CVS Health (NYSE:CVS) stock hasn’t been a winner today or throughout 2023, but don’t get discouraged. The company’s results speak for themselves, and I am bullish on CVS stock because the market is, in my opinion, stressing too much about CVS’s forward guidance.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Headquartered in Rhode Island, CVS Health operates a chain of retail drugstores that also sell cosmetics and home goods. Because the market has focused so much on artificial intelligence (AI) and “Magnificent Seven” technology stocks, CVS has been practically abandoned all year long.

Yet, passive income investors shouldn’t ignore CVS stock. Even if CVS Health had to adjust its earnings outlook, the company is generally in good shape and can continue to deliver dividend payments to its loyal shareholders.

CVS Health‘s Remedy for the Skeptics: Street-Beating Results

If CVS Health’s critics are the disease, then there’s no better cure than solid quarterly earnings results. Thus, it’s encouraging to see that CVS delivered top- and bottom-line growth in Fiscal Year 2023’s third quarter.

Here’s how it went down. On a year-over-year basis, CVS grew its revenue by 10.6% to $89.8 billion. Analysts, on average, had only expected $88.3 billion in revenue.

So far, so good. Furthermore, CVS reported third-quarter adjusted earnings of $2.21 per share, marking a moderate improvement over the year-earlier quarter’s EPS of $2.17. This result, moreover, topped the analyst consensus earnings estimate of $2.13 per share.

Now, I’m not suggesting that CVS is in perfect health. It’s worrisome that some CVS Health staff members recently staged a walkout. Only time will tell if this has a significant impact on the company’s financials.

Nevertheless, it’s undeniable that CVS beat the experts’ quarterly forecasts with decent results. So, how did investors respond to CVS’s earnings report?

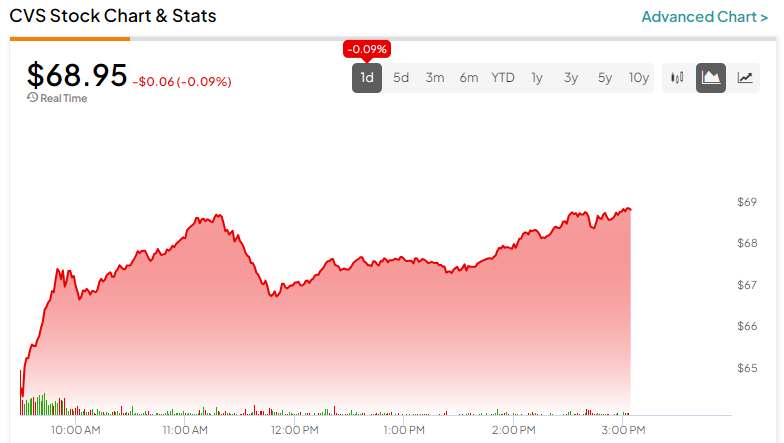

CVS Stock Fell on Lowered Earnings Guidance

As is sometimes the case on Wall Street, investors have decided to ignore CVS Health’s good quarterly results and instead focus on the company’s full-year outlook. In particular, CVS lowered its FY2023 GAAP-measured diluted EPS guidance range from $6.53-$6.75 to $6.37-$6.61.

That’s not a horrendous revision, but it was enough to cause consternation among today’s stock traders. CVS stock was down by over 6% at one point today.

This isn’t the only way to measure expected bottom-line results, though. Notably, CVS reiterated its adjusted EPS guidance range of $8.50-$8.70.

On the other hand, CVS interim Chief Financial Officer Tom Cowhey added some commentary that may have made some investors nervous. Even though CVS reaffirmed its previous full-year adjusted EPS outlook, Cowhey cautioned, “We believe it is prudent for investors to ground their expectations for 2024 adjusted EPS at the low end of our previously communicated preliminary guidance range.”

That’s certainly not what today’s investors wanted to hear. I suspect that after many months of poor price action in CVS stock, people hoped for a fully confident beat-and-raise today.

This isn’t what happened, so short-term investors are punishing CVS. Yet, I encourage investors to look at the big picture.

It’s a tough economy, but CVS managed to deliver good quarterly results. Plus, the company’s cautionary remarks today could set CVS up for a positive surprise in the coming quarters.

Is CVS Stock a Buy, According to Analysts?

On TipRanks, CVS comes in as a Strong Buy based on 13 Buys and three Hold ratings assigned by analysts in the past three months. The average CVS Health price target is $89.36, implying 29.9% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell CVS stock, the most accurate analyst covering the stock (on a one-year timeframe) is Michael Cherny of Bank of America (NYSE:BAC) Securities, with an average return of 9.71% per rating and a 57% success rate. Click on the image below to learn more.

Conclusion: Should You Consider CVS Stock?

Remember — just because the crowd sells a stock, it doesn’t mean that you have to. CVS Health still offers a forward annual dividend yield of 3.5%, which is higher than the sector average dividend yield of around 1.5%. Therefore, passive income investors can appreciate CVS Health’s solid quarterly results and collect generous dividend distributions every quarter. When all is said and done, I believe investors should consider CVS stock.