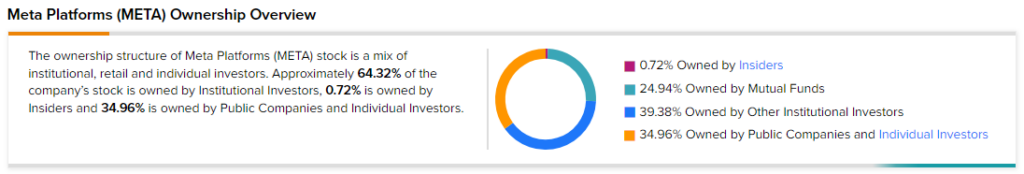

Per the ownership structure, Institutional Investors hold a majority stake in Meta, with 64.32% of the shares (comprising 24.94% from Mutual Funds and 39.38% from Other Institutional Investors). Individual Investors and Public Companies own 34.96%, and Insiders own just 0.72%.

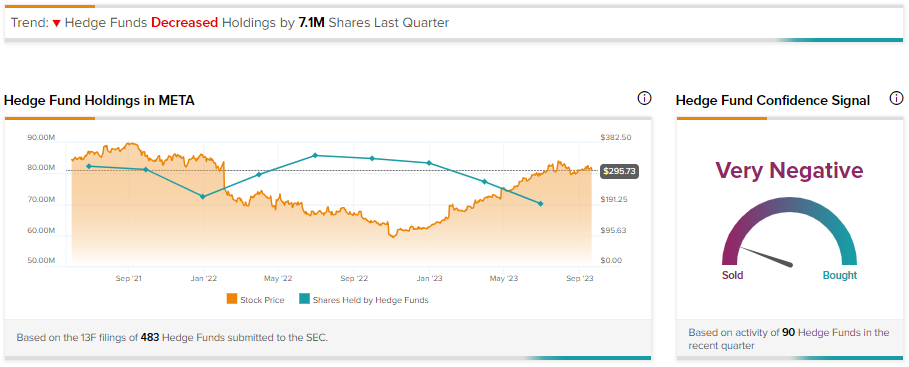

As Institutional Investors own the majority stake in Meta, let’s begin by analyzing their ownership structure and outlook. First, we’ll look at Hedge Funds (Other Institutional Investors). The current Hedge Fund Confidence Signal is Very Negative on META stock based on the activity of 90 hedge funds. TipRanks’ data shows that hedge funds sold 7.1 million shares of Meta Platforms last quarter.

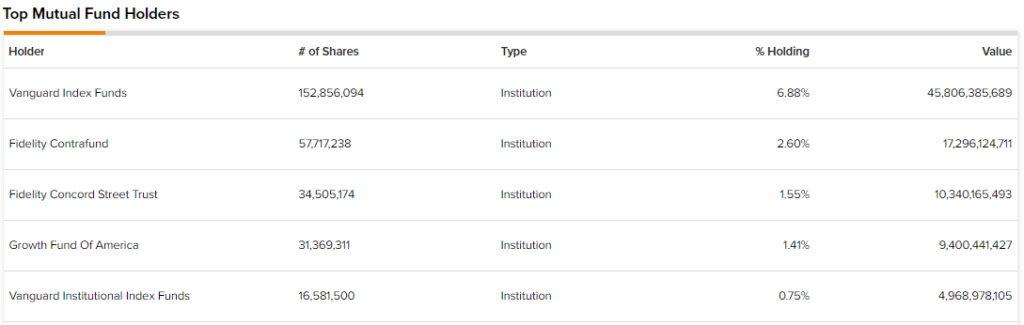

From hedge funds, let’s move to Mutual Funds’ ownership. Vanguard Index Funds owns the largest percentage (6.88% of Meta stock) among mutual funds. Following Vanguard is Fidelity Contrafund, which owns 2.6%.

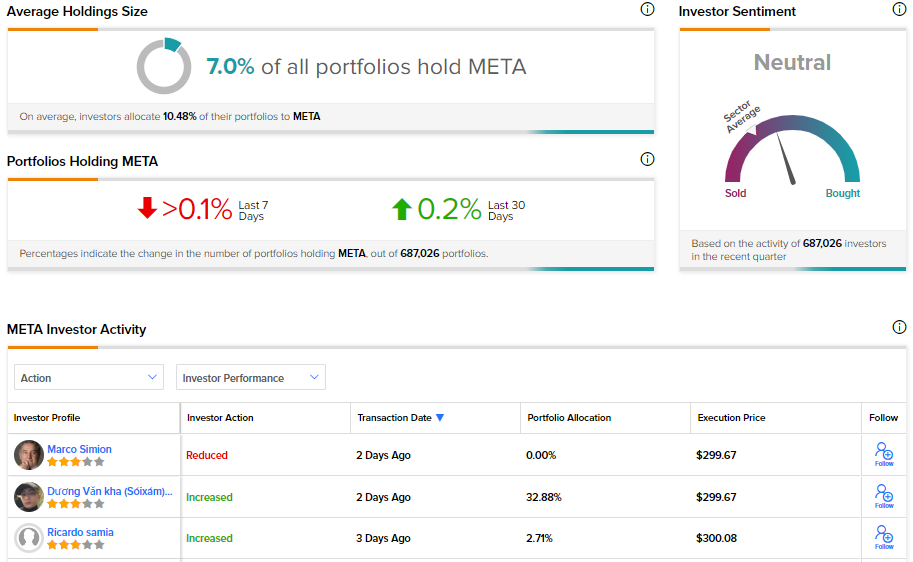

Regarding individual investors, the Investor sentiment on META stock is Neutral, as only 0.2% of the investors holding portfolios on TipRanks have increased their exposure to Meta in the last 30 days. On the other hand, TipRanks data shows that 7% of TipRanks’ retail investors hold Meta stock.

As for Corporate Insiders, TipRanks’ data shows that the Insider Confidence Signal is Very Negative for the company. Corporate Insiders sold Meta shares worth $11.6M in the last quarter.

Bottom Line

By utilizing TipRanks’ Ownership tool, investors can closely monitor a company’s ownership structure and track the recent activity of its top owners. This powerful tool streamlines the understanding of a company’s ownership, empowering investors to make well-informed investment choices with ease.