Despite the disruptive power of artificial intelligence – in particular, ChatGPT and its brutal reimagining of the educational technology (edtech) space – online course provider Coursera (NYSE:COUR) has so far risen above the muck. However, the rise of AI can possibly disrupt the stock in the future. Plus, options traders suggest that the stock’s promising run may soon fade. Therefore, I am bearish on COUR stock.

COUR Stock May Eventually Suffer Disruption

Since the advent of the internet, the ability to transmit massive volumes of information transformed academia. However, humans have always had to provide the substance of said information. With the rapid introduction of AI and machine learning protocols, the digital age has now shifted into a higher gear. For now, COUR stock has been fortunate. Nevertheless, its good luck may run out.

A case in point is the terrible situation involving Chegg (NYSE:CHGG), an edtech specialist that provides online tutoring services. Up until early September 2021, CHGG appeared to be a wise investment. With the COVID-19 pandemic forcing everyone to quarantine temporarily, the company enjoyed a relevancy spike. Unfortunately, with the widespread introduction of ChatGPT and other generative AI platforms, the bullish thesis practically evaporated.

Since the start of this year, CHGG stock has fallen by 67%. And while it’s not fair to compare Chegg’s dilemma with COUR stock, the two underlying businesses share similarities. Essentially, both platforms decentralize learning so that it can occur anywhere.

Of course, the main distinction undergirding COUR stock is the certification angle. Through Coursera, students enjoy the company’s partnership with over 300 leading universities and companies. Therefore, it’s not just about getting a recognized certification (which is massively important); rather, Coursera can jumpstart a career or a mid-career transition.

With Chegg, you get help with your homework, something that ChatGPT can perform with ease and across numerous subjects. Still, with shifting workplace norms – such as remote work and the gig economy – the focus may center on technical expertise rather than “paper” degrees.

Under that context, even Coursera may soon court trouble.

Options Traders Appear to Target Coursera

To be clear, COUR stock does not appear to be in imminent danger of collapsing. Since the January opener, shares have returned over 48%. Still, in the trailing one-month period, COUR stock is roughly flat, possibly reflecting a sentiment shift. Even more worrisome, options traders appear to be skeptical of Coursera’s continued rise in the charts.

According to options flow data – which screens exclusively for big block transactions likely made by institutions – the most recent major options trade was for 2,052 contracts written (writing an options contract refers to selling it without owning it) of the Oct 20 ’23 17.50 call. Here, the trading entities received a premium of $289,170, representing 3.16 standard deviations above the mean. Also, as of the end of last week, the open interest of this call stood at 4,089 contracts.

In addition, on August 11, traders sold 993 contracts of the Jan 19 ’24 20.00 call. Open interest for this option stands at 1,764 contracts, indicating strong demand. It also means that the liability of fulfilling the option remains open for the call writer.

To get everyone on the same page, buying a call option gives the holder the right (but not the obligation) to exercise the contract — in other words, the ability to buy the underlying security at the listed strike price. However, a call writer (seller) has the obligation (but not the right) to fulfill the contract if the option is exercised. Therefore, the call writer must sell the underlying security at the strike price.

Where it gets especially risky for call writers is if the position is uncovered. Then, they would be obligated to buy high and sell low. Still, either way, prematurely selling a hot stock leads to opportunity costs. Therefore, these options writers more than likely have strong convictions in their transactions.

Rough Implications

Currently, COUR stock trades near $18.50. However, given the implications of the sold calls at strike prices of $17.50 and $20, these transactions imply an upside limit within this range. Coincidentally, COUR has been flat over the past month, as stated earlier.

Therefore, with the combination of possible fundamental disruption by AI protocols and options traders seemingly betting against COUR stock, investors need to be cautious about their next move.

Is Coursera Stock a Buy, According to Analysts?

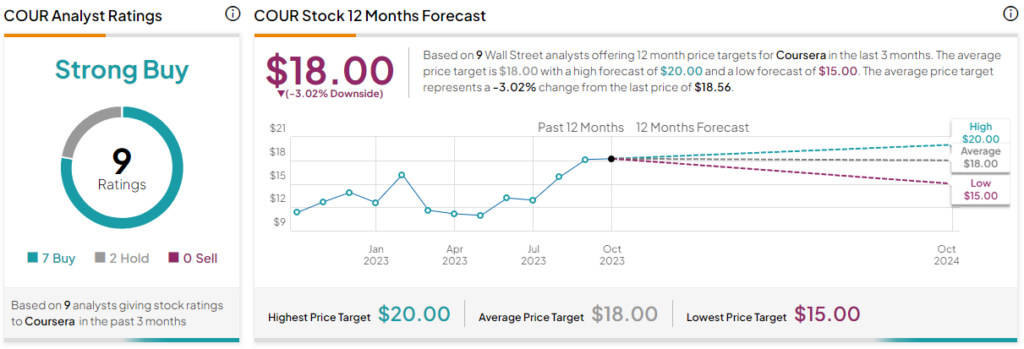

Turning to Wall Street, COUR stock has a Strong Buy consensus rating based on seven Buys, two Holds, and zero Sell ratings. The average COUR stock price target is $18.00, implying 3% downside risk.

The Takeaway: COUR Stock May be Approaching a Speedbump

While COUR stock has enjoyed a great run this year, some evidence points to a possible fading of optimism. Amid questions about AI disruption and large transactions seemingly betting against Coursera, investors will want to be careful in their approach.