Chevron (NYSE:CVX) will report its second-quarter financial results on Friday, July 28. However, ahead of the earnings, this integrated energy company provided Q2 performance highlights, wherein it reported Q2 earnings of $3.08 a share, which surpassed the Street’s EPS forecast of $2.92.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Even though CVX’s bottom line exceeded the Street’s expectations, it registered a significant year-over-year decline. For instance, Chevron delivered earnings of $5.82 per share in the prior year quarter.

Nonetheless, the company added that its production from the Permian Basin reached a quarterly record of 772,000 barrels of oil equivalent per day. Further, the company expects to close the acquisition of PDC Energy in August 2023.

Overall, CVX reported a production volume of 2,959 million barrels of oil equivalent per day. The Q2 production volume came in higher than the Street’s forecast of 2,941 MBOED, said Goldman Sachs analyst Neil Mehta in his note to investors dated July 23. Mehta has a Hold recommendation on CVX stock.

Against this background, let’s check what analysts project for CVX on the revenue front.

Q2 Revenue Expectations

Wall Street analysts expect Chevron to post revenues of $46.73 billion in Q2, which is significantly lower than the sales of $68.76 billion in the prior-year quarter. Moreover, it also reflects a sequential decline, as CVX posted revenues of $50.79 billion in the first quarter.

The year-over-year revenue decrease reflects lower production volumes and a decline in the average price per barrel of oil and natural gas liquids.

On July 24, Truist analyst Neal Dingmann lowered CVX’s price target to $163 from $194 and maintained a Hold rating as he expects lower oil and gas prices to significantly hurt the free cash flows of several energy companies.

What is the Future of CVX Stock?

Wall Street analysts are cautiously optimistic about CVX stock ahead of Q2 earnings, as lower commodity prices will likely hurt its top and bottom lines in the short term.

Nonetheless, the company’s strong balance sheet and ability to enhance shareholders’ returns through higher dividend payments and share buybacks act as a positive catalyst. Chevron paid $2.8 billion in dividends in Q2 and repurchased shares worth $4.4 billion.

CVX stock has received nine Buy and eight Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $184.47 implies 14.34% upside potential.

Insights from Options Trading Activity

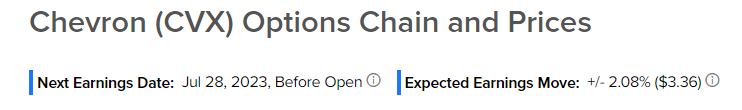

While analysts are cautiously optimistic, the option traders are pricing in a 2.08% move on earnings, which is higher than the previous quarter’s earnings-related move of 0.97% and the average 0.05% move in the last eight quarters.