In the dynamic world of finance, access to information has long been a privilege reserved for hedge funds and institutional investors. Retail investors have often found themselves at a disadvantage, lacking the comprehensive data needed to make informed decisions. Recognizing this disparity, TipRanks has embarked on a mission to level the playing field. With the unveiling of the Ownership Tab, TipRanks is taking another significant stride towards fulfilling its commitment to empower retail investors with the same data traditionally exclusive to the elite.

The Ownership Tab offers retail investors a comprehensive and detailed analysis of a company’s ownership structure. It provides a multifaceted view of a company’s stakeholders, breaking them down into four distinct segments: insiders, institutional investors, individual investors and private companies and mutual funds. Moreover, the Ownership Tab is designed to simplify the user experience by integrating features previously available as separate tabs, such as insider trading and hedge fund activity.

A Closer Look at the Ownership Tab

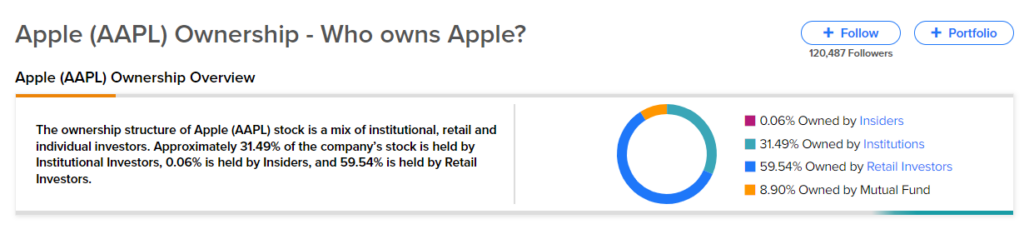

Ownership Overview: This section serves as the heart of the Ownership Tab. It offers a comprehensive breakdown of who holds shares in a specific company. By segmenting ownership into the categories of insiders, mutual funds, institutional investors, individual investors, and private companies, we gain valuable insights into the composition of a company’s shareholder base.

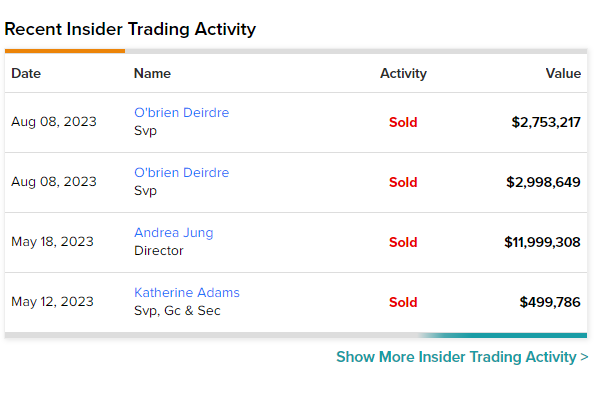

Insider Trading Activity: Moving the Insiders Tab from the side navigation to the Ownership Tab streamlines the user experience. It allows users to easily track insider transactions and gain a deeper understanding of how company insiders are buying or selling shares.

Hedge Fund Trading Activity: Similarly, recent hedge fund trading activity can now be conveniently accessed through the Ownership Tab. Moving the Hedge Funds Tab from the side navigation to the Ownership Tab simplifies the process of monitoring hedge fund actions. It will help users stay updated on the moves made by these influential market players.

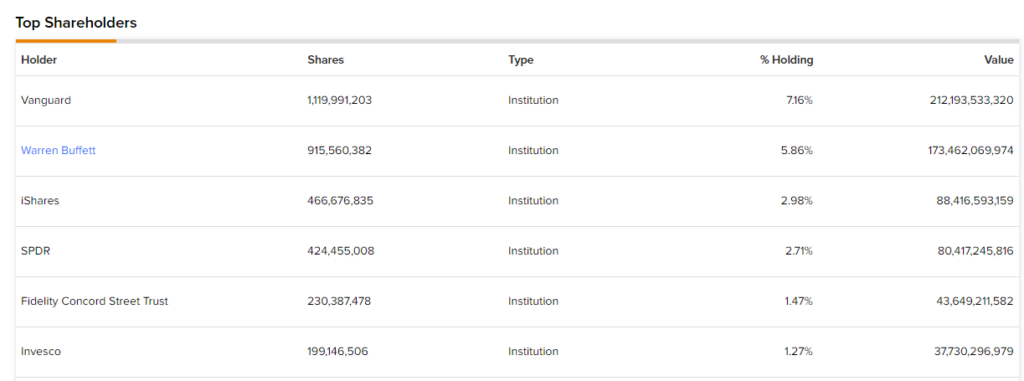

Top Shareholders: The Ownership Tab also provides a breakdown of a company’s top shareholders. By identifying the major players in a company’s ownership structure, users can gauge the confidence and support of key stakeholders.

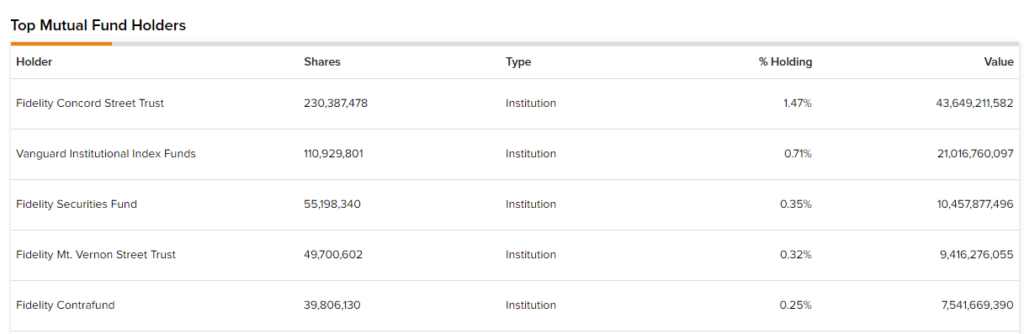

Top Mutual Funds Holders: For those interested in mutual funds, the Ownership Tab includes a list of the top mutual funds holding shares in the company. This information is invaluable for investors looking to align their investments with reputable fund managers.

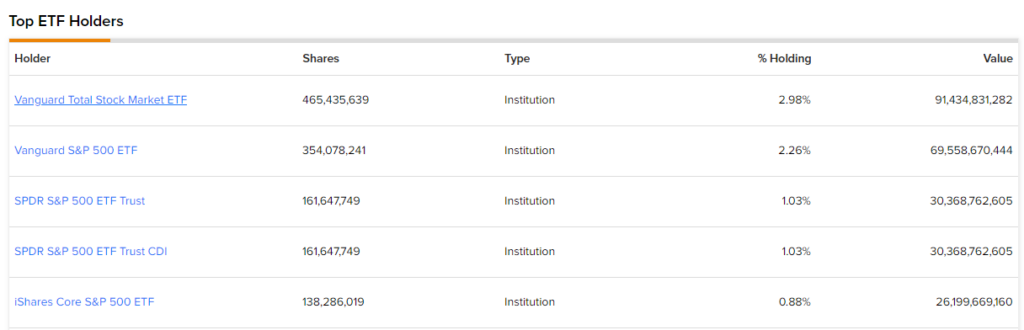

Top ETF Holders: In addition to mutual funds, the Ownership Tab highlights the top exchange-traded fund (ETF) holders for the company. Understanding which ETFs have significant exposure to a particular stock can aid investors in making strategic investment decisions.

Incorporating these essential features into the Ownership Tab not only simplifies the user interface but also enhances the user experience. This consolidated approach allows retail investors to access critical information about a company’s ownership structure, insider and hedge fund activity, and top shareholders, mutual fund holders, and ETF holders, all in one place.

Power Up Your Investing with TipRanks’ Ownership Tab

By consolidating critical information about a company’s ownership structure, insider and hedge fund activity, and top shareholders, mutual fund holders, and ETF holders, the Ownership Tab offers a holistic view of the investment landscape. With the removal of the separate Insiders and Hedge Funds Tabs, TipRanks has made it easier than ever for retail investors to access the insights they need to make confident and informed investment decisions.

This innovative feature represents a significant step forward in leveling the playing field, ensuring that all investors, regardless of their background or experience, have access to the information necessary to thrive in the world of finance.