Investors are struggling to find quality dividend growth REITs in the current market environment. Retail properties offer uninspiring dividend growth prospects, commercial properties remain gloomy, and industrial properties appear to be overvalued. Fortunately, Crown Castle (CCI) has robust dividend growth prospects while also trading at a reasonable valuation. As a result, I am bullish on the stock.

Crown Castle’s Summary and Qualities

Crown Castle International owns, operates, and leases shared communications infrastructure across the U.S., including over 40,000 towers and other structures, such as rooftops, and 80,000 route miles of fiber, mainly supporting small cell networks and fiber solutions.

Crown Castle features numerous qualities, along with the handful of other tower REITs which have formed an oligopoly in the field. Firstly, with only a few players on the market and a capital-intensive business model, it has become very costly to penetrate the industry. This makes for a significant competitive advantage.

Additionally, unlike traditional real estate properties, whose tenants may find it challenging to pay rent during harsh economic environments, telecom companies share almost no such risk. Instead, they record relatively resilient and predictable cash flows due to the necessity and mission-critical nature of the telecommunications industry.

This practically guarantees no impact on Crown Castle’s performance during economic downturns. To add to that point, telecommunication behemoths are publicly-traded companies with transparent financials and solid creditworthiness. Consequently, Crown Castle faces minimal counterparty risks as well.

These attributes were proven valuable during the Great Financial Crisis and the COVID-19 pandemic when Crown Castle’s top and bottom lines kept advancing higher despite the underlying hurdles in each of these periods.

Q2 Results: Consistent Growth Despite the Rough Environment

The company’s latest results once again exhibited its capability to grow in a rough environment. Crown Castle’s revenues grew 9.5% to $1.73 billion on a year-over-year basis. Increased revenues were supported by a more extensive portfolio of towers and more elevated leasing activity.

Specifically, the company achieved rental revenue (`roughly 90% of total revenues) growth of 10%, or $142 million, year-over-year, including about $58 million in organic contribution and a $75 million upsurge in straight-lined revenues. The $58 million in organic contribution implies about 4.7% growth, comprised of around 7.8% growth from core leasing action and contracted tenant increases, net of roughly 3.1% from tenant non-renewals.

Benefiting from economies of scale, funds from operations (FFO) rose more than revenues, specifically by 14.7% year-over-year to $842 million. FFO also rose 14.7% on a per-share basis to $1.94 amid a stable share count year-over-year.

Treading toward the second half of Fiscal Year 2022, Crown Castle’s prospects remain energetic. As a result of great operating momentum, management boosted its full-year outlook, now expecting FFO/share to be between $7.69 to $7.79. The midpoint of this range implies an increase of 21.1% compared to last year’s $6.39.

Crown Castle’s Dividend Growth Prospects are Very Strong

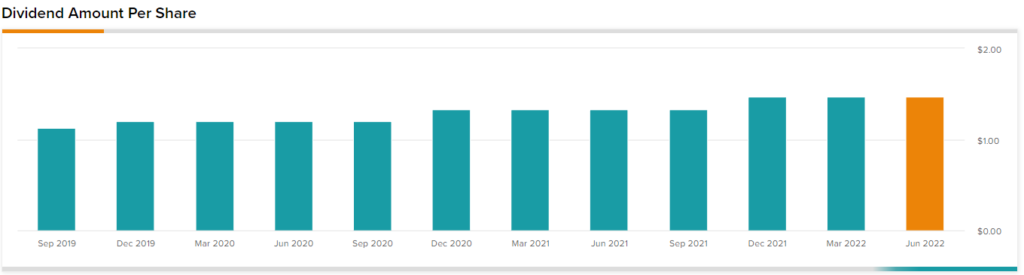

Crown Castle has been paying dividends since 2014. Since then, the dividend per share has grown annually at a CAGR of 10.75%. Management’s long-term annual dividend per share growth target stands between 7% and 8%. However, what is signified by “long term” here is a bit vague.

Sure, in a decade from now, Crown Castle’s dividend growth could hover close to these levels. However, with FFO/share set to grow by more than 20% this year, dividend growth should be easily sustained in the double digits over the next few years. It’s also worth noting that the midpoint of management’s guidance implies a comfortable payout ratio of around 76% as well.

Following the stock’s 17% decline year-to-date, the dividend yield has been pushed upwards, currently standing at 3.4%. Few companies yield that much while sharing Crown Castle’s dividend growth prospects and the overall margin of safety attached to its business model.

Wall Street’s Take on CCI

Turning to Wall Street, Crown Castle has a Moderate Buy consensus rating based on seven Buys, two Holds, and one Sell assigned in the past three months. At $193.22, the average Crown Castle price target implies 12.38% upside potential.

The Takeaway – A Reasonably Valued Dividend Growth Opportunity

Besides its aforementioned qualities and vigorous dividend growth prospects, I believe Crown Castle is reasonably valued. Again, by applying the midpoint of management’s FFO/share estimate for the year, shares are trading at a P/FFO of 22.4 at their current price levels.

Of course, one should be cautious with valuation multiples in a rising-rate environment. Still, I find this one rather reasonable, considering that both FFOs and dividends should keep growing in the double-digits on a per-share basis over the next few years.

Combined with Crown Castle’s hard-to-find traits and moat in the industry, I don’t think investors will be able to cherry-pick the stock at multiples substantially lower than the current one. For this reason, I am bullish on the stock.