Since the COVID-19 pandemic began in early 2020, used car sales have been up dramatically due to various issues like part shortages for new vehicles. However, the tide could be turning as the specter of a recession nears. In this piece, we compared two used car stocks, CVNA and KMX. The bottom line for these two stocks is that the used car space might not be a good one to be in right now. However, for those who want to buy the dip and hold, potentially for an extended period, there are critical issues with Carvana, which is hemorrhaging cash, while CarMax could offer some potential eventually.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Carvana (NYSE: CVNA) became a pandemic-era darling due to its business model and the explosion in used car sales, but it’s off 96% from its peak. It’s been a similar story for CarMax (NYSE: KMX), although the damage hasn’t been as bad.

The Latest on the Used Car Space

Used car sales have skyrocketed more than 50% since April 2020, but unfortunately for dealers, it looks like they’ve turned the corner. Automakers appear to have largely ironed out their supply-chain issues, so there are more new cars in stock at dealers across the country. However, they’re largely selling for more than the sticker price, and Americans might not be able to afford them.

The cost of financing has risen dramatically as the Federal Reserve aggressively hikes interest rates. At the end of the third quarter, the new vehicle loan rate was up two percentage points for the year to 7%, according to Cox Automotive. Unfortunately, the rates for used vehicle loans are even higher — up 11% after an increase of two percentage points.

Meanwhile, inflation remains at the highest levels in decades, squeezing consumer wallets even further as they try to afford necessities like groceries and gas. As a result, consumers may not be able to afford used cars either, putting dealers in a precarious position.

Carvana (CVNA)

The current environment for used cars is a critical issue for Carvana, which only sells used cars. One would think the company’s business model would come with sizable margins because it is an online-only dealer, but it continued to hemorrhage cash throughout the pandemic — even when used car sales were booming. As a result, a bearish view seems appropriate for this stock, both now and for the long term.

Before digging into the analysis, it’s important to point out a key risk for Carvana on the bearish side. Short interest is extremely high, at more than 16%, meaning that a short squeeze is possible at even a minuscule hint of good news.

Coltrane Asset Management and several other hedge funds have enjoyed shorting Carvana this year because it’s been one of their most profitable shorts. However, there is a clear schism in the investment case for this used car dealer.

ValueWalk exclusively set out the bull and bear arguments for Carvana stock in August, adding what the market was pricing in at that time. Bulls expect the company to expand its market share due to the “better mousetrap” thesis suggesting its business model is better than those of all its competitors. Of course, crashing used car prices factor into that bull thesis, and this is exactly where we are now.

In fact, the first-quarter letter from Clifford Sosin’s CAS Investment Partners revealed the damage being done to Carvana bulls. The fund lost lots of money on its long position in Carvana earlier this year. In fact, Sosin dug in hard, adding to the position despite the plummeting stock price. His long-term view is that Carvana is America’s largest and most profitable car retailer.

However, it’s difficult to reconcile that with the continuing cash bleed and repeated capital raises, with the most recent raise occurring as recently as April 2022. Additionally, Carvana reported net losses of $238 million for the second quarter of 2022, but even when used car sales were booming, it lost $135 million in 2021 and $171 million in 2020. It’s no wonder the dealer’s bonds were rated as junk.

Even with a price/sales ratio of a mere 0.2x, there just isn’t anything to like about Carvana right now. Perhaps, Sosin is right, and it will eventually become the Amazon of used cars, but it doesn’t seem worth the risk to make that bet right now. Bankruptcy looks more likely.

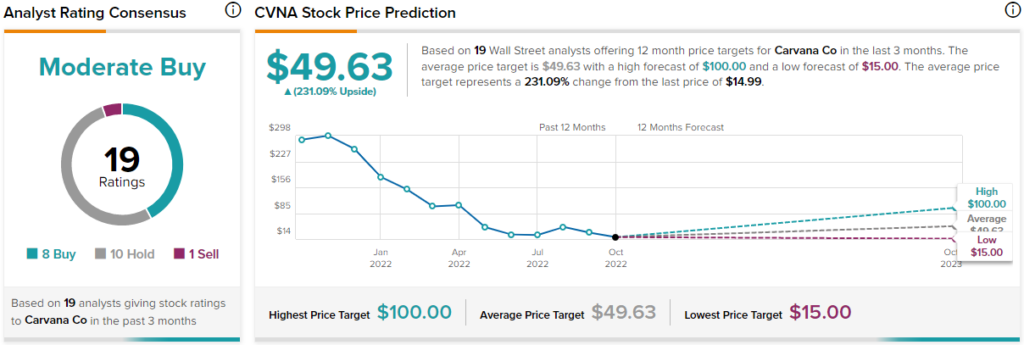

What is the Price Target for CVNA stock?

Spectacularly, Carvana has a Moderate Buy consensus rating based on nine Buys, 10 Holds, and one Sell rating assigned over the last three months. At $49.63, the average price target for Carvana implies upside potential of 231.1%.

CarMax (KMX)

CarMax has the same macro headwinds that Carvana has in terms of plunging car sales due to skyrocketing interest rates. However, this dealer is actually profitable, making a neutral rating seem appropriate in light of the environment for used cars.

In its second-quarter earnings report, CarMax posted a massive earnings miss, which was coupled with a warning from management that consumers were struggling to afford vehicles amid soaring inflation. Thus, it should be no surprise that CarMax shares are down more than 50% year to date, with about half of that coming in the last month.

However, for investors looking for a bargain to buy and hold until the vehicle market improves, CarMax’s business model looks far more attractive than Carvana’s. CarMax reported net revenues of $8.1 billion with a net income of $125.9 million, demonstrating its staying power at a tumultuous time in the used car market. In the fiscal year that ended in February 2022, the dealer reported $1.15 billion in net income, while it had $746.9 million the year before, showing that it can perform well during the good times.

What is the Price Target for KMX stock?

CarMax has a Moderate Buy consensus rating based on four Buys, six Holds, and one Sell rating assigned over the last three months. At $82.10, the average price target for CarMax implies upside potential of 42.8%.

Conclusion: Dump CVNA, Hold on to KMX for Now

There’s no getting around the fact that this isn’t a good time to be selling cars, but it’s clear from their fundamentals that CarMax is far superior to the cash-burning zombie Carvana. A bear thesis is certainly appropriate for Carvana, although CarMax is debatable.

On the one hand, this could be a good time to buy the dip on CarMax, but on the other, the bull thesis could take months or even years to play out, depending on whether a recession occurs and how bad it is. Thus, a neutral or Hold rating is appropriate for CarMax in the near term, potentially with a bullish view reserved for ultra-long-term investors.