As the various consequences of climate change and the economic burden of rising gasoline prices coalesced, electric vehicles became attractive. Under this framework, relative EV upstarts like China-based Nio (NYSE:NIO) enjoyed substantial rewards. However, as the global consumer market enters a different paradigm, expensive vehicle brands without established pedigree may become a liability. I am bearish on NIO stock.

Credit belongs to TipRanks contributor Steve Anderson for recognizing the signs of a sector slowdown. While the big Chinese EV manufacturers like Nio, Xpeng (NYSE:XPEV), and Li Auto (NASDAQ:LI) disclosed delivery numbers, none of them stood out for providing substantively encouraging figures. While year-over-year comparisons pinged positively, regional economic data actually presented a dark cloud over the proceedings.

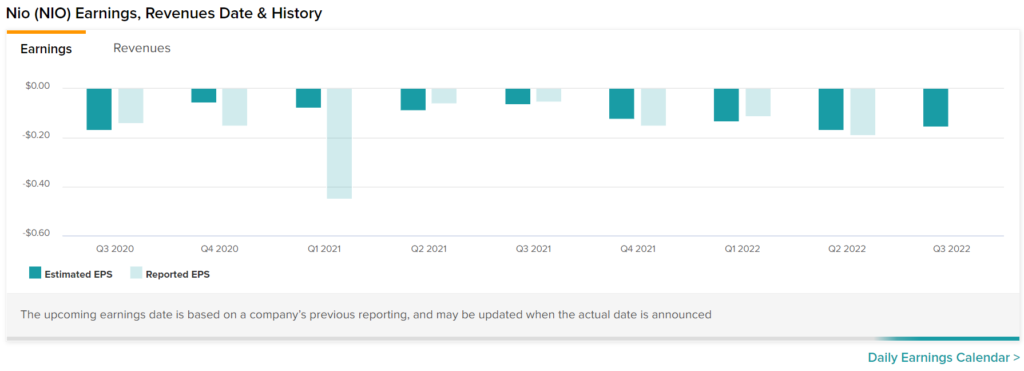

Sure enough, when Nio released its financial disclosure for the second quarter of 2022, management raised some eyebrows. Nio incurred an earnings loss of $0.19 per share, in contrast to the loss of $0.06 in the year-ago quarter. Notably, the red ink expanded despite the EV maker improving deliveries.

Still, NIO stock managed to swing higher following the Q2 report. In particular, market observers liked that the EV specialist managed to post revenue generated from vehicle sales of $1.43 billion, up 21% on a year-over-year basis.

Additionally, management upgraded its outlook for Q3, expecting deliveries ranging between 31,000 to 33,000 vehicles. This would imply a year-over-year increase of between 26.8% and 35%. Also, total revenue could come in between $1.92 billion and $2.03 billion, representing growth of 31% to 38.7%.

Despite some solid performances in Q2, the underlying projections for NIO stock may be too optimistic, given current circumstances.

Economic Woes Will Likely Impede NIO Stock

While many, if not most, market analysts love to tout the ambitious aphorism that electric vehicles are the future, the reality is this future depends on economic cooperation. If outside circumstances negatively affect consumer sentiment, it won’t matter how clean and efficient EVs are. Everything comes down to the bottom line. In that sense, China’s economic woes represent arguably the biggest concern for NIO stock.

In June of this year, TipRanks reporter Amit Singh noted a deceleration in China’s economy. More recently, a September article by Bloomberg warned that the world’s second-largest economic power is bracing for a slowdown that could be even worse than 2020. Of course, that’s an alarming headline considering the catastrophic COVID-19 pandemic.

If that wasn’t troubling enough for NIO stock, The Wall Street Journal reported in August that China’s central bank was no longer interested in implementing the aggressive measures it deployed in the past to bolster economic performances. Now, Beijing’s concerns about rising debt and diminishing returns from spending killed the appetite for dovish monetary policies.

Therefore, the optimistic projections about NIO stock run into a credibility problem. If multiple high-level sources are sounding the alarm bells for China’s economic viability, the idea that EVs – which tend to be pricier than their combustion-powered counterparts – will somehow thrive seems unrealistic.

Consumer Culture Differences Could Hurt Nio Stock

In late July, I mentioned that in the casino industry, eastern and western gamblers approach the sector differently. If the east/west cultural divide imparts significant differences in revenue allocation for gambling centers, it stands to reason that such a divide can also impact other consumer segments. Specifically, Chinese EV investments like NIO stock can end up hurting because they command a premium but without a justifying heritage.

Though some circumstances are changing, for the most part, Chinese consumers tend to gravitate toward American chain restaurants because of the status symbol effect. While getting a burger and fries is a nothing-burger in America, in China, such a practice was exotic for decades.

Now, consider the elements involved in an EV purchase. In the U.S., the average price of a new EV stands at nearly $63,000. In relation to the median U.S. household income, an average EV represents about 90% of median earnings.

Here, Chinese and American consumers may feel the same. If they’re going to fork over that much of their earnings for a vehicle, it should mean something. Otherwise, it might be better to simply get something cheaper.

However, the problem for NIO stock is that the underlying company has not yet proven that it can sustainably deliver cheap EVs. With a retained earnings loss of over $8.7 billion at the end of 2021, Nio can’t sustainably deliver expensive EVs to market.

What is a Good Price for NIO Stock?

Turning to Wall Street, NIO stock has a Strong Buy consensus rating based on nine Buys assigned in the past three months. The average NIO price target is $31.84, implying 52.1% upside potential.

Takeaway: Consumer Sentiment is Fading and Will Pressure EV Sales

When NIO stock first materialized, the upside potential stemmed from the underlying massive consumer base and broader interest in EV integration. However, with the global economic paradigm shifting rapidly, consumer sentiment will likely fade, presenting significant challenges for Nio and many other EV manufacturers.