Well, the New Year is almost here. We’ll get a day’s break from trading, which means a chance to breathe easy, and maybe catch up on some market data before jumping back into the daily routines of the trading floors. We don’t know how the coming year will shake out, but we can prepare by taking stock of some good portfolio ideas.

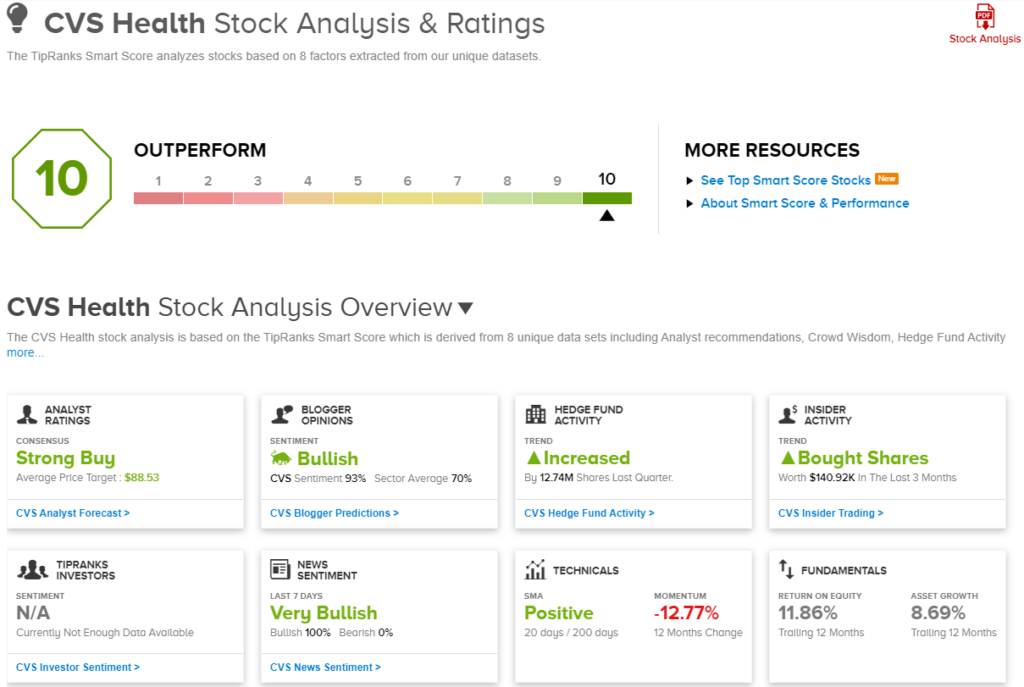

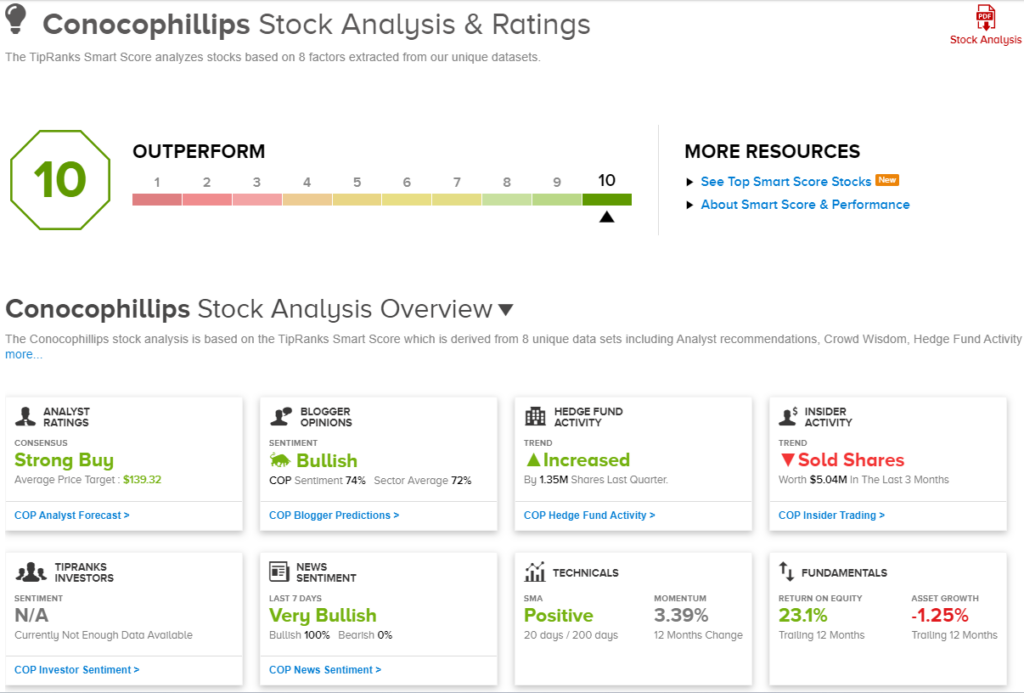

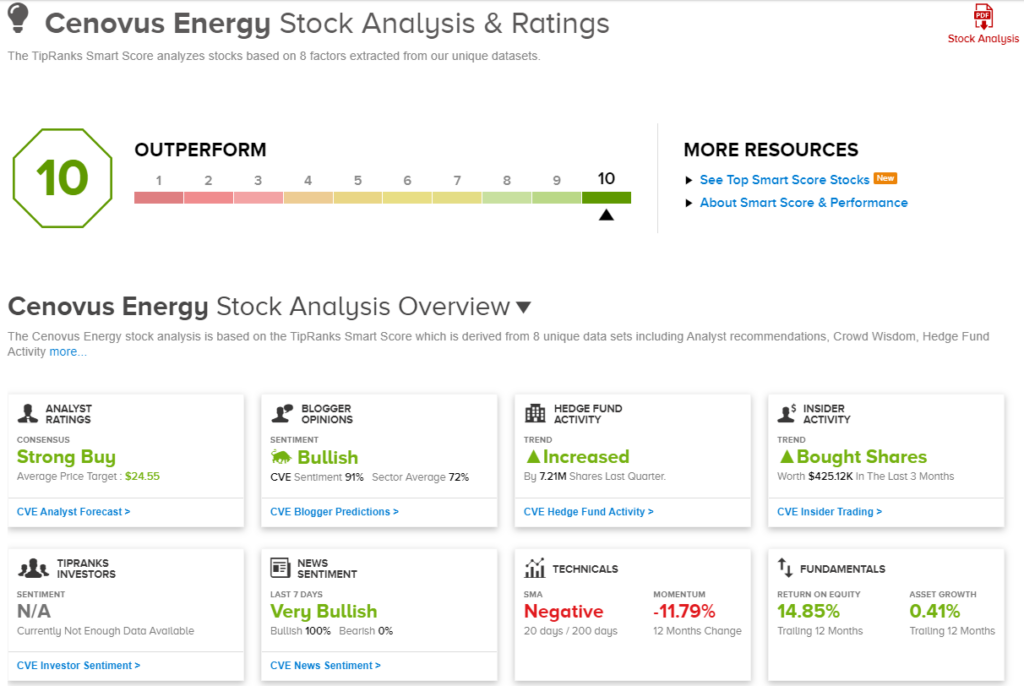

In fact, we can look at some ‘Perfect 10’ ideas, stocks that have earned top ratings from both the analysts and the algorithms. The TipRanks Smart Score fills that second category. It’s an advanced AI-powered data-sorting algorithm, that sifts through the multitudinous information generated by millions of daily trades, and rates every stock by how that data stacks up. Specifically, the algorithm compares each publicly traded stock to a set of factors that have proven themselves as predictors of a share future overperformance – and it distills that down to a single score that’s readable at a glance.

The Smart Score is given on a scale of 1 to 10, with the ‘Perfect 10s’ marking the stocks whose stars have aligned – and which investors may want to give a second look. We’ve gotten that process started, and found several Perfect 10s that are also getting top ratings from the Street’s analysts.

It’s an interesting list. It includes industry leaders and Blue-Chip favorites, names like ConocoPhillips and CVS Health that should be familiar to every investor. Let’s check the details.

CVS Health Corporation (CVS)

First up on our list of ‘Perfect 10s’ is CVS Heath Corporation, the modern iteration of the well-known CVS pharmacy chain. The company has long been identified as one of the market’s blue-chip favorites, and it still retains its two-sided business strategy, working in both healthcare and retail.

CVS’s core business remains its chain of pharmacy-slash-convenience stores. The company has over 9,400 brick-and-mortar locations, offering storefront pharmacy services, consumer health and hygiene products, basic groceries, and small electronic appliances. In addition, CVS also operates as a pharmacy benefits manager and, with its acquisition of Aetna – completed in 2018 – the company became a major player in the US health insurance market. Backing these health-related services, CVS also offers direct healthcare benefits on insured and self-insured plans.

The company’s Health Care Benefits segment gives customers access to medical, pharmacy, dental, and mental health services, and counted a membership of 25.7 million people as of September 30, 2023. This is a fast-growing segment of the company, and brought in nearly $26.3 billion in revenue for 3Q23, for year-over-year segment growth of 16.9%.

Elsewhere in the Q3 report, CVS showed a top line of $89.8 billion, up by 10.6% year-over-year and $1.63 billion over the forecast. The firm’s bottom line came to an adjusted $2.21 per share by non-GAAP measures, 4 cents per share better than the year-ago quarter and 8 cents per share better than had been anticipated. And, CVS initiated a 9.9% bump in its dividend, making the new payment 66.5 cents per common share, scheduled for payout on February 1, 2024. At the new rate, the dividend annualizes to $2.66 per share and gives an inflation-beating yield of 3.36%.

So, turning to the comments HSBC analyst Daniela Bretthauer, it makes sense that we find her upbeat on the company. Bretthauer cites the high growth potential of the Healthcare Benefits business and Aetna’s health insurance, saying of the company, “In general, our estimates for CVS are above consensus and reflect the latest updates in strategy covered at the company’s 2023 Investor Day held in early December. We differ the most from consensus for the Healthcare Benefits segment based on our positive view of trends. The Healthcare Benefits segment is expected to experience a higher-than-previously-expected medical cost trend in Medicare Advantage for the remainder of 2023. Aetna continues to be a leader in $0 premium products, and approximately 84% of Medicare-eligible patients will have access to Aetna plans in this category in 2024. CVS’s sales strategy for new business has been successful thus far, capturing more than 60% of national employers that moved to PBM (pharmacy benefit manager).”

Overall, the HSBC view on CVS is a Buy, with a $94 target price pointing toward a 19% gain on the horizon. (To watch Bretthauer’s track record, click here.)

This stock’s Strong Buy consensus rating is based on 18 recent analyst reviews that break down to 14 Buys against 4 Holds. The shares are selling for $78.96 and their $88.53 average price target implies a one-year upside potential of 12%. (See CVS Health’s stock forecast.)

ConocoPhillips (COP)

Next on our list is the $137 billion oil giant ConocoPhillips. By market cap, this company ranks as the 7th largest oil and gas company in the world – and it is one of three US companies counted among the top ten. ConocoPhillips is an independent exploration and production firm, with its business based on a solid foundation of known production output and proven reserves to back it up. The company currently has operations in 13 countries.

Those operations involve the discovery, exploitation, transportation, and marketing of a range of hydrocarbon products – crude oil, natural gas, natural gas liquids, liquified natural gas, and bitumen. The company employs some 9,800 people to make this possible, from the C-suite execs to the roughnecks in the oil patches. They work everywhere from the Canadian mountains to Texas to the Middle East to Australia.

At the most basic level, this company’s business is getting fossil fuels out of the ground. And in its last quarter, its production numbers reached 1,806 Mboe/d company-wide. The lion’s share of that production, 1,083 Mboe/d, came from the ‘Lower 48’ states – and of that total, approximately 72%, or 722 Mboe/d, came from the Permian Basin of Texas. The company’s operations generated $5.5 billion in cash for the quarter.

ConocoPhillips used that cash to support its program of capital return to shareholders, which totaled $2.6 billion in Q3. This included $1.3 billion worth of share repurchases and another $1.3 billion returned through the ordinary dividend. That dividend was last paid out on December 1, 2023, at 58 cents per share. The annualized rate of $2.32 gives a yield of 2%.

Size brings benefits all its own, and Evercore analyst Stephen Richardson notes that size is one of ConocoPhillips’ chief advantages. He cites the company’s focus on streamlining operations and returning cash to investors as additional enticements for investors. Richardson writes in his recent note on this oil giant, “COP enjoys a scale portfolio across geographies and asset type that affords uncommon visibility (for a depletion industry). A dogged focus on cost of supply for the better part of decade assures that all investments are generating adequate returns. Add to this a visible framework of cash returns (shareholder distributions tracking $11.1 Bn on our estimates), it is unsurprising the market gets lulled into thinking the COP story is fully discounted… COP model is compounding returns daily and there are no gaps in the portfolio or anxiety about resource depth that could drive adverse shareholder outcomes that exist elsewhere in the peer group (both big and small).”

Richardson goes to give COP an Outperform (Buy) rating, and a $156 target price that suggests the stock will appreciate 34% by the end of 2024. (To watch Richardson’s track record, click here.)

There are 19 recent analyst reviews on record for ConocoPhillips, and their 15 Buys to 4 Holds support the stock’s Strong Buy consensus rating. The shares are trading for $116.07, and the average price target, of $139.32, indicates room for a 20% upside on the one-year horizon. (See ConocoPhillips’ stock forecast.)

Cenovus Energy, Inc. (CVE)

Let’s wrap up with another energy stock, Cenovus Energy. This Calgary-based company has been operating in Western Canada oil sands – the resource that made Alberta a world-class energy producer – since 2009. Today, the company’s production activities remain centered in Alberta, where it works a combination of conventional oil and gas plays as well as the oil sands and heavy oil ops that were its original focus.

In addition to its oil and gas extraction activities, Cenovus has expanded into the refinery business. The company has refining and upgrading operations in Alberta, as well as in the Great Lakes region of the US. The company also has offshore exploration projects, in Atlantic Canada off Newfoundland, off the coast of China, and in Indonesia. These activities have given Cenovus, once a regional player, a truly international footprint.

During the third quarter of 2023, the last reported, Cenovus generated a total upstream production of 797,000 barrels of oil equivalent per day (Boe/d), and averaged a downstream throughput of 664,000 barrels per day (bbls/d). Based on this production, Cenovus generated C$2.4 billion in free funds flow for the quarter – or $1.8 billion in US currency. Based on that solid cash generation, Cenovus paid out C$361 million in common share dividends, as part of its C$1.2 billion in capital returned to shareholders.

5-star analyst Neil Mehta, from Goldman Sachs, gives this stock a Buy rating with a US$23 share price target, implying a 38% upside for the year ahead.

Goldman Sachs’ Neil Mehta is upbeat on the company’s overall position, especially its ability to meet debt targets and integrate its upstream and downstream activities. The 5-star analyst writes, “Looking to 2024, we believe the setup for CVE is constructive given (a) a relatively supportive commodity price in a $80/bbl Brent environment (GS mid-cycle view), which should allow the company to ramp shareholder returns in the back half of 2024 upon meeting the C$4 bn net debt target; (b) key refining assets are now online, most notably Toledo with 128 kbpd of throughput expected in 2024 (CVE 2024E US refining total capacity of 632 kbpd), driving further cash flow inflection; and (c) broader integration opportunities within the Upstream/Downstream portfolio following a series of more ‘add-on’ transactions completed in the 2021-2023 timeframe.”

Quantifying his stance, Mehta gives this stock a Buy rating with a US$23 share price target, implying a 38% upside for the year ahead. (To watch Mehta’s track record, click here.)

Looking at the consensus breakdown, Cenovus has picked up 11 recent analyst reviews, including 10 Buys against just a single Hold, to back up its Strong Buy consensus rating. With an average price target of US$24.44 and a share price of US$16.65, the stock boasts a one-year upside potential of 47%. (See Cenovus’ stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.